- China’s dairy supply is tight and European prices are rallying.

- With this, we’re seeing some Asian buyers turn to Oceania for their supply.

- New Zealand’s dairy prices have rallied in response.

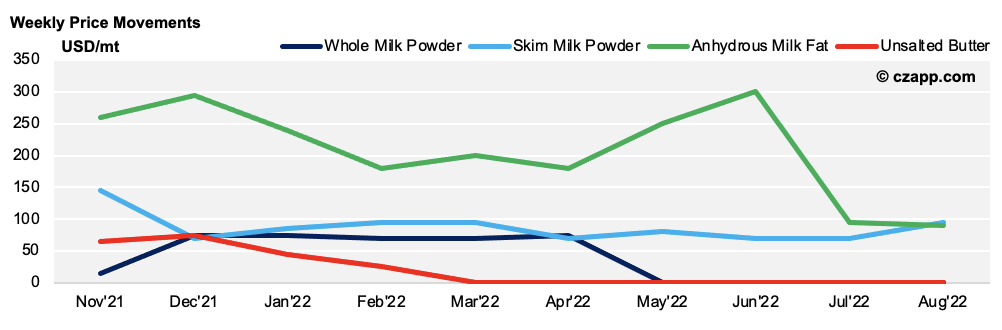

The New Zealand Futures Exchange (USD/mt)

- New Zealand’s dairy products rallied again last week, especially anhydrous milk fat.

- This is because Africa and the Middle East are looking beyond China and South-East Asia for the first time in a while.

- We hold a positive view for New Zealand, as Chinese supply is tight and European prices are high.

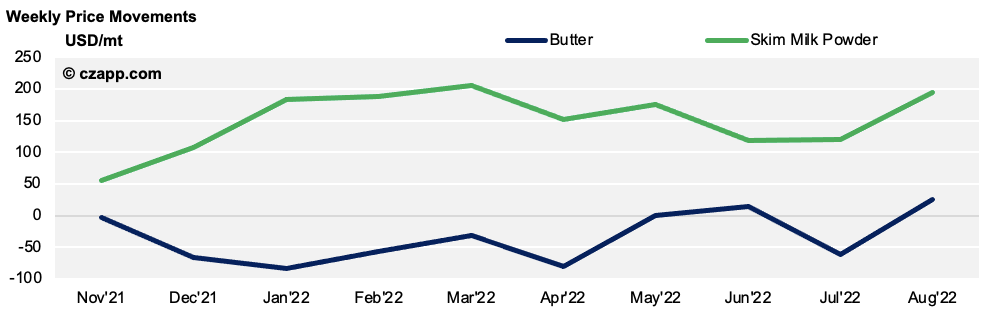

Eurex (EUR/mt)

- The European butter price dropped last week, and skim milk powder traded higher.

