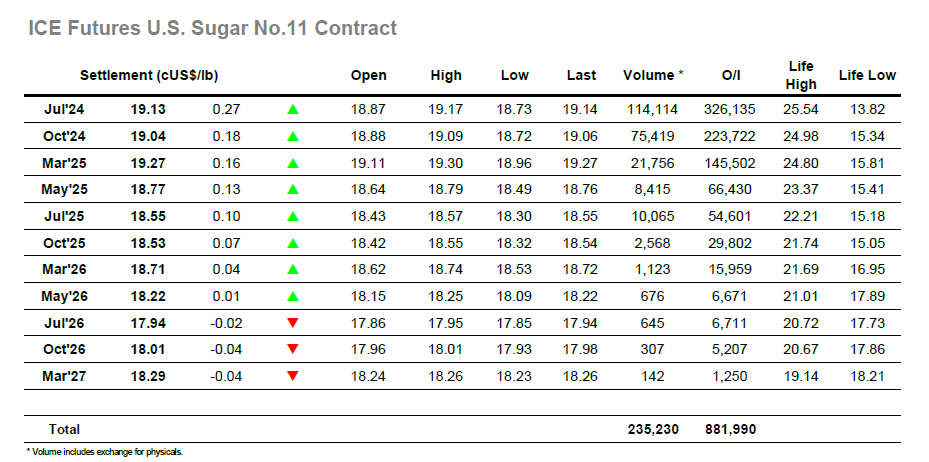

Initial sideways movement failed to inspire, and the market soon saw some small trader liquidation which set Jul’24 back to 18.74. Another quiet morning then developed with Jul’24 holding within early parameters, though those of a bullish persuasion will have been happy to see the bulk of recent gains maintained to continue hope of challenging the 19c area. Moving into the afternoon there was no change to the picture, and so the timing of the spec/algo push which followed may have surprised some. Over a short period Jul’24 surged from 18.87 to 19.07 on over 8,500 lots, finding a few buy stops along the way before pausing to look and cement above 19c. This was successfully achieved through mid afternoon and so provide impetus for additional buying / short covering during the later part of the session, sending prices up to new session highs despite the continuing presence of producer selling across 2024 and 2025 positions. Spreads were also firm with Jul/Oct’24 finally pully away from flat (where it has been stuck in recent weeks) and trading up to 0.10 points premium. Volume was strong, hinting that we may be seeing specs roll ahead of the index window which commences on Friday, and maybe the lack of index selling was a factor in the ease with which the value widened. Daily volume moved above 200,000 lots for the first time in weeks as prices remained at the upper end of the range into the close with Jul’24 settling at 19.13, the technical significance of which should see the market try and continue higher with scope now to push through ‘the 19’s’.

Light early buying helped the white’s market to pop up towards yesterday’s highs, however there was insufficient buying to continue through and instead the market settled back to the mid $550’s for yet another period of slow trading. Good strides have been made over this week though and this consolidation did at least keep the market within range of recent highs, providing encouragement to those wishing to build upon yesterday’s efforts. AA remained quiet through to the early afternoon, and when movement finally arrived it was driven by the No.11 market with whites proving to be a willing follower, the first time these roles have reversed in recent times. Aug’24 forged ahead to $559.80 before pausing, holding onto these gains through the next three hours as the market set itself up for a firm technical close. New highs were registered at $561.50 during the final hour, though the pace of increase remained a little shy of that seen for the raws with Aug/Jul’24 dipping back towards $138.00 once more. The outright strength was not replicated for the spreads with Aug/Oct’24 remaining near to $22.00, however the flat price held firm leading to another solid settlement for Aug’24 at $560.30.