Insight Focus

- The ILWU union has been engaged in labour conflict with US West Coast ports for the past year or so.

- A tentative agreement has been reached with US workers but problems for ports are not yet over.

- Unrest has spread and now, unionized port workers north of the US border will strike.

Why are West Coast Ports So Important?

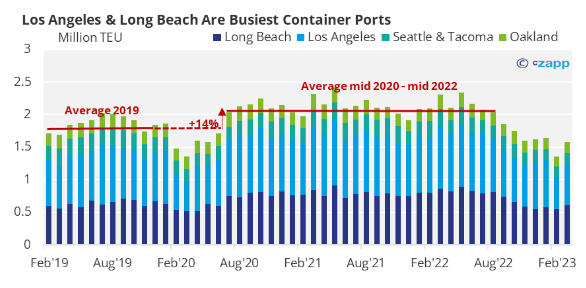

The ports of Los Angeles and Long Beach are two of the busiest container ports in the world. Outside of China, Los Angeles is the world’s seventh busiest port in terms of TEU volumes and Long Beach is the twelfth, according to the World Shipping Council.

And while there tends to be more ports on the country’s East Coast, five West Coast ports are the main recipients of goods from China – one of the US’ top trading partners.

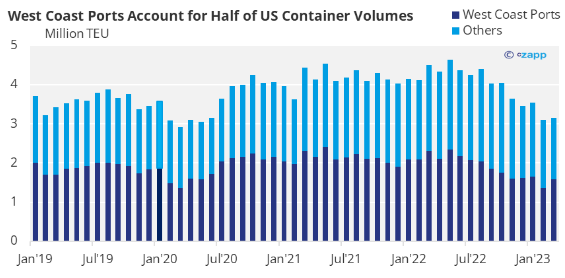

In 2020, the total TEU moved through West Coast ports equated to about half of all container volumes transiting the US.

Source: US Bureau of Transportation Statistics

Due to the huge growth in e-commerce in the wake of the pandemic, there were large surges in volumes in 2021 and 2022. This higher demand led to higher throughput at West Coast ports.

Source: US Bureau of Transportation Statistics

Why is there a Labour Dispute?

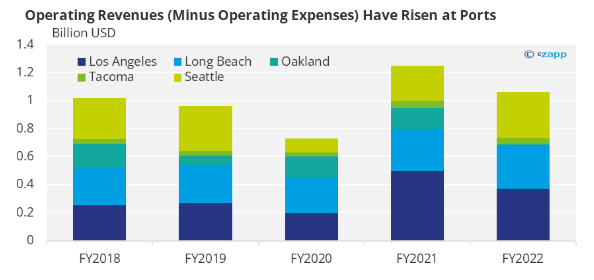

With high container volumes shipped, there was a corresponding increase in revenues. Operating revenues at West Coast ports increased in 2021 and 2022, according to financial reports.

Source: Port of LA, Port of Long Beach, Port of Oakland, Port of Seattle, Port of Tacoma

Meanwhile, dock workers were working on an old contract until it expired in July 2022. At this point, the rise in port revenues drove workers and unions to demand higher pay, which led to a year-long standoff with occasional work stoppages.

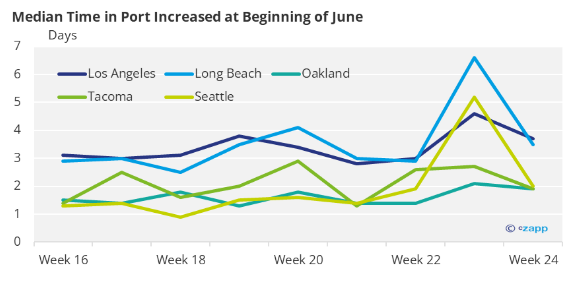

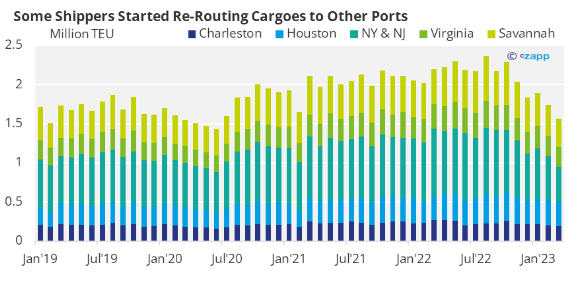

Some of these stoppages caused havoc with port traffic, creating long delays and driving some shippers to divert cargoes to other US ports.

Source: Marine Traffic

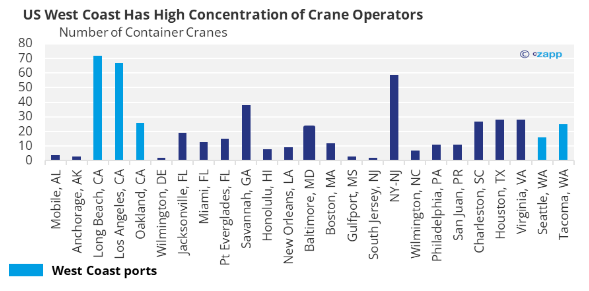

Another sticking point for the dockworkers is the increasing automation at ports. While some ports, such as Singapore, are pursuing goals to fully automate ports , workers understandably do not want to be replaced with robots in a drive for efficiency.

For example in Singapore, automated quay cranes can be controlled remotely, meaning one operator can control multiple cranes. But in the US, several jobs are provided by manually operated cranes.

Source: 2023 Port Performance Freight Statistics Program

Port workers, under the International Longshore and Warehouse Union (ILWU), are some of the best represented in the US.

No terms were disclosed but longshoremen, a part of the ILWU, earned on average USD 197,514 in 2022, according to a financial report by the PMA.

Labour Agreement Eases Panama Canal Issues

Recently, the weather has presented another major issue for US import-export businesses. Low water levels in the Gatun Lake – the water body that feeds the Panama Canal – mean draft restrictions and surcharges have been imposed on vessels.

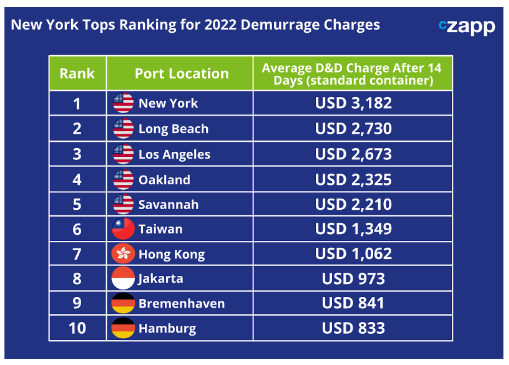

Previously, with labour troubles at West Coast ports, shippers had the (albeit costly) option of sending vessels through the canal to the east coast.

Source: US Bureau of Transportation Statistics

And port fees are slightly lower on the west coast, which is good news for shippers.

Source: Container XChange Demurrage & Detention: Annual Benchmark 2022

Concluding Thoughts

- West Coast ports have avoided disaster ahead of a potential peak season.

- But labour issues persist around the world.

- The same union – the ILWU – has voted to strike in the Western ports of British Columbia, Canada.

- CAD 300 billion (USD 227 billion) worth of goods pass through these Canadian ports.

- New strike action at this port has implications for North American and Asian supply chains.