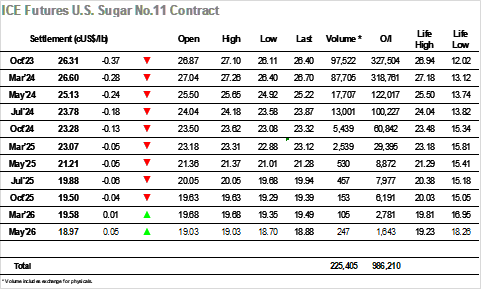

There was a continuation of last night’s rally as the market immediately surged to 27.10 on today’s opening and while the price action then eased back to the 26.90’s the early sentiment remained positive. The lack of buying allowed Oct’23 to drift back to overnight levels by late morning however the market dug in with Oct’23 holding moderate gains at 26.80 as the Americas morning got underway. There was little change to the pattern of trading initially with prices continuing to move near to overnight levels, though the lack of any fund buying was a cause of concern to the bulls. Today marked the first day of the index fund roll and Oct’23/March’24 activity was dominating proceedings with the spread working back down into the -0.20’s as volumes increased. This in turn had an impact upon the flat price moving through the afternoon and Oct’23 worked all the way down to 26.11, a huge 99 points beneath this morning’s contract high to make a fourth consecutive day of yo-yo trading within a wide band. The market seemed set to head into the weekend with a settlement around the lows until some late short covering/defensive buying took the settlement value to 26.31, while Oct’23/March’24 went out at -0.29, a point above its low on a volume of more than 60,000 lots.

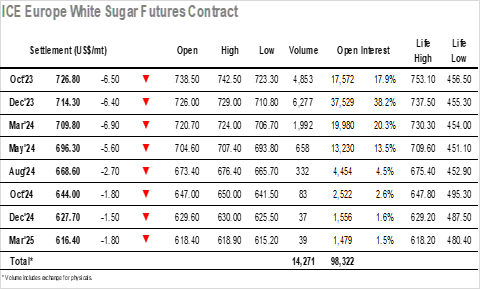

Guided by the No.11 market there was an opening push to $729.00 for Dec’23, setting the tone for a morning of steady consolidation. Having seen weakness for the white premiums recently the market was proving to be rather more robust, though the lack of buying for No.11 did mean that the gains were slowly being eroded with Dec’23 moving back into negative ground during the early afternoon. Most of the volume was generating from spread activity as rolling continues ahead of next Friday’s expiry, though both sides were well matched leaving Oct/Dec’23 to trade a $12.00/$13.80 range throughout the session. The spec nature of outright activity has left the market following the path of least resistance and today this proved to be another turn lower with the later afternoon seeing Dec’23 down to a low at $710.80 before encountering closing buying. This ensured settlement a few dollars above the lows at $714.30, with further choppy movement seeming likely when we resume on Monday.