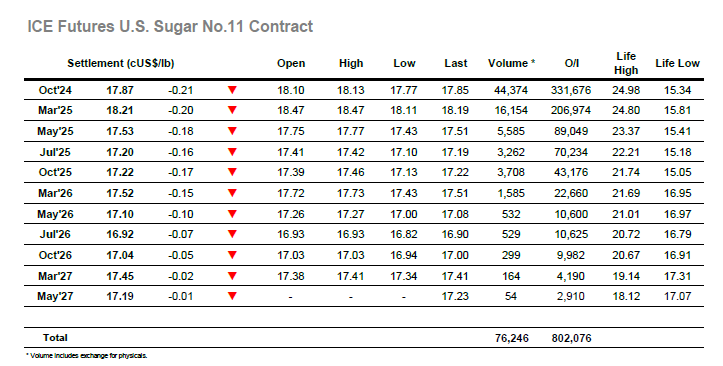

Higher opening prints based upon light overnight offtake soon gave way and a continuation of last night’s closing retreat then sent Oct’24 down by 20 points to trade at 17.88. A couple of hours were then spent edging along ahead of this low before a late morning pop back above 18.00 occurred against some light short covering. This did not lead to any wider recovery, and such has been the nature of recent days that apathy amongst the smaller traders has started to grow again, showing a reluctance to commit too heavily for fear of being swung out of positions at a loss. Consequently, the market continued to track along within the early range, seeing a drop back to 17.90 during the early afternoon and bringing the morning lows back into view. For a period, these held but sentiment eventually got the better of proceedings with smaller traders and specs knocking the market through into the upper 17.70’s before the next bout of sideways consolidation ensued. This area held through the final part of the afternoon to leave yesterday’s low mark of 17.64 untroubled, though closing at 17.87 leaves the technical picture still vulnerable to additional pressures.

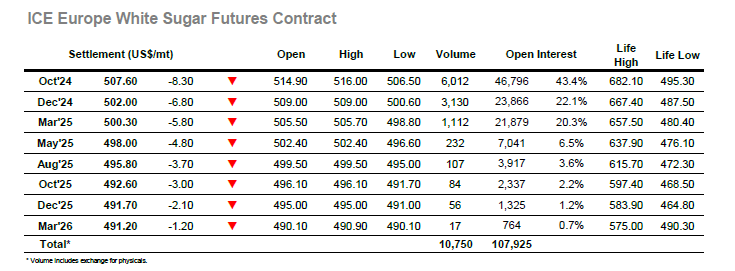

The market started lower and continued downward during the first hour, struggling to fight back against the recent tide as the price again eased back to $510.20. Consolidation followed and the market did recover toa daily high mark at $516.00 briefly, however the trend is proving difficult to break at present and for the most part we saw process resting at the lower end of the range. This area was attracting steady support and so held firm through to the middle of the afternoon, but eventually the pressure told, and the price fell to $506.70, a mere 0.20c above yesterday’s low. This weakness was impacting upon nearby spreads and white premiums, where both sectors were showing sizable losses compared to last nights values as lack of buying played its part. Through into the final hour the market appeared set to hold on, and there was even a pop back up to $510 against the latest set of covering before prices retreated on the close. Yesterdays $506.50 mark was matched on the call ahead of a settlement at $507.60, though it seems a big ask for this “double bottom” factor to hold the market given the continuing precarious nature of proceedings.