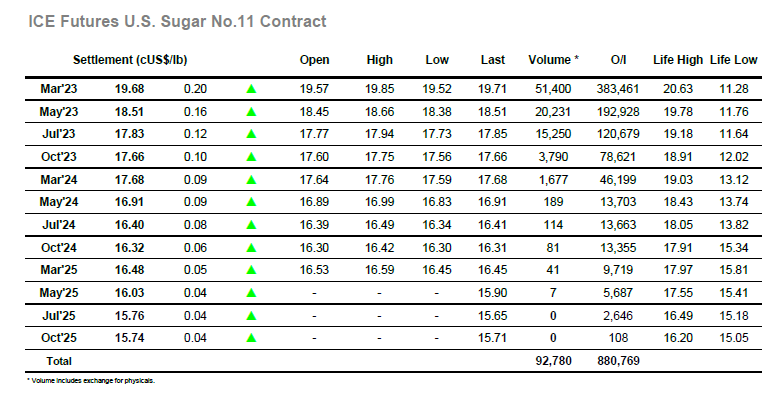

An element of macro recovery was the invitation that the specs had been hoping for with immediate buying taking March’23 quickly up into the 19.60’s where the gains could be comfortably consolidated. Over the following hours the market remained positive although progress was far more gradual with increased producer scale pricing starting to be seen ahead of the recent 19.94 highs, with any buying needing to churn through this. Still the market forged ahead with some slightly heavier buying volume from the US during the early afternoon taking the price to 19.85 before things stalled. Consolidation followed at the upper end of the range however with no further progress being made and some of the macro gains being given back a degree of day trader liquidation sent the price back to 19.65. The structure remained positive despite the retreat with March/May’23 holding around 1.16 points (the earlier high was 1.19 points) and this continues to support the specs positive outlook with light buying returning to again hold prices in the 19.70’s. There was some light position squaring as we headed into the close but the market otherwise ended with a whimper, March’23 settling at 19.68.

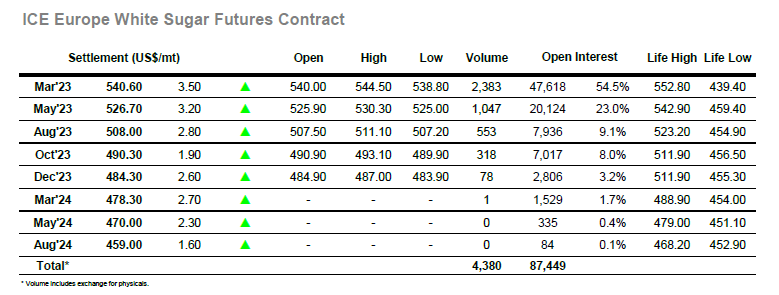

March’23 immediately jumped up above $540 to provide a positive footing from which the market could mount another effort higher, the firmer No.11 and macro values again providing the initial impetus. The level of buying in the market was again relatively limited however it proved to be sufficient to keep the upward movement in place over the course of the morning with slow and steady gains being recorded through the lower $540’s. The grind higher peaked at $544.50 during the early afternoon with the limited quantities of buying no longer sufficient to take the market any further, though aside from some light profit taking there was similarly nothing to send prices back down, leaving the market to simply edge along within the range for the rest of the afternoon. Spreads and premiums remained solid, in keeping with the March’23 performance, May/Aug’23 was trading at around $14 late in the afternoon while the March/March’23 premium was sitting near to $107.00. There was some end of day position squaring which knocked March’23 back by a couple of dollars to settle at $540.60, still no nearer to forcing a breakout from the range.