Insight Focus

PET and Raw Material Futures cautiously increased after CNY, following upstream strength. PET resin export prices remain relatively flat as markets reopen, firming into the weekend. Despite the upcoming buying season, futures forward curves continued to show minimal forward premiums.

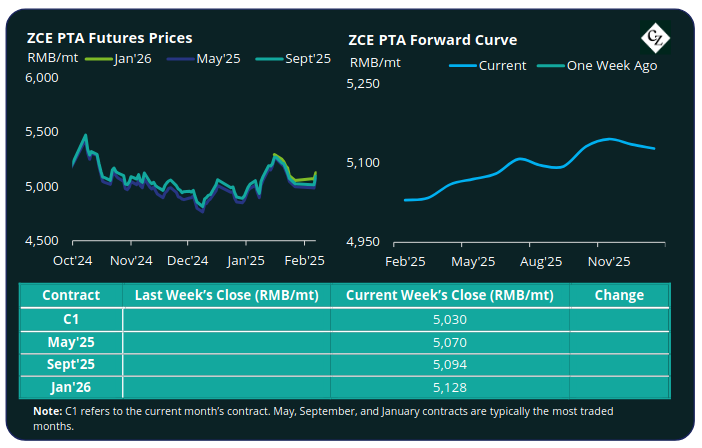

PTA Futures and Forward Curve

PTA futures closed the first week back following the CNY holiday up, with current and main month contracts seeing increases of between 0.5% and 0.9% versus the previous full week’s close.

After falling to around USD 76/bbl on Jan 27, Brent oil prices continued to ease through CNY and early last week. However, having reached around USD 74/bbl, prices experienced a bounce on Friday and through the weekend, lifting to back into the mid-75 USD/bbl range.

Much of this increase was driven by news of a blanket tariff of 25% on all steel and aluminium coming into the US. In general, oil traders expect Trump’s policies will remain supportive for oil in the near-term.

The PX-N CFR spread improved to around USD 186/tonne, reflecting relative strength in the PX market. PTA plant operating rates experienced only a slight increase, with the PTA-PX CFR spread softening marginally. It decreased to an average of USD 78/tonne for the first three days of trading after markets reopened last Wednesday.

PTA spot liquidity improved through the week as logistics gradually returned following the break.

All eyes are now on how the downstream polyester industry responds, given the low operating rates before the holidays. At present, whilst some restocking is evident, most are still digesting pre-holiday stock.

The PTA forward curve has become slightly shallower although remains in contango, with the May’25 contract holding a RMB 40/tonne premium over the current month’s contract. Sept’25 holds a RMB 64/tonne premium.

MEG Futures and Forward Curve

MEG Futures opened marginally down, by less than 1%, versus the pre-CNY close, with the May’25 contract dropping around RMB 34/tonne.

Partly responsible was the surge in East China main port inventories, which as expected, increased by over 30% to around 623,000 tonnes, because of slower offtake during the CNY and a wave of import arrivals.

Inventory buildup is expected to continue through February as imports continue at pace through February, although current weather conditions may see a temporary slowdown.

Beyond the current month, supply and demand fundamentals are expected to improve in March as the downstream (in particular bottle-grade PET resin manufacturers) see demand swing into pre-season buying.

The MEG Futures forward curve kept in carry with the May’25 contract having a RMB 72/tonne premium over the current month’s contract. Sept’25 held a RMB 95/tonne premium, narrowing slightly versus pre-CNY.

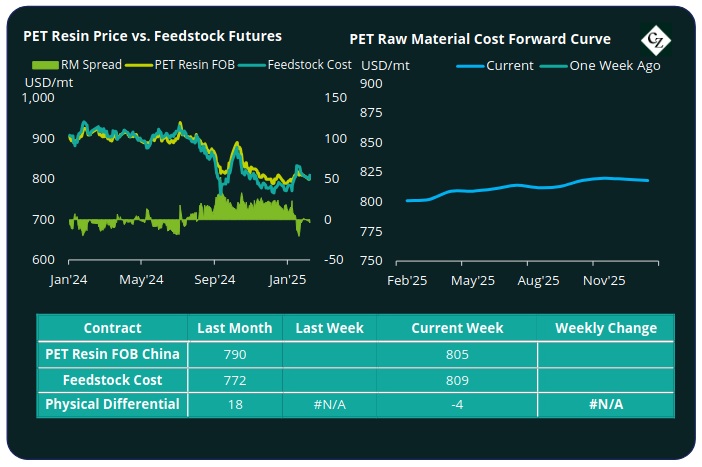

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices softened slightly, dropping to an average of USD 805/tonne, down USD 5/tonne versus prior to CNY, although Friday’s increase in PTA values is likely to see prices firm into the coming week.

The average weekly PET resin physical differential against raw material future costs improved to just negative USD 2/tonne last week, up around USD 8/tonne versus pre-CNY. By Friday, the daily differential was negative USD 4/tonne.

The raw material cost forward curve eased somewhat, although still in slight contango through 2025 with May’25 holding just a USD 8/tonne premium over the current month’s contract, and Sept’25 holding a USD 12/tonne premium.

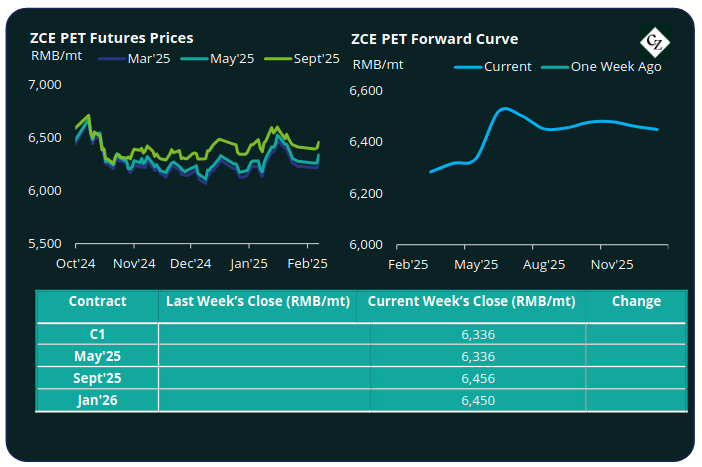

PET Resin Futures and Forward Curve

PET Resin Futures ended the first week back after CNY around 1.2% higher after PTA futures pushed higher on Friday.

The Mar’25 contract, the first contract month of these new futures, increased to RMB 6,336/tonne (USD 867/tonne), equating to an FX adjusted increase of USD 5/tonne versus the last full week before the CNY break.

The average weekly premium of the Mar’25 PET futures over Mar’25 raw material futures increased to around USD 23/tonