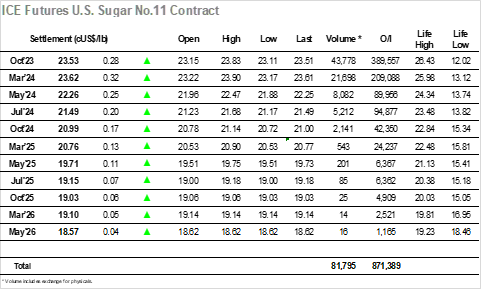

The market started lower with a dip to 23.11 as the apathy that prevailed seemed set to continue, and though values popped back to unchanged levels soon afterwards there was little reason to get excited. The later morning played out more positively with a push up to sit around 23.50, and while this remained beneath the highs seen on yesterdays inside day it did show some intent from specs to try and resume some upward movement. With spec activity the key element of upside movement currently there was a small nudge higher during the early afternoon, in turn followed by a more aggressive push the saw Oct’23 extending to 23.83, its highest level of the current rally. Spreads were showing no inclination to follow suit with the flat price strength as Oct’23/March’24 dropped back to -0.09 points, mildly contrarian action which may limit the upside potential as resistance approaches in the form of the old 24.02 low. Profit taking/long liquidation followed which sent the market back from the highs and the remainder of the session saw a return to tedious range bound activity until Oct’23 eventually closed at 23.53. With weather related news remaining not aiding the bulls at present it seems likely that efforts to push higher in the short term may end in the same way as today, a more likely route being a continuation of the broadly sideways pattern seen over this week.

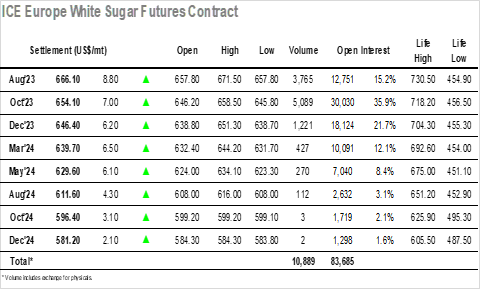

A steady start to the day provided the platform from which traders were able to edge the market back upward with Oct’23 working up to sit comfortably in the lower $650’s by late morning. Volumes were rather poor and it seemed that many were looking towards the larger spec activity from the US to provide any additional movement with trade/consumer entities having largely stopped buying since prices bounced so far from the recent lows. Despite this lack of flat price interest there was another strong showing being made by the Aug’23 contract at the top of the board with the Aug/Oct’23 spread enjoying another positive session as it moved back towards $13.00. Spec buying did appear during the afternoon to pull Oct’23 upward to $658.50, though the move felt somewhat forced and it was not surprising that profit taking arrived to nudge values back down from the highs. Having dropped back to the mid-$650’s the rest of the day saw trading become muted once again, lower volumes hanging hands as the market edged quietly towards the close. Oct’23 settled at $654.10 with the Aug/Oct’23 spread valued at $12.00, a steady end to the week though with the possibility increasing that we will see more sideways movement for the near term.