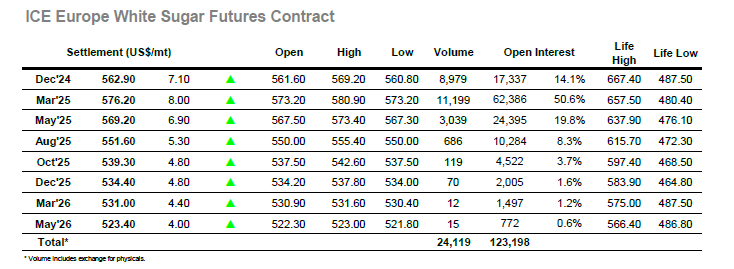

Having tested and held in front of the underlying support for three consecutive sessions the market started today far more positively with an opening push to 22.32. This firmer start was maintained through the rest of the morning on quiet consolidation which left the market well positioned to continue upwards as we moved into the early afternoon as another wave of smaller trader / spec buying extended the gains to 22.49. The usual momentum problem then surfaced as the buying dried up and long liquidation took place, and having sent prices back to the centre of the days range the market stagnated. It was not just the flat price which was trading quietly with spreads also struggling to find much interest, and so another dull session moved along slowly through the afternoon. With the price having levelled out near to 22.20 the final couple of hours saw virtually no additional movement with the market simply drifting towards the close on no volume. Closing trades left March’25 setting at 22.20 on the nose, with March/May’25 dropping back slightly to 1.53 points, mild gains for the flat price but little more.

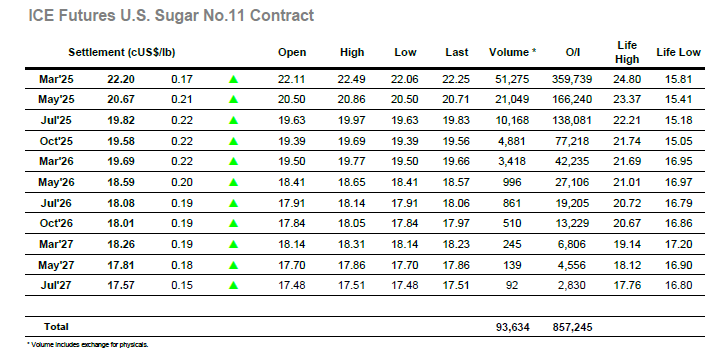

With No.11 values trading higher this morning the market reacted by gapping upward to the mid $570’s and continued onward to $577.00 during the first hour. Progress then stalled and the rest of the morning was spent consolidating the early movement on low volume with the flat price again taking a back seat to the Dec’24/March’25 spread. Dec’24 open interest now stands at just 17,337 lots with more than a week until expiry, but that did not deter more steady rolling throughout the session. There was a push to new session highs during the early afternoon with March’25 reaching to $580.90, and though this rise could not maintain when the market did retreat it was simply to the mid $570’s and another extended spell of consolidation. With the flat price seeing an afternoon of malaise there was a surprising rise in the value of nearby premiums which saw March/March’25 working up to $87 by late afternoon, largely insignificant though maybe a sign that the market has temporarily finished with the downside. Closing values were solid with March’25 at $576.20, while Dec’24/March’25 remained at the bottom of its range at -$13.30 following another good daily volume of almost 5,200 lots. Overall, it brings values further from the lows but likely condemns that market to even more rangebound trading as we move forward.