An unchanged opening provided the basis for early stability with the market holding the 17.80’s through the first couple of hours on low volumes. From here the Oct’24 contract then looked to build, and it only took a small degree of position covering from recently added shorts for the price to move back above 18.00 and set things on a slightly more positive course. Day traders and algos were playing from the long side and through into the early afternoon this maintained t5he direction and led values to highs at 18.26, though with no other sectors joining the buying the move ended with the inevitable position squaring. This sent Oct’24 back down to 17.89 to virtually erase the gains though it proved to be a short-term dip and the market soon resumed back above 18.00. Spreads were a touch firmer with Oct’24/March’25 up to -0.30 points, aided by the desire of the day traders to maintain the price up around the earlier highs. By the close we saw Oct’24 retreating into the range as more positions were closed out, and though a settlement price at 18.14 is a bit more positive it was achieved on paltry volume and so plenty of work will still be required if this is to mark a bottoming process.

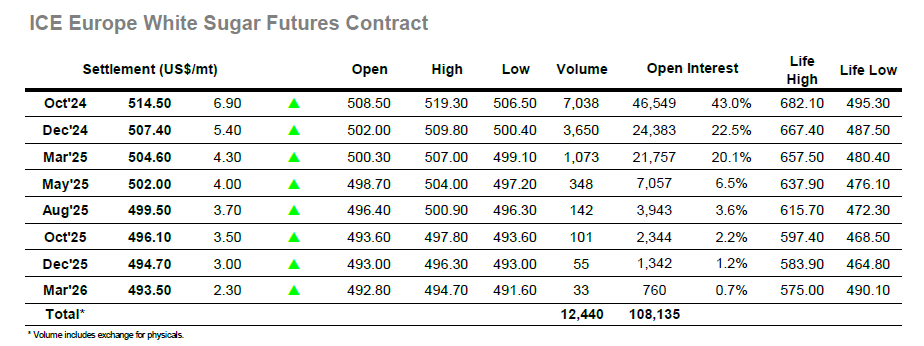

The first hour of today’s session saw the market holding either side of overnight levels, a small early dip to $506.50 providing the third successive session that this level has marketed the low. This technical factor seemed to buoy the market and some buying interest followed and had a significant impact with the market rallying all the way to $517.00 on modest buying before pausing for breath. There was more strength to follow once the US morning commenced with a little more spec interest extending the range up to $519.30, and in the process, this reversed the losses seen for the spreads and arbs during yesterday’s session. More day trader liquidation followed, and the price slipped back beneath $510, however there was more resilience about proceedings today and over the final couple of hours Oct’24 clawed its way back up the range. Reaching the close there was some position squaring to knock the price back a touch, leaving the spreads away from their highs at $7.50 for Oct/Dec’24 while the Oct/Oct’24 white premium was also unable to hold its gains and ended at $114.60. Oct’24 settlement at $514.50 did represent a solid gain, though work remains if our $506.50 low is to hold.