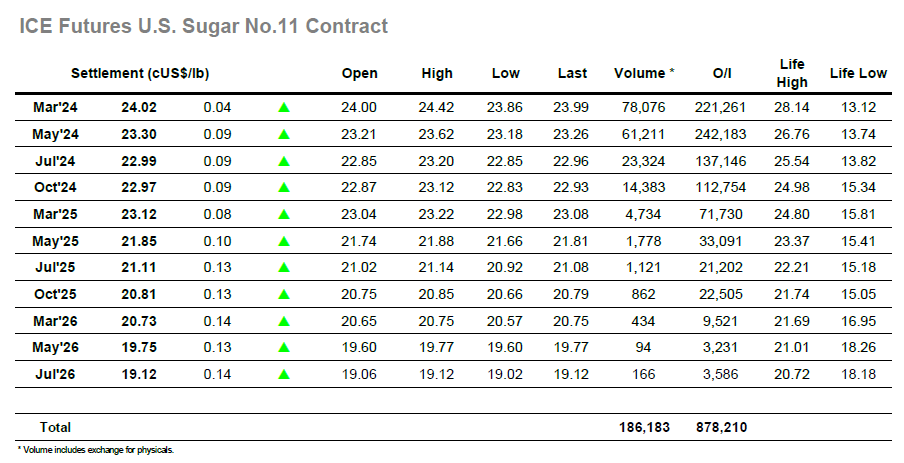

Undeterred by recent failures to sustain above 24c the market was instantly pushing ahead again today on consumer and spec buying, reaching to 24.25 before easing back through the early range and finding support near to overnight levels. Consolidation followed through the remainder of a slow morning though this still left the market well poised to look upward once again once the US based specs joined the fray early in the afternoon. Their arrival brought a sharp push into the 24.30’s and subsequently the market forged further ahead to 24.42, a single point above Wednesdays high, before collapsing back down to new session lows against long liquidation. The index roll continues to generate some solid volume for the March/My’24 spread though with hedge funds not involved to any great extent the period has seen lower volumes than in other recent expiries. Todays spread volume remained beneath 40,000 lots and saw the differential move into 0.67 points at one stage before ending in the low 0.70’s. A flat price recovery to mid-range ended abruptly as additional position liquidation took place into the close, leaving March’24 to settle at 24.02 and bring the curtain down on a week of rangebound activity.

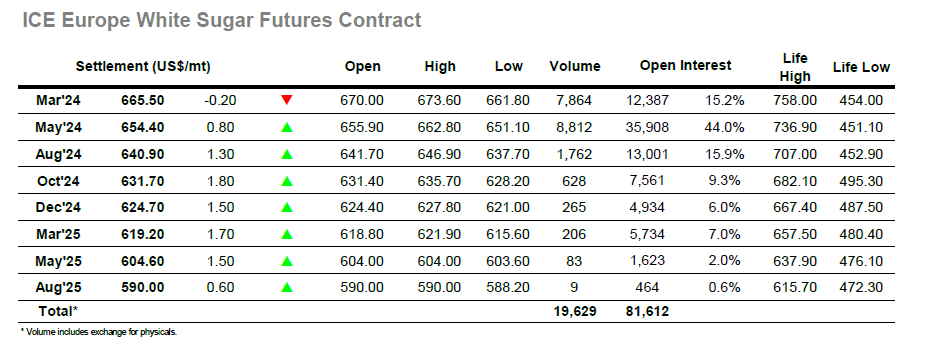

May’23 commenced the week positively with prices remaining in the mid $650’s during the early part of the session before dipping back to $651.10 midway through the morning, Despite previous failures to sustain rallies the specs appear undeterred and having consolidated through the rest of the morning they were again pushing from the long side and forcing the market up to new daily highs. This latest effort yielded a degree of success with May’24 reaching its highest level since late January at $662.80 before running into long liquidation. Alongside this movement it was still the March/May’24 spread providing the lions share of volume with pre-expiry rolling sending the value back down towards $10 during the afternoon. The sell-off saw May’24 all the way back to $652.70 before re-stabilising during the final hour, though the later buying lacked size and there was no sign that the earlier highs would be revisited. Moving towards the close the picture was quietly stable as May’24 held around $657.00 while the May/May’24 white premium was trading at $141.50. End of week liquidation left May’24 settling at $654.40, a neutral way to end following another choppy session.