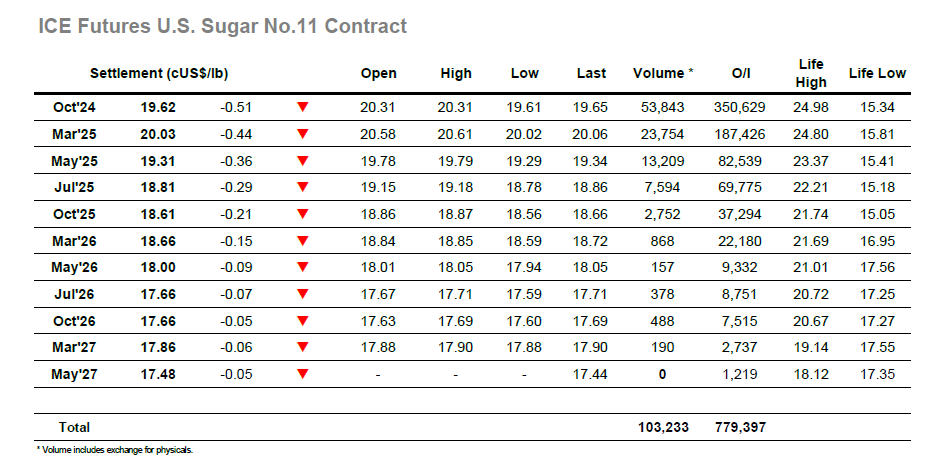

Opening buying ensured that Oct’24 commenced trading at 20.31, however there was no continuation to this initial bid and through the first 30 minutes the market softened to again be sitting just in front of 20.00. That was not the end of the struggles as continuing selling sent the price down to the mid 19.80’s over the rest of the morning, though volume was light and there proved sufficient scale pricing in place from yesterdays lows to defend against further damage. Last nights COT report had shown the majority expectation to be correct with a week of spec buying bringing the net position positive, now standing at 8,906 lots long, with more than 38,000 lots bought across the reporting period. Consolidation followed through into the early afternoon but given the movement since last Tuesdays close it feels certain that the specs have flipped back to the short side and more selling followed from them as the afternoon progressed. Bits and pieces of buying were filled along the way, but the scales were not overly heavy and driven by the white sugar weakness the market extended down to 19.62. A little more buying emerged during the final hour, but it had minimal impact and so prices were back around the lows reaching the call. Session low was made at 19.61 with settlement just a single point above at 19.62, and while the action of the past week has not been critical it seems certain to pen the market back within the broad range for the time being.

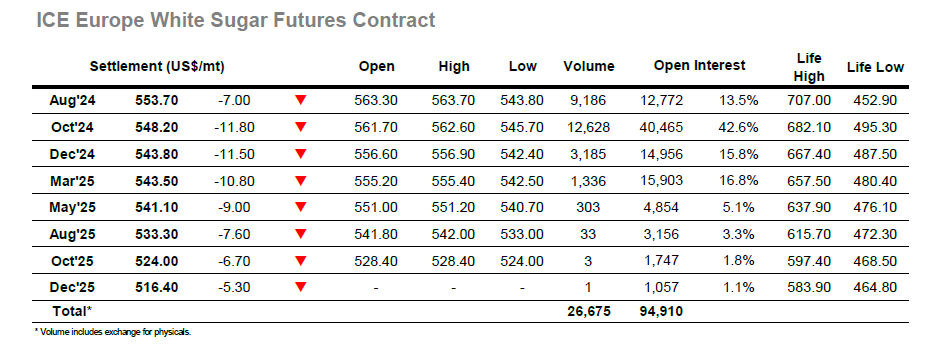

Oct’24 saw trades either side of unchanged on the opening, though with no real support in play following yesterday’s horror show the market then started to track slightly lower again. Any pricing interest has been confined to scales and with specs showing no interest to step into the way of the juggernaut the path remained unchanged, albeit with the losses racking up at a slower pace than 24 hours ago. By noon, the losses had extended to the mid $550’s, with the trend of slow erosion maintaining through into the afternoon. The white premium had been holding near to last nights value, however this changed by mid-afternoon as the speed of decline picked up. Oct’24 found itself trading beneath $550 in quick time, and the losses did not end there with the price weakening to a session low $545.70. At the top of the board Aug’24 saw more weakness though the earlier stages with Aug/Oct’24 reaching a low at -$2.00, however there was a recovery during the afternoon with the spread ending the day back at $5.50 premium. There was a small effort to recover during the last hour (short covering) however the chart continues to show poorly with tonight Oct’24 closing value of $548.20 more than $30 below last Thursdays high.