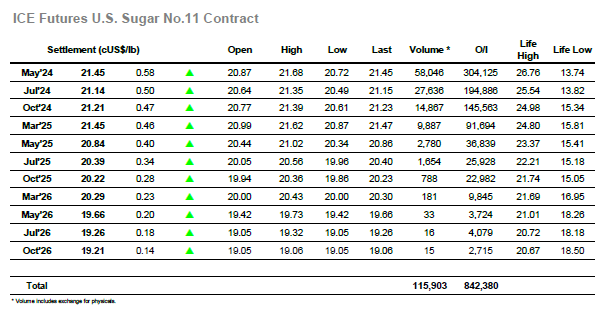

May’24 dropped back to 20.72 on the opening though there was support around beneath the market through scale consumer interest and that provided the base for morning consolidation which saw the market mostly holding the 20.80’s. The picture changed around noon with a sharp push upward to 21.27, and suddenly the market was back on the front foot with specs showing as buyers / covering shorts. With resting orders still limited on the sell side the market made additional progress soon after with an extension to 21.52, the sentiment now being aided by the newswires. Here there was talk of 1m tons of Egyptian imports during 2024 while Datagro were talking down the Brazilian crop to 592 million tons of cane, and though their numbers do not always prove accurate the headline served to maintain some spec interest. This meant an afternoon spent at the upper end of the range with May’24 holding comfortably in the 20.30’s / 20.40’s which left the picture well poised to reverse the recent technical weakness with a solid conclusion and bring values back up into the range. Additional buying followed during the later stages which saw session highs registered at 21.68, and even after the end of day profit taking had taken place we saw May’24 close at 21.45 to provide hope that the market may now continue to stabilise.

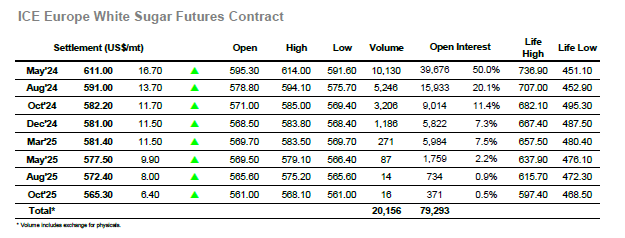

London whites were muted again this morning with initial small losses carried through the first few hours as May’24 sat quietly between $591.60 / $594.00 for a period. It was not until late morning that things picked up with a reaction to the spec led move for No.11 bringing buying to our own market and leading the price quickly back up towards $600.00. With a little more positivity being exuded the May’24 contract was attracting spec buying and drove ahead to reach $611.20 before pausing and looking to consolidate. This was done comfortably within a few dollars of the highs as a steady volume of support continued to appear both outright and through the spreads which saw May/Aug’24 widen to $20.80 and Aug/Oct’24 to $9.60 with both seeing solid volumes. Such consolidation provided a decent basis for additional gains to be made and the specs duly obliged with more buying during the final 90 minutes which extended the highs as far as $614.00 before being curtailed by the usual end of day position squaring. May’24 remained buoyant with a settlement at $611.00 while the May/May’24 was back up at $138.00 having dipped down through the $130’s earlier in the session, a positive conclusion which building upon yesterdays efforts will prove more reassuring to longs that the recent fall has been arrested.