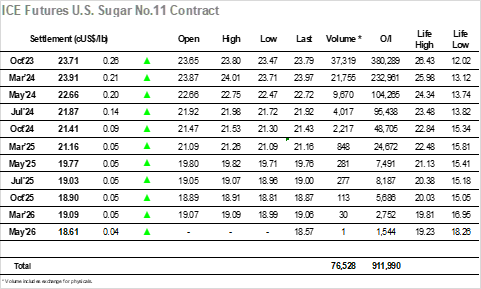

The decline to one-month lows drew out some consumer buying interest with the market rallying against the resultant hedge lifting to reach 23.78 after just 30 minutes. With the hedging completed there was no additional buying from other sources to maintain the higher levels and so the market retreated to a comfortable band near to 23.60 where a period of slow consolidation ensued. A small dip around noon saw Oct’23 fall back to 23.50 however the arrival of US based specs soon after generated some fresh buying interest and allowed prices to move back up the range to 23.70. A mixed macro picture was providing no guidance / influence and so activity remained minimal with values left to drift along. The later afternoon saw a marginal new low recorded at 23.47 with the market then yo-yoing around the range a little more vigorously as day traders came back to life. This set the tone for an aggressive late spec push to new daily highs, Oct’23 reaching 23.80 on the post close having settled at 23.71, a positive end to the day though still firmly confined to the recent broad range.

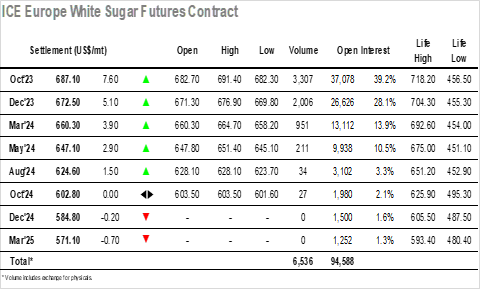

Taking the lead from No.11 there was a surge in values as soon as we opened that saw Oct’23 swiftly move through to $691.40 (+$11.90) before cooling. The gains were maintained in part with the market settling down to hold the mid $680’s on volume that was by now incredibly light. With the market away from the highs there was a cooling for the spread and premium values too, Oct/Dec’23 easing back from its $14.60 high while the Oct/Oct’23 WP gathered itself around $164.00 having briefly printed to $167.00 on the rally. Such was the slow nature of the day that the market simply meandered along at the lower end of the range, making a marginal new low at $682.30 but never looking likely to fill the overnight gap on the intra-day chart. All remained calm until the final hour when some spec buying emerged to push the market back towards $690, resulting in a higher closing level of $687.10 for Oct’23 though changing little within the broader picture.