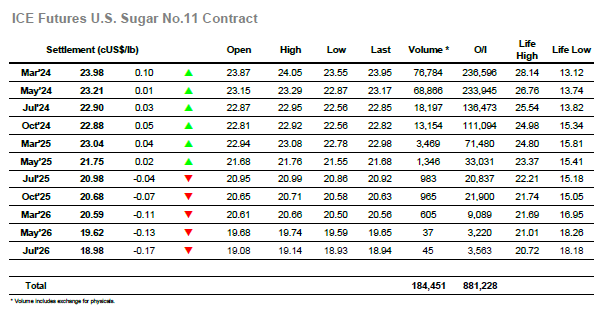

Having failed to sustain above 24c the market started today’s session on the back foot once again, resulting in an early slide to 22.57 before prices began to stabilise. There was less volatility than recent sessions, maybe due to the impact of recent activities upon the smaller traders, and so the morning proved to be incredibly calm with prices tracking sideways for the next couple of hours and only starting to pick up a little ahead of the US morning in anticipation of potential fresh spec interest. Over a couple of hours, the price worked onward to the low 23.90’s and a small net credit however interest remained generally muted and there seemed little prospect of reducing the upside in any meaningful way. Spreads meanwhile were seeing the bulk of an admittedly moderate volume with the index roll continuing, though here too the movements were slight as the price held between 0.64 points and 0.73 points for March/May’24. Having stagnated for a period there was a long liquidation led pull back into the range, though the movements were still slight, and the feeling remained that many smaller traders had joined the group presently standing aside. New highs were seen as we reached the final hour with March’24 pushing up to 24.05. Market closed a bit below trading at 23.95. Settlement price was 23.98, 10 points up from previous settlement, volume traded was 77k lots and HK spread strengthened further to 0.77 points.

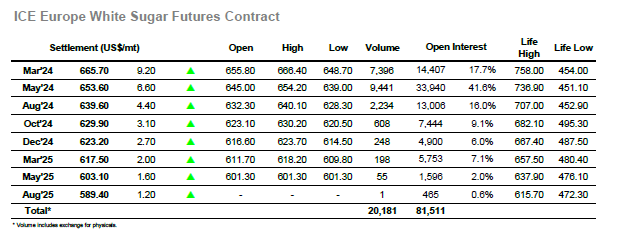

A sloppy opening saw May’24 trading back down to $640.10, a legacy of yesterday’s latest failure to rally as smaller traders continue to scratch around within the broad range. Underlying consumer support was uncovered, and while not overly significant in size it proved sufficient to hold values through the morning with the only extension of the range being a brief dip to $639.00. With the market struggling there was again weakness for the white premiums with March/March’24 back to $129 and May/May’24 near to $134.00, however these values were to recover as the fickle nature of the environment saw buying reappear around noon. Over the course of two hours the May’24 price climbed steadily to a daily high of $650 while the premiums widened by around $5 from their lows, though despite the efforts of the smaller traders the market was unable to reach the heights of yesterday’s efforts and instead flatlined through the afternoon. Spreads meanwhile made up the bulk of the volume with March/May’24 still finding strong rolling interest ahead of next Wednesdays expiry, the differential seemingly comfortable either side of $10 as it held a narrow range. There was a dip from the highs during the middle of the afternoon though that was gathered up swiftly and reaching the final hour the market was breaking new ground to the upside. Final trading hour consolidated late afternoon movements and led K4 to close at $652.9. Settlement price was 653.6, $6.6 above yesterday’s settlement. Volume traded was 9.4k lots.