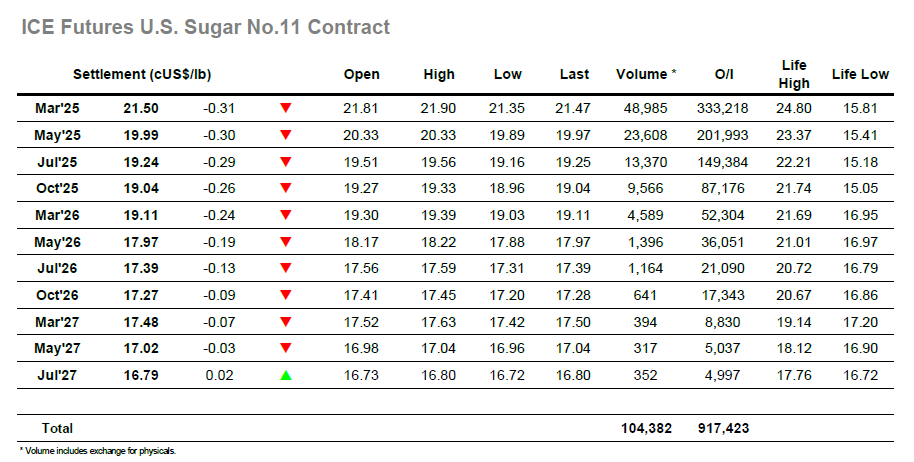

It was a slow start to the week with March’25 seeing trades either side of overnight levels through the first couple of hours, but while unspectacular this did serve to maintain the ground re-gained on Friday afternoon. The latest COT report was published over the weekend and shows a net spec position of just -62 lots having all but erased the previous short holding, and with values having moved away from the edges of the range any spec position growth to either direction is likely to be limited. This pattern endured through into the early afternoon however the arrival of Americas traders drew in a little more selling as the weak BRL encourages pricing activity which knocked values down to new session lows. The losses were uniform with the pricing taking place across 2025 and 2026 positions, and in March’24 it stimulated lows at 21.54 before some degree of consolidation was achieved. This merely proved to be a pause in the decline as the final two hours saw additional pressure applied and resulted in a session low at 21.35 as the close approached. There was some pre-close position covering which meant a March’25 settlement at 21.50, while March/May’25 closed at 1.51 points as we continue to track along within a very familiar band.

The market continued from where it left off on Friday by maintaining the gains achieved and sitting comfortably in the region of $560.00. Volume was poor throughout the morning as a narrow trading band held firm and it was not until the interest from the Americas arrived that the range extended to fresh daily ground. Through the early afternoon this meant March’25 dropping back to $556.70 before finding an element of support, though the lack of additional pressure was also in part due to low volume selling with the No.11 movement acting as a driver for white’s traders. As a result, the white premium values were perkier with March/March’25 widening back out towards $83.00 once again while May/May’25 moved above $114.00 at one stage. Until the later afternoon the market was showing some resilience however it then cracked and dropped to the lower $550’s to wipe out the white premium gains and take on a more vulnerable appearance for the final part of the day. Lows were registered at $550.80 ahead of the close though day trader short covering followed to present a settlement at $555.00 and conclude and inside day on the charts.