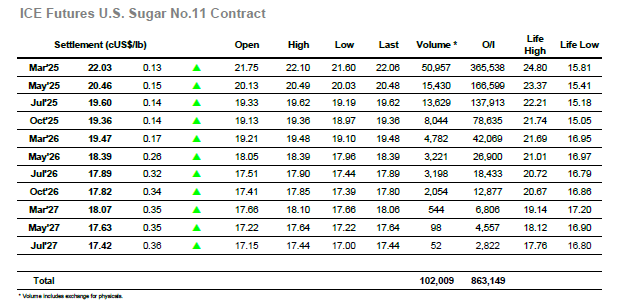

There was an immediate drop in values as March’25 traded down to 21.61, though the opening losses met with supportive scale buying in front of the char support and prices looked to stabilise soon afterwards. Through the morning we saw the price back up into the 21.80’s to fill the overnight gap for the intra-day charts, though with that concluded the price eased back down to be quietly sitting at the lows as the US day got underway. By now news of the Trump victory was confirmed, but despite some solid gains showing for the stock indices there was no discernible reaction from the commodity world which was showing mixed fortunes. Our own outlook improved midway through the afternoon with a sharp rise back through 22c on just a few thousand lots of buying, and with no fresh input arriving from anywhere the usual spec suspects looked to maintain the stability and post a more positive performance. To this end they were successful with the remainder of the session seeing activity either side of 22.00 and an eventual close showing moderate net gain at 22.03. Spread values were little changed and while the day reinforces the range there will be some disappointment that the immediate aftermath of the US election has not yet generated any new interest.

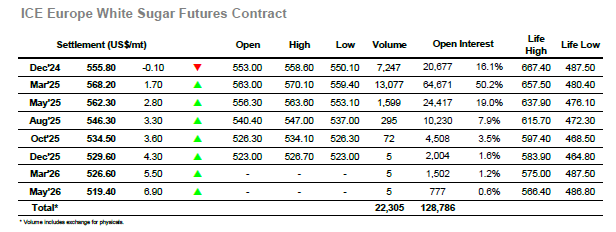

It was a very familiar picture for the whites this morning as the market followed the call set by No.11 to trade down into the lower $560’s once again, though in keeping with recent movements the $560.70 October low remained intact. Prices recovered across the morning however the higher levels were not sustained and as the afternoon got underway the market had returned to challenge the lows another time. This latest move finally saw $560.70 broken with low trades registered at $559.40, however there was no sign of any stops and with the specs still holding on to their significant long position the market soon looked to rally away from this mark. The rally was rapid and only saw prices level out having reached the upper $560’s, back within the range as the longs looked to stabilise the picture. There was some white premium movement through the day which saw March/March’25 dropping back from its early value around $84.50 to be trading near to $82, while against the greatest volume came from the front spread where Dec’24/March’25 slipped back to end the day at -$12.40. Session highs were recorded prior to the close with March’25 settling at $568.20, continuing the status quo for another day.