Yesterdays muted performance seemed to have increased the level of apathy felt by many toward the market at the present time, the first hour today seeing March’23 hold a tight 19.40/19.46 band on minimal volume. With no sign of any spec support the market attracted a little selling and dropped down to 19.30 however this encouraged the first signs of some defence with the market returned to credit before stalling in the upper 19.40’s. The structure of the market continues to be solid with the March’23 spreads once again encountering support through the morning, March/May’23 pushing out to 1.15 points despite the modest flat price movement and holding onto gains even as the March’23 slipped back into the red. The flat price continued to flip around within the 19.40’s until mid afternoon at which stage some fresh spec selling/liquidation became the dominant theme, possibly motivated by weakening crude values which came despite a relatively mixed macro. New lows were recorded at 19.27 later in the afternoon before specs reappeared with a final late flourish to haul March’23 back up and record new session highs at 19.54 during the final moments. Settlement was made at 19.48 to provide some gloss, though overall it was yet another day within the current broad 19/20c range which provided no hint that this malaise can end anytime soon.

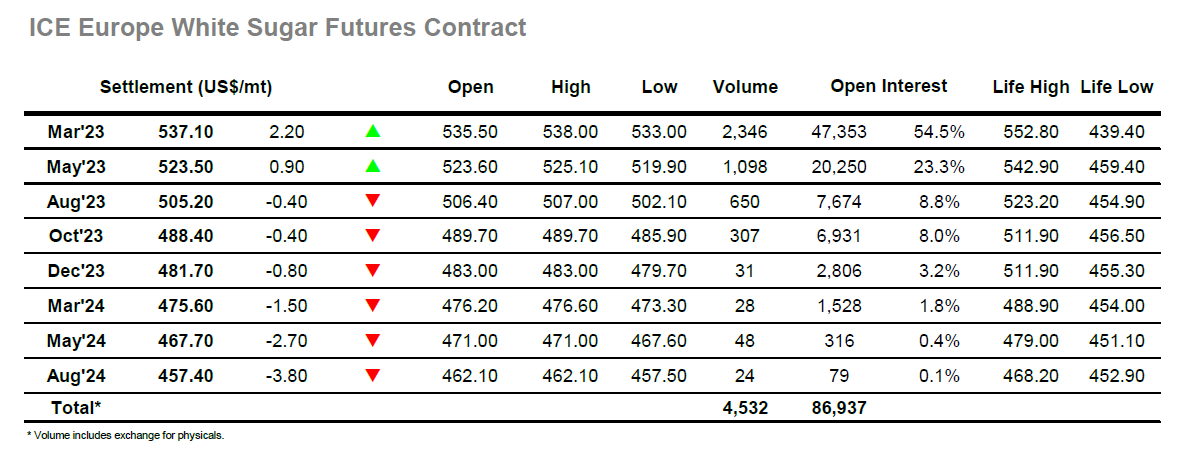

A low volume start to the day saw March’23 quickly settle down to hold at $535.50, a flat-ish macro and the current rangebound nature of the market contributing to the quiet environment. Despite the market having settled back down into a broad range over the past couple of weeks the spec long position means that they will continue to push from the long side when the opportunity presents with this pattern of activity continuing today as prices were pushed back into credit. A series of small swings within the range culminated in a session high of $538.00, though such was the thin nature of the volume that specs were defending the market in tens of lots with dips following as soon as they stepped back. The game changed during the later afternoon as a fall in crude values discouraged specs from continuing to play the defensive strategy and led March’23 back towards the morning lows, though the movements were relative and lacked substance to take the March/March’23 white premium back towards $109.00. Prices shot back up through the range on late defensive buying to conclude the day higher at $537.10, though the window dressing could not disguise what had been a slow, directionless day.