528 words / 3 minute reading time

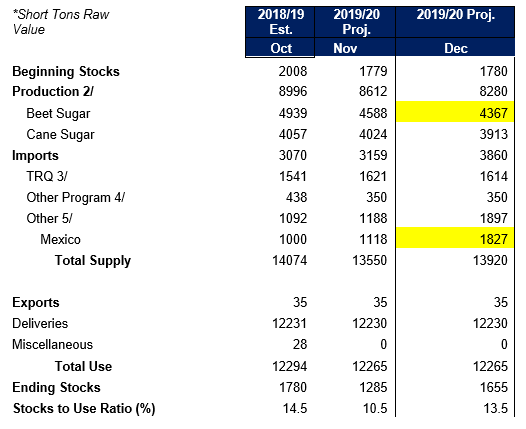

- The latest WASDE release has further downgraded the beet crop to 4.4m short tonnes raw value.

- As a result, they have increased the Mexican quota volume to remedy the domestic supply shortfall.

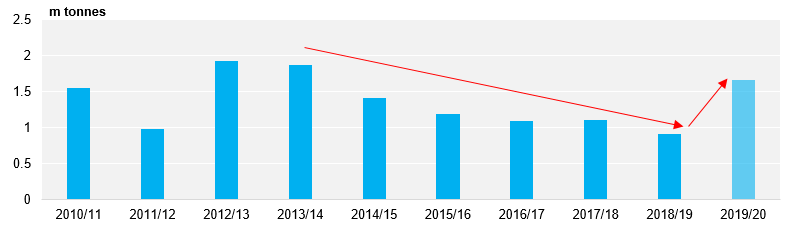

- The North American market will now be keeping a close eye on the Mexican crop to ensure it can meet the US market needs.

December WASDE Release

December WASDE Report

- Total US production has now been downgraded by 1m short tonnes since the initial forecast.

- This has been due to the early cold spell in the US Northeast and Midwest, as well a short cold spell in Louisiana that damaged cane yields.

- As per the suspension agreement (more on this later), Mexico has first access to fill the supply deficit.

- Considering the quota volume has been granted, it seems Mexico are confident they’ll export 1.8m short tonnes north of the border.

- The USDA are hoping that the Mexican crop can produce enough sugar to meet domestic needs as well as the quota volume.

- You can track its progress using the Mexican Crop Model, found in the Int eractive Data section on Czapp.

Mexican Exports to the USA

- Furthermore, the USDA also hope that the domestic supply of refined sugar does not tighten too much before Mexico can export it in earnest. This is because, even though the suspension agreement has been thrown out by the courts, we still believe Mexico will abide by the 70/30 raw to refined sugar split and the anti-bunching regulation that restricts shipments before March.

- If Mexico cannot fulfil its quota, the US will need to reallocate and maybe increase TRQs to meet this shortfall. However, this isn’t likely to happen until March.

Suspension Agreement Ruling – What Happened?

- The appeal against the original ruling has been rejected by the courts.

- Officially, this means that the current suspension agreement is now void.

- In theory, this means that Mexico could fulfil its US quota as a 47/53 refined/raws split.

- In practice though we don’t expect anything to change.

- Currently, the USDA is publicly reviewing the “new suspension agreement.” It is effectively the same one as the last. It is due to be presented on December 16th.

- In the short term, we do not think the Mexican government is likely to give out any further licenses to match the 47/53 split.

- Hence nothing should change in practice and we should see the suspension agreement effectively reinstated on the 16th.