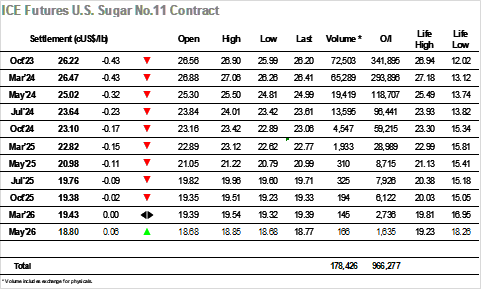

Yesterday’s barnstorming performance put the market on a very firm footing, and with sentiment remaining positive over the past two weeks the market continues to find supportive buying from the trade and specs/funds. This ensured another steady start with Oct’23 making its way up to 26.90 this morning, just 4 points shy of the new contract high, with prices holding steady against moderate interest ahead of the arrival of the US funds. What followed was unexpected therefore as the start of the Americas day drew selling which eradicated the morning gains, impacting the near-term sentiment and encouraging the smaller traders to scurry out of some longs. Buying was limited with most consumers unprepared to pay up to such lofty levels, and with the white sugar market already diving lower the No.11 followed a similar path. Oct’23/March’24 spread selling was having an impact through the afternoon and successive waves of selling eventually saw the spread reach -0.27 points while Oct’23 slumped all the way back to a 25.99 low. This did not represent a disastrous showing with the chart simply showing the performance as a wild “inside day”, though it does suggest that without a willingness from the consumers/end users to chase higher with their pricing orders that we may see some cooling/consolidation following the near 400-point rally over the past two weeks. There was some end of day shenanigans with defensive buying/short covering popping Oct’23 upward on the close, ensuring a settlement value of 26.22.

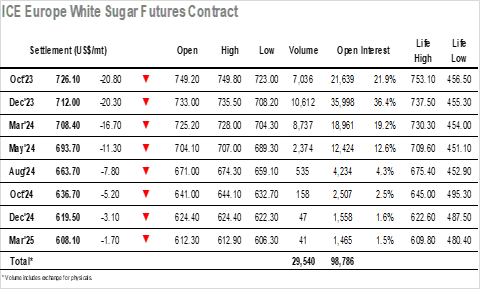

Initial steadier values were not maintained, and despite the strong showing yesterday the market proceeded to come under pressure through the morning. The pullback was modest in comparison to yesterday’s gains and came at significant expense to the nearby white premiums which gave back around $8 with the No.11 market finding the support to be trading higher on the day. Thoughts that the arrival of US based specs would bring some fresh support to the environment were misplaced, and with no apparent willingness from the trade to pay up to current levels the market found little underlying support and continued to retrace yesterdays gains. The pressure upon the WP’s intensified with Oct/Oct’23 some $15 weaker than yesterdays highs as it slipped to $149.00 while Dec’23 slipped beneath $720 and was trading in the teens by mid-afternoon. Still there was no significant support to be found and following a brief attempt at consolidation the market saw another leg lower to be sitting just ahead of $710 entering the final hour of trading. The spec liquidation led the market to trade a low at $708.20 heading into the close, and though some day traders closed positions to take the market away from the lows and settle at $712.00 the nature of the performance was poor. White premiums also settled weakly with Oct/Oct’23 at $148.00 and March/March’24 at $125.00.