Insight Focus

- The macro-commodity environment continues to support global dairy prices.

- Chinese butter price rises due to restrictions on imported frozen dairy products.

- The oversupply of Chinese raw milk and weak demand could cap dairy prices in 2022.

China is the largest dairy importer in the world, but its demand has been capped by supply chain disruption so far in 2022. The pandemic is now showing signs of abating in China, with most regions expected to return to normal by June. But the impact on consumption is likely to linger. Meanwhile, the depreciation of the yuan is leading to higher import prices, which is supporting domestic dairy prices.

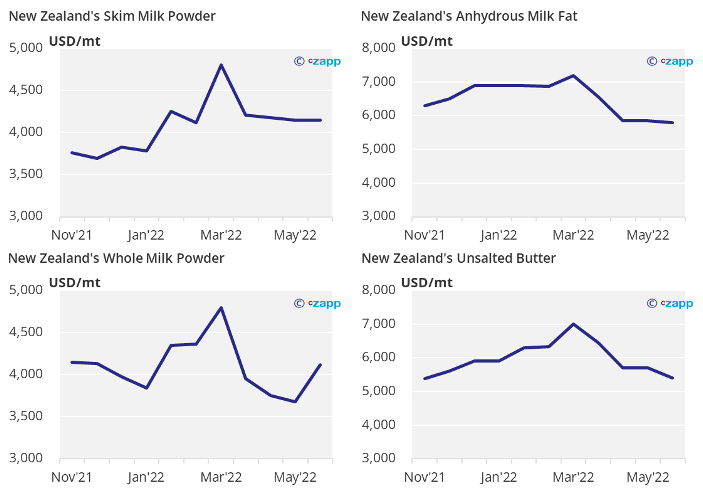

New Zealand

- Supported by the latest GDT auction price, New Zealand’s whole milk powder rebounded above USD 4,000 a tonne.

- Physical demand for New Zealand butter grew after two significant price cuts, with the price now back to where it was in November 2021.

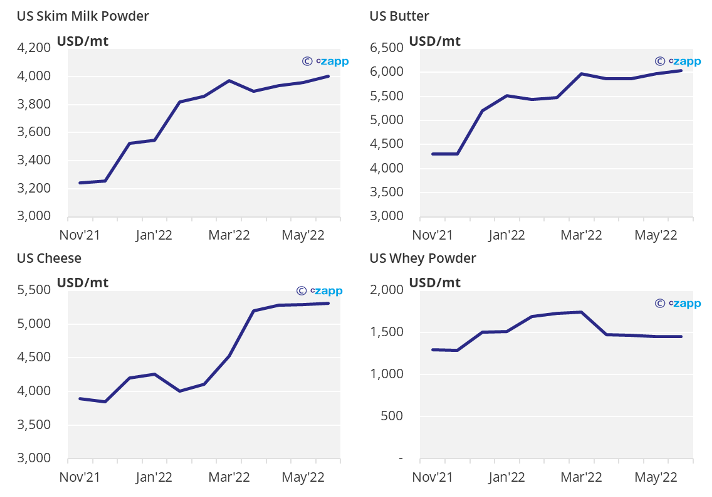

USA

- US dairy price posted another week of rises.

- Logistical difficulties in the US and the baby milk crisis will exacerbate supply shortages.

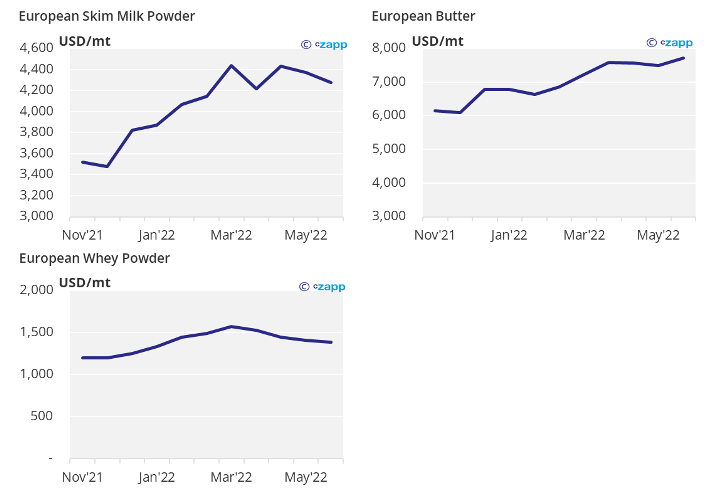

Europe

- The European butter price is turning upward because the butter production season is drawing to a close.

- Sentiment is bullish about consumption in second half of the year.

Other Insights That May Be of Interest…

Russian Food Self-Sufficiency: Reality or a Potemkin Village?

PET Resin Trade Flows: China’s COVID Response Slows Trade Flows