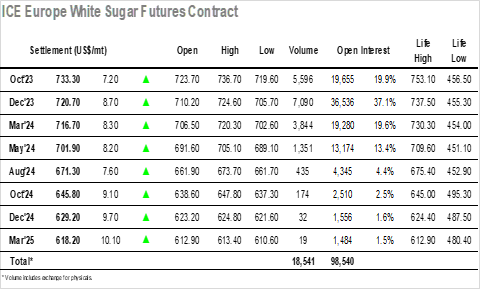

With the whites having led the retreat from contract highs in sugar yesterday there was a calmer air about the market as we resumed, a morning spent consolidating near to $710 before pushing back to the mid-teens as some light buying interest emerged. Volumes continued to be modest outside of the Oct/Dec’23 roll and with the consumer buying confined to a scale down basis there was little interest away from lows in persisting with the rally, allowing vales to fall back to a session low at $706.70 midway through the afternoon. White premiums continued to come under some pressure, however that did not prevent the market from turning around significantly during the final 3 hours of trading, the market being hauled upward by some strong spec led buying for the No.11 market. Dec’23 rallied to settle at $720.70 before making a late high at $724.60, though the gains were notably less than those seen for No.11 which was near to contract highs by the end o0f the day. The premiums again closed lower with Oct/Oct’23 at $145.00 and March/March’24 at $124.00, and with thoughts of consolidation ended so abruptly this afternoon it seems that further volatility beckons.

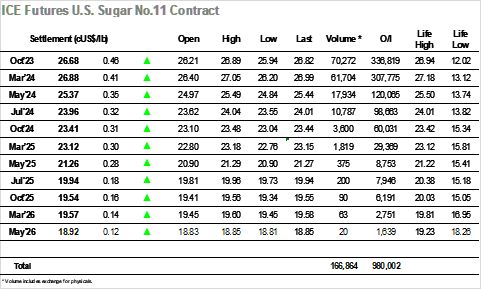

The market commenced today’s session relatively calmly, the wild swings seen already this week seeming to leave some traders a little reticent to jump back in given the risks associated to current volatility. This led Oct’23 to be trading slightly lower through the early morning before finding some light buying which pulled the price up into the 26.30’s ahead of the busier afternoon period. Hedges funds appeared reluctant to add to their recent buying efforts in a meaningful way and so it was that day traders worked back out of longs and sent the market sliding to new session lows, with Oct’23 dropping to 25.95 midway through the afternoon. This action seemed fitting with expectations of consolidation so what followed came as something of a surprise in the context of the day. Specs once more turned buyer as they looked to defend the recent strong gains and made a series of pushes higher that forced the market into fresh daily ground ahead of the final hour. This in turn generated additions system buying with the result that Oct’23 surged all the way to 26.89 on the post close, though settlement had already been established at 26.68 to represent more modest daily gains. Ahead of the index roll starting tomorrow there was also a strong close for the Oct’23/March’24 spread, recovering to settle at -0.20 points on the late rally with highs registered at -0.16 points heading out.