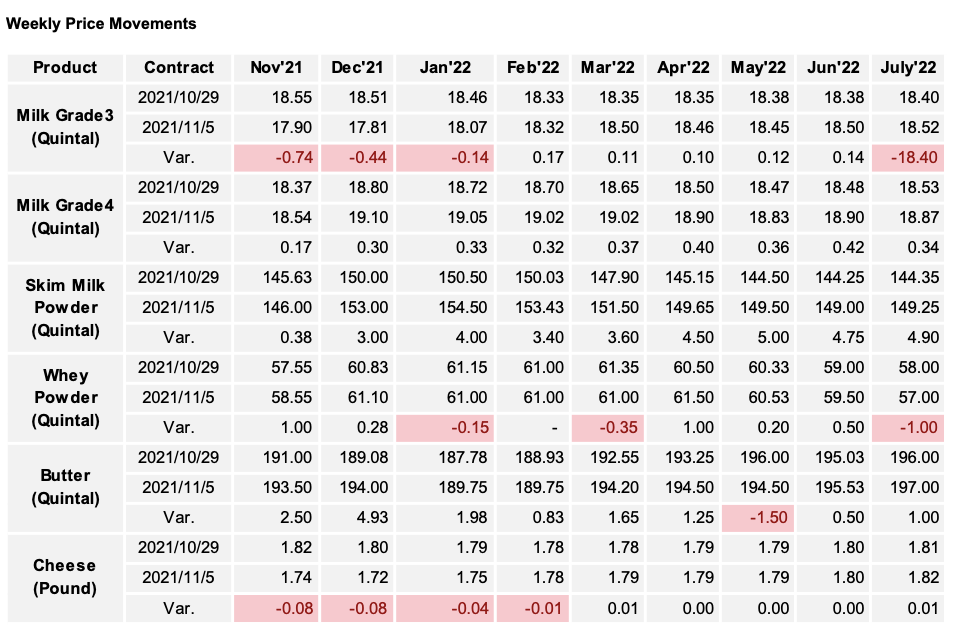

Chicago Board of Trade (USD)

- US cheese and milk (Grade 3) dropped last week, but skim milk powder rose again.

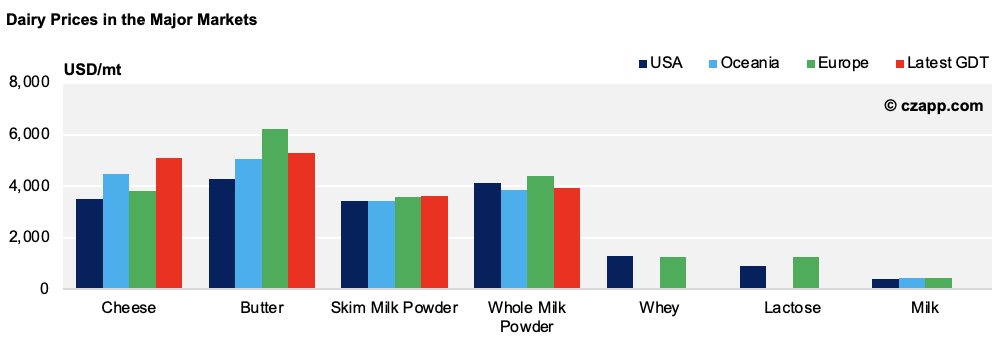

Dairy Prices in the Major Markets (USD/mt)

- European dairy prices have been rallying for two months and are now struggling to compete with other markets.

- This is especially the case for butter, with buyers now turning to Oceania.

- We’re entering into the peak consumption window in Western Europe, so prices could hold strong right through to the end of the year.

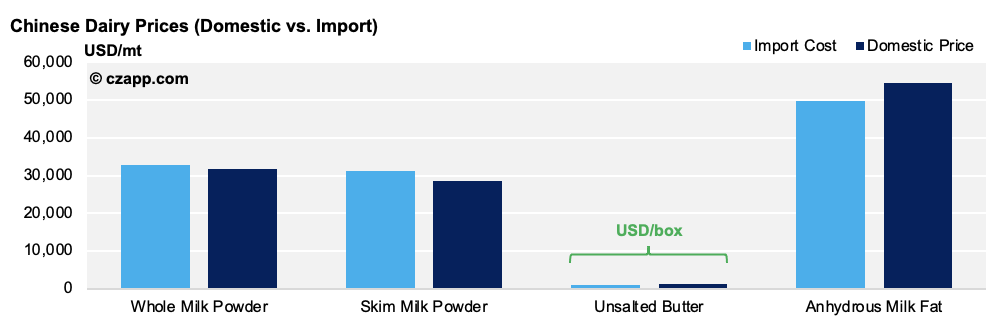

China’s Cheaper Domestic Prices Weakens Import Appetite

- China’s domestic whole and skim milk powder prices have dipped below the import cost

- With this, Chinese buyers displayed little interest in importing during last week’s GDT auction.

Other Opinions You May Be Interested In…

- NEW! Dairy Prices Soar on Energy Shortage

- Czapp Explains: Skimmed Milk Powder vs. Whole Milk Powder

- New Zealand Dairy Producers Strive to Fill European Supply Gap