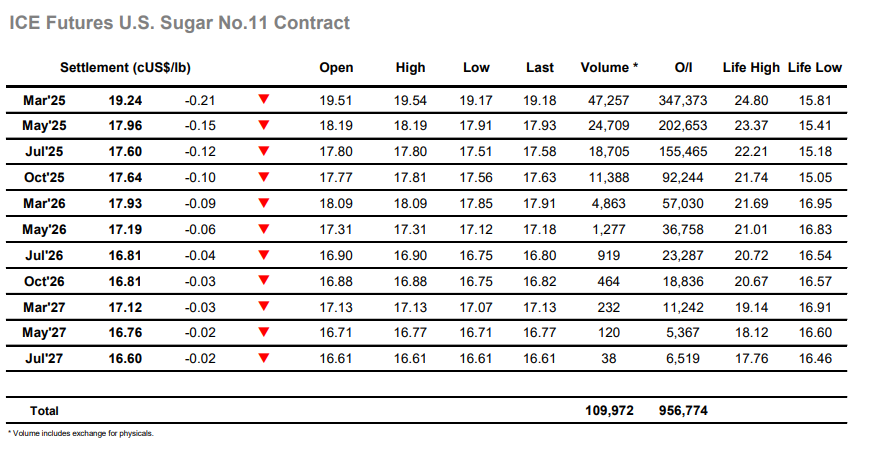

It was a subdued start to trading today with some light opening buying swiftly completed to leave March’25 nudging along in the 19.40 area and showing little sign of looking to move in either direction. By late morning there was a little more buying interest showing from day traders but any efforts to push the price higher were stalling in the upper 19.40’s and so liquidation followed close behind as traders retreated due to the lack of progress. Even the spreads were dull as only small quantities of volume changed hands for March/May’25 in the lower 1.30’s, and it seemed that the picture wouldn’t change as the pattern maintained into the afternoon. There was a widening of the range during the last couple of hours as the lack of upward progress encouraged some exploration from the short side, but this only extended the band down to 19.23 before short covering kicked in and left the late December 19.04 mark unchallenged. Such a slow day would have appropriately seen a tedious close, but this did not occur as instead a late burst of selling arrived and sent March’25 back to a new daily low at 19.17. Along the way a settlement value was established at 19.24, still a distance from the recent lows but with an increased air of vulnerability once again.

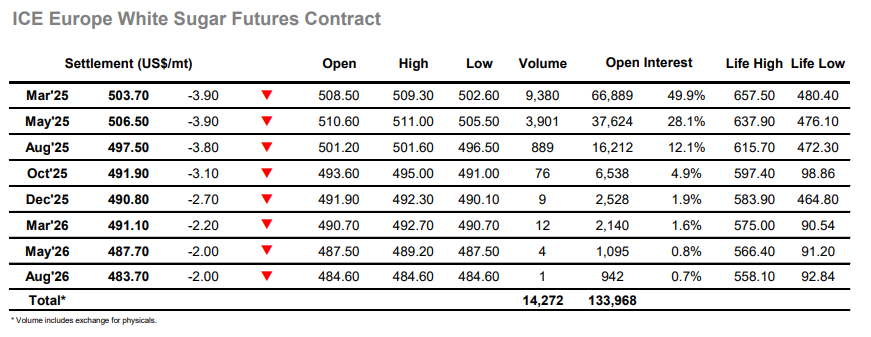

Opening trades were either side of unchanged though the market soon settled down to sit around the $505.00 mark, showing an unease with the recent lows just a few dollars beneath. By mid-morning these were in sharp focus as smaller traders hit the market with fresh selling and sent March’25 down to $502.60, and in the process narrowed the March/March’25 white premium back to $77.00 before the market rebounded. The bounce was sharp with the covering taking March’25 up by $7 in the thin environment and returning the premium towards $80 and see-saw movements continued into the afternoon within the range though the volumes were small and so didn’t have any impact upon wider parameters. With the March’25 expiry just five weeks away there will be increased activity for the front spread, however so far this year the movements have remained light with another modest volume seen today at a small discount, in keeping with the subdued nature of the market. The later afternoon saw values work back to the bottom end of the range as March’25 moved to close at $503.70, a weaker finish which brings the recent lows back into focus for tomorrow.