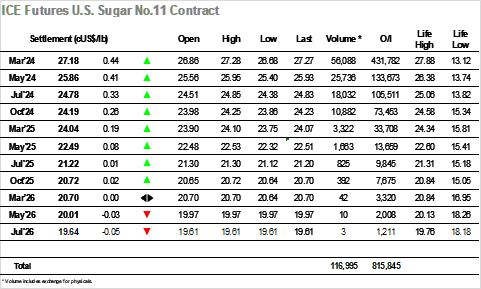

March’24 started the new week in positive fashion with the price immediately spiking into the 26.90’s, and though there was a pullback to 26.71 soon afterwards the upward trend soon resumed with the market climbing back up to fresh daily highs by late morning. Friday’s COT report showed a reduction in the net speculative long to 164,964 lots, and this provides some capacity for the smaller specs to load further to the long side should they be inclined. Their efforts saw the March’23 contract reach to 27.05 before retreating as we moved past noon, long liquidation seeing the price fall to anew daily low at 62.78 before being jolted higher once more. There were further swings in the price, illustrating well the nature of smaller spec and algo involvement, however the preferred direction remains upward, and so new highs were recorded at 27.09. Despite only seeing light selling from producers the market was finding it challenging to make further headway leading to some light profit taking as the market sat just beneath 27.00 heading towards the close. There was a late twist as aggressive buying arrived for March 24 through the final 15 minutes with almost 10,000 lots changing hands as the price surged to 27.28 and ensured a strong technical close. Settlement was recorded at 27.18 and should the specs maintain their recent renewed interest we may soon be looking to towards the contract highs again.

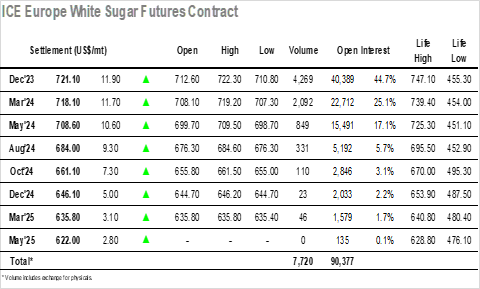

Initial buying saw the market move higher and following a brief retreat to $710.80 which enabled Dec’23 to fill the overnight gap the upward trend continued, ensuring strong gains at the front end of the board. By late morning Dec’23 was showing a high at $719.00 to place the market in a strong position, though progress was starting to prove more difficult due to the No.11 with gains in the white premium unable to continue indefinitely. Moving into the early afternoon there was a softening of prices back into the range, and though the price then dipped back towards the lows it was a brief interlude as buyers quickly returned to chase higher once more. Profit taking did cause brief dips in price but the trend was generally positive and by later afternoon Dec’23 had traded to a session high at $720, while the March/March’23 white premium was sitting comfortably in the $119.50 area. It appeared that the day would peter out quietly until the final 15 minutes when an aggressive spec led push sent the market to another set of new highs and a settlement price at $721.10, a positive conclusion which maintains the recent technical strength.