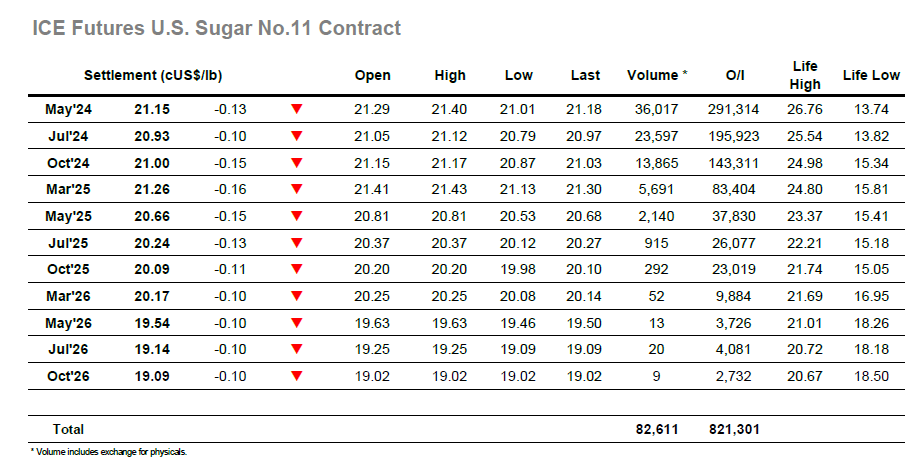

Commencing the day either side of unchanged the market was showing little intent to move significantly in either direction with early trading confined to a 21.34/21.09 band. Moving through the later morning there was no sign that this would widen with trading confined to smaller traders and volume having declined to very low levels following yesterday’s inside day. With news thin on the ground and this weeks Dubai conference having not inspired the market in the same way that the 2023 event did we continued to tread along quietly, and though the arrival of Americas traders saw market parameters widen a little to both sides it was of relative insignificance and the market remained on course for successive inside days on the chart. Even the spreads could not muster any worthwhile volume/movements and so traders seemed to fade away from the market and make an early head start into the weekend. A further drop to 21.01 during the later afternoon was picked up and the final hour was then able to play out at the lower end of the range. May’24 saw settlement made at 21.15, while May/Jul’24 closed at 0.28 points to send the market into the weekend quietly

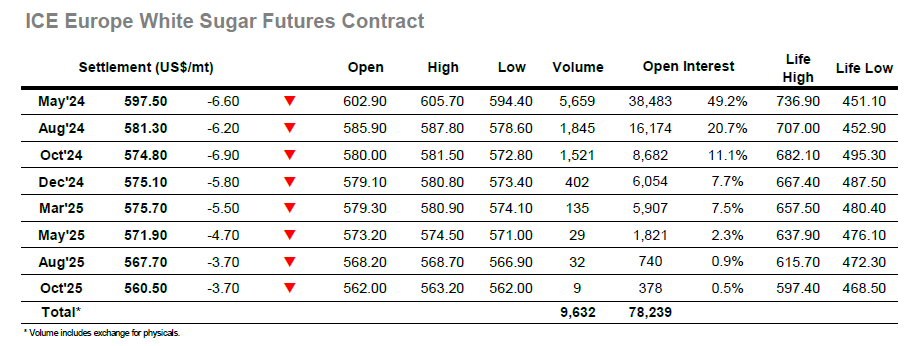

A marginally lower start soon gathered additional selling and the first hour saw May’24 drop back through $600 to a low at $598.10 as buying again proved to be limited. It was not just the flat price under pressure as the May/May’24 white premium also slipped down through its recent range to be trading around $132.00, raising concerns for long holders that Wednesday’s rally may have been a false dawn. The rest of the morning saw the market gather itself to be printing either side of $600, with the range then widening during the early afternoon when marginal new lows were followed by a short covering rally which extended to $605.70. The rally was brief, and it was not long before the market slipped back into the red with a fresh slide to the lows approaching late afternoon. May’24 saw a 30% jump in volume as the earlier lows were broken and the price slumped to $594.40 and were it not for some increased consumer interest ahead of $590 then this selling would have had a more significant impact. Values held ahead of these lows through the final hour to leave May’24 settling at $597.50, a weaker finish which may draw more selling when we resume on Monday.