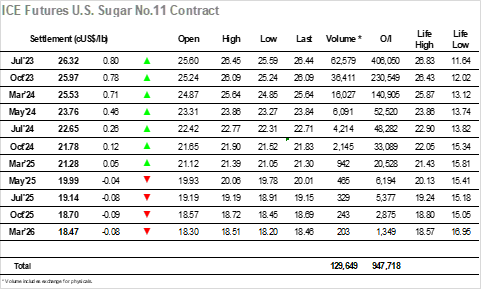

The late afternoon recovery yesterday has traders once again looking at the market more positively and buying came into the market quickly this morning to record early highs at 25.84 before pausing to consolidate. A quiet morning then ensued though with no hint of significant selling the picture was once again feeling stable, no doubt to the delight of the trade and spec longs whose bottom lines have been growing of late. By early afternoon, the market found a little more buying to work values up towards 26c, and while the progress remained steady the lack of overhead selling provided the sense that we would see the push continue ahead of the weekend. That it did with a steady push that extended all the way through to 26.45 ahead of the close, a remarkable 93 points higher for the day and just 3 points shy of this week’s highest mark on Monday. There was only limited strength for the front spread as Jul/Oct’23 widened marginally to 0.38 points; however, the gains were significant between the first and second years on the board which was interesting given how it had been the 2024 positions leading the charge upward yesterday afternoon. Some pre-close profit taking from day traders was inevitable and this left Jul’23 settling ‘a mere 80 higher’ at 26.32, an impressive turnaround that erases the losses from earlier this week. Monday sees a delated opening at 7:30am NY/ 12:30pm London with whites closed for the Kings coronation celebrations, and with the technical picture firm once more there is likely to be some continuation of the upside movement with the contract high at 26.83 the initial target.

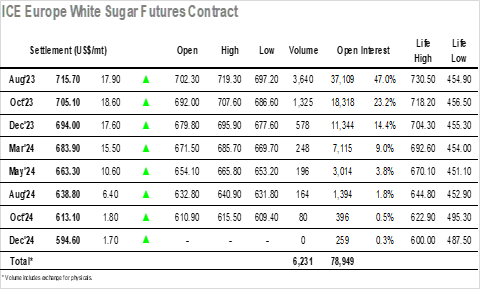

Aug’23 jumped immediately up to $703.40 on this morning’s opening, and while a few hours of tedious consolidation followed the low volume morning maintained a supportive pattern either side of $700.00. The arrival of Americas based traders and resultant increase in volumes provided a small pep up to new daily highs, but the market remained generally quiet with spread volumes also very low. It was only as mid-afternoon loomed that things became interesting with a more aggressive push upward to the low teens, though the reality of this market remains that upward movement is consistently being aided by the lack of meaningful selling from producers, a factor that could well lead to more contract highs being seen soon. This spike led the Aug/Jul’23 white premium value to swing back up towards $138, though that level was cut by a few dollars later in the afternoon as No.,11 values also accelerated. Flat price progression continued through the rest of the afternoon at slower pace, though the impact was astounding with Aug’23 only topping for the day at $719.30 to show gains of more than $20. There was some pre-weekend profit taking from longs which left the settlement price shy of the highs at $715.70, however it is safe to say that the longs have not gone away with today’s performance likely to signal further upside efforts when we resume next Tuesday.