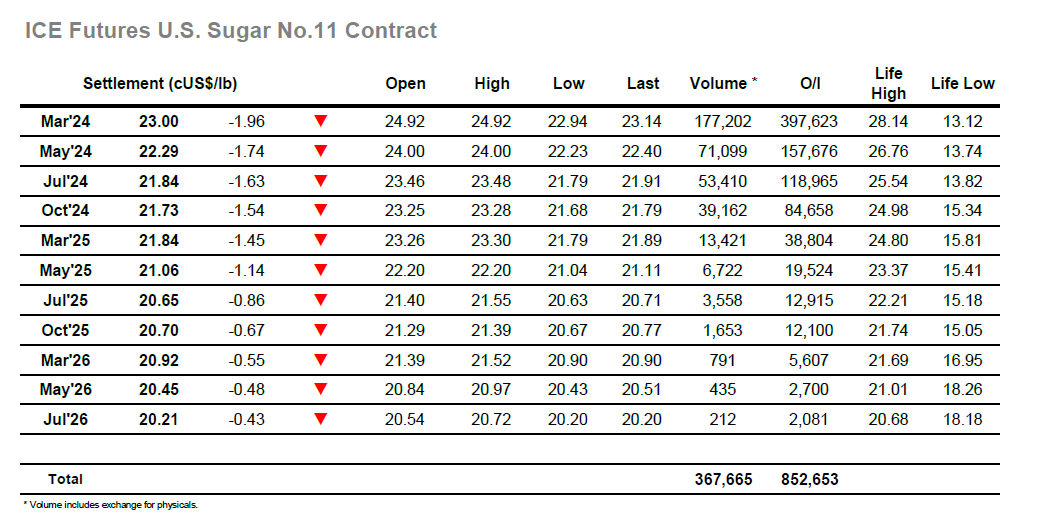

Yesterday’s retracement of Mondays recovery had clearly unnerved more of the longs and so a weaker opening soon had the market looking towards the recent 24.58 low mark. This was quickly despatched and with only scale buying interest showing to provide any semblance of support the decline extended to reach 24.20 before the morning was through. These levels seemed to draw some additional interest from the long side and so aa small recovery developed through the middle part of the day, with a lack of additional selling from the US raising questions as to whether the market had fallen sufficiently far. The answer to these was a resounding no as the afternoon then saw the market break lower again under the strain, Initially to 23.47 to virtually match the low from late August. This encouraged some buying/short covering in anticipation that the technical factor could serve as a double bottom, with values then looking to consolidate, though there remained a reluctance to rally very far. Rumours were circulating of India increasing sugar production over ethanol and its impact on the balance sheet, and whether due to this or just the atrocious state of the technical picture there was another leg down ahead of the close. Sell stops were triggered on the way to 22.94, with the pressure being maintained into the close where settlement was made only 6 points above at 23.00. March/May’24 ended at 0.71 points, still better than may have been expected in the circumstances. Though end user buyers are keen to take advantage of this situation with the next March’24 support level at 22.06 basis the late June low we may not have seen the bottom just yet.

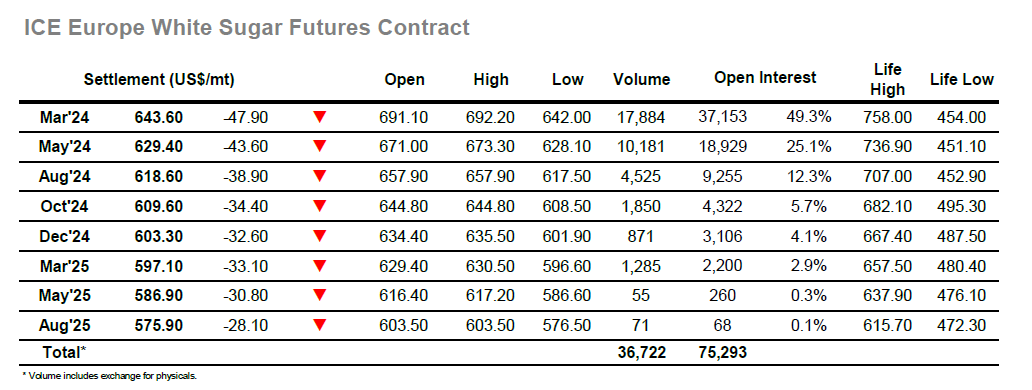

Yesterday’s retreat which erased Monday’s recovery set some warning signs in place again, however the early move today to challenge Mondays lows really had the alarm bells ringing for the longs. As with recent days support remains from consumer/end user buyers but their scale activity is proving to be no match for the juggernaut that is the spec liquidation and so the market started to break new ground once again. By late morning March’24 had sunk to $675.00, and while the was no further collapse as those in the Americas joined the fray it proved to only be a temporary pause in proceedings. Sell stops were triggered as the market descended through the $660’s in one easy stroke, with worse to follow later in the day when a similar move from the high $650’s saw March’24 collapse down to a low at $642.00. Through the collapse there was inevitably some damage inflicted to the spreads with March/May’24 trading to a low at $13.70, while for the white premium there was some softening intra-day against the moves, but values generally held well due to the No.11 market collapsing in tandem. March’24 ended a day which saw a range of more than $50 only just above the lows at $643.60, and while the scale of the fall in the last week leaves the short-term picture oversold there may yet be more pain to follow in the near term if the liquidation continues.