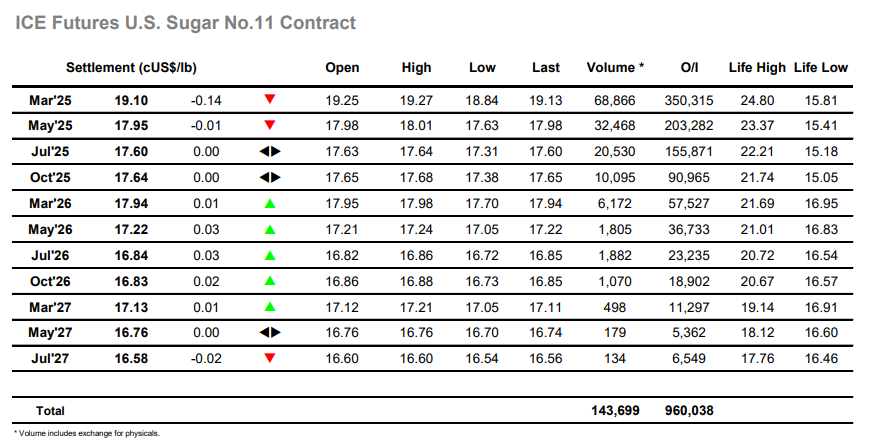

Marginally higher opening prints were short lived, and the market was soon tracking lower again as the smaller traders and spec shorts focussed their attentions upon the recent 19.04 low mark. There was proving to be steady buying ahead of this mark through some tactically placed pricing and this restricted the lows to 19.11 and 19.05 before the lows cracked and sent the front month plunging through 19.00 towards the end of the morning. The price reached 18.84 before pausing as the selling pressure eased, and for a while the price trod cautiously ahead of these new lows before popping back above 19.00 on elements of short covering. This recovery halted the decline but did nothing to reverse the current trend as the following hours saw March’25 holding either side of 19.00 and awaiting some more dynamic input. Alongside the lower front month values there was a decline in the spreads with March’25 bearing the brunt and seeing the headline March/May’25 trade down to 1.14 points, a level that it remained near to through the afternoon despite a flat price recovery. The recovery saw March’24 reach to 19.23 before dropping away during the final hour to a settlement value at 19.10, still appearing vulnerable to more downside testing in the near term.

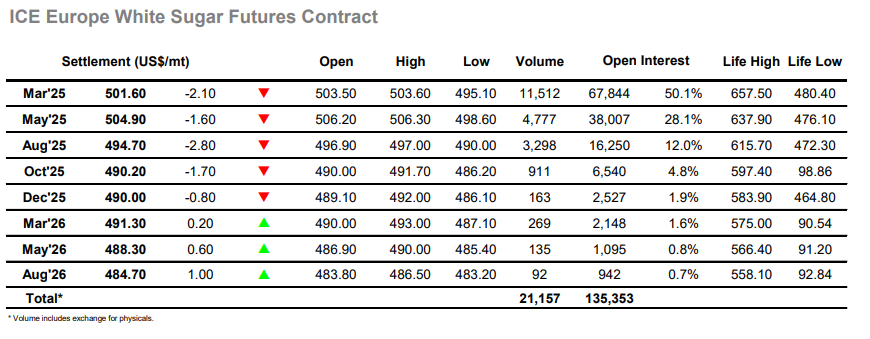

An instant drop to $500.00 placed the market on the back foot and while there was a recovery to erase the losses over the following hour the market was struggling to ward off the negative sentiment. Later in the morning this told with renewed pressure being exerted to crack the $500 mark and set prices lower, and while there was not a straight line collapse the market was struggling to find any real buying which might fight against the trend. Day trader jostling did lead the price to swing within the range but by the middle of the afternoon the pressure was back on and March’25 had reached a new low at $495.10. Spreads and arbs were also under pressure in conjunction with the flat price with March/May’25 edging down to -$3.50, while the March/Mar’25 was valued beneath $78 intra-day before recovering back towards $80- ahead of the close. This was largely due to a flat price rally based on short covering that helped March’25 to hold above $500 into the close and post a slightly better close than may have been anticipated, though as is often the case it may merely be papering over the cracks of a still weak looking market. March’25 settlement was made at $501.60, but with news still thin a continuation of support testing seems the most likely way forward.