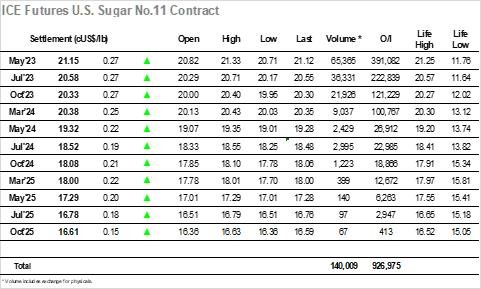

The pattern over the past couple of weeks has seen the market pushing ahead one day before consolidating the next, ensuring that the pace of the price race has tracked sufficiently well to avoid becoming too overbought on the charts. On that basis today would be expected to see a price rise and so some alarm bells were ringing as early trading saw the price action taking place in the red as May’23 slipped back into the lower 20.70’s, though the market then regathered to consolidate through the rest of the morning and keep the platform intact. All remained calm as the Americas day got underway however there was soon a fresh surge in prices which followed as specs returned to the market. The timing was somewhat ironic as it coincided with the wider macro falling away from morning highs. May’23 quickly progressed all the way to 21.29, with a second push extending the move to new contract highs at 21./33 before activity cooled. |Against the spreads were reluctant passengers for the move and continued to send out fewer positive vibes with May/Jul’23 only extending a small way to 0.63 points on the flat price strength before falling back into the mid 0.50’s as the afternop0on wore on. The flat price remained positive though was also away from its highs with May’23 falling back into the teens, continuing in this vicinity through to another sold close at 20.15.

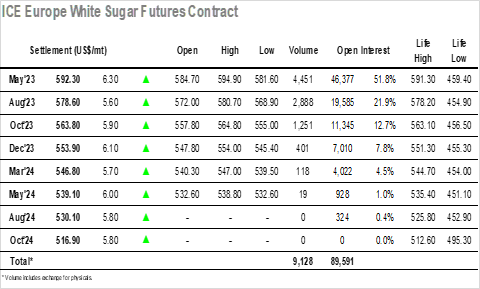

It was another slow start for the whites today as May’23 slipped back into the lower $580’s where supportive buying was found that ensures the flat price structure remains intact. A quiet morning ensued however by early afternoon the market was pushing higher once more with a vengeance, specs buying into a relative vacuum as the May’23 contract surged through to yet another set of new contract highs. There was a little more selling seen once the price moved through $590, though the buyers persisted, eventually topping out at $594.90 where we made an intra-day triple top. Spreads were moderately former on the move with May/Aug’23 reaching $14.90, though they remain rather unconvincing compared to the flat price, while the premium continued in the mid $120’s. The final couple of hours played out away from the highs though still in the lower $590’s, eventually leading to a settlement level at $592.30. Overall, it was another in a series of strong showings, with the longs no doubt eyeing up a psychological test at $600 before the move is over.