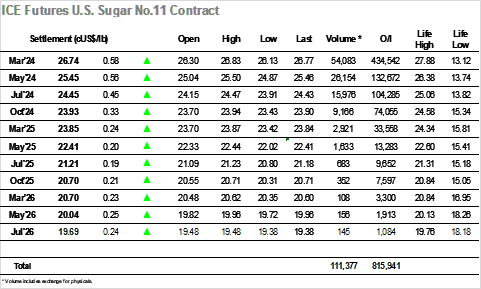

Successive positive finishes have returned an element of stability to the market, sentiment which was apparent during early trading today as consumer led buying sent the market through a relative vacuum to reach 26.52. There was some light selling which followed in behind this, but for the most part the market action remained positive with spec support now present to aid consolidation in the vicinity of 26.50. The placed the market well ahead of the Americas day, though when that drew no fresh interest there followed some liquidation and a fall back down to 26.13. Fresh news remains tough to find, and with the market drifting to the centre of the range it felt that an anti-climatic end to the week would be seen until specs returned and forced a late afternoon move to new daily highs. This drive higher was maintained through to the end of the session, pushing March’24 all the way to a weekly high at 26.83, the volume required being lower than average due to the dearth of producer pricing. Settlement was made at 26.74, providing a positive platform for the specs to continue pushing next week, though should the price move above 27c progress may start to prove more difficult due to increased selling.

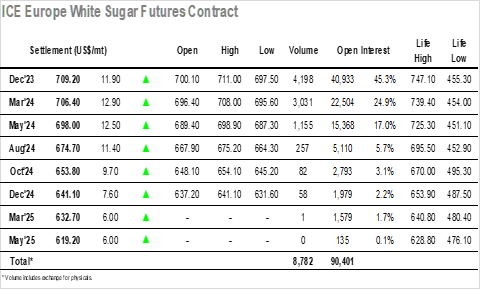

Opening buying sent Dec’23 jumping higher with the early push seeing trades up to $707.60, the highest levels traded since the market tumbled on Monday. As with so much of the recent movement there was a prompt correction, though the sentiment remained positive thereafter and the market was content to hold the $704.00 area through late morning. Despite the significant gains that were on show the outright volumes remained light, with the spreads still contributing a good proportion of the activity, and with the US specs failing to generate any fresh impetus to proceedings the market slipped back to $697.50 and filled the small gap on the intra-day charts. This seemed likely to mark a quiet end to the week, but instead there was time for another move upward during the late afternoon, bringing the market back towards the morning highs as specs looked to end the week positively to try and instigate momentum for next week. The white premium experienced a see-saw day on the movement, with the relative weakness through the morning (compared to No.11) seeing March/March’24 work down to $113.00 with a recovery to $119.00 following during the afternoon as the market moved higher. The closing stages saw successive new highs recorded to an eventual $711.00, with the Dec’23 settlement at $709.20 sending the market into the weekend positively.