We saw a mixed opening however as trading settled down it soon developed into a drift lower to the disappointment of longs following their efforts yesterday. Within an hour March’25 had gathered some increased momentum and traded down to 21.94, though this selling was likely led by day traders as a return to 22.25 followed on short covering soon afterwards, Such recovery provided some fresh impetus to play the long side again and the market ended the morning at 22.33, however as with the downside move there was no continuation and by the time that US traders joined for the day we were trading back in the red. This seemed to kill enthusiasm from all sides as the next couple of hours saw stagnation until the malaise was ended quite spectacularly with an aggressive spike down to 21.86 on just 2,000 lots of selling. The price action pulled back to the 22c area looking to stabilise ahead of the weekend, however the final hour saw renewed selling to leave the market trading to fresh lows heading into the close. Lows were made at 21.75 ahead of some late position squaring with a March’25 settlement at 21.82 sending us into the weekend looking a little more vulnerable once again.

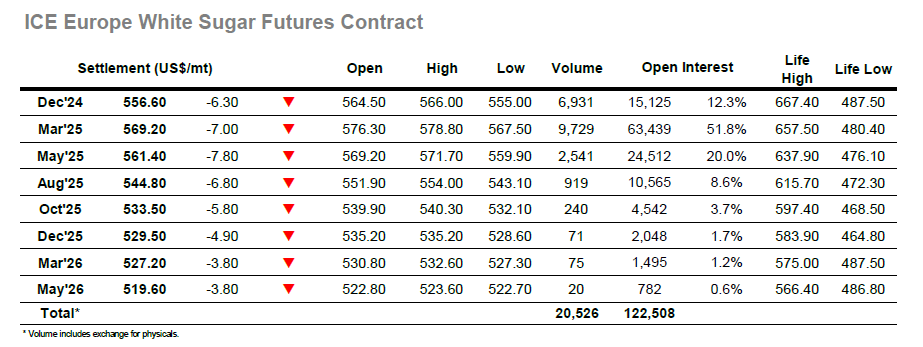

March’25 traded up to $578.70 on the opening but then immediately retreated into deficit with buyers inconspicuous in comparison to yesterday. The dip was gathered up and by late morning the market was trading right back around the highs as the longs looked to tee things up for the afternoon. The lack of fresh impetus from the US led to some day trader long liquidation during the early afternoon and sent prices back down by a few dollars, but that aside there was very little occurring for the flat price leaving it to settle down to sit within a tighter band. A drop from the band saw the price quickly reach $568.00 to fill the chart gap established only yesterday, but again the market looked to pull back and minimise the losses on defensive buying. Despite the flat price remaining lower there was remarkably low movement for the Dec’24/March’25 spread as it saw another 4,000+ lot daily volume, while the March/March’25 white premium was also performing solidly and holding in the $88.00 area. A final push from the short side during the final hour sent the market into the weekend at little nervously at $569.20, with the Dec’24 expiry to look forward to as the range endures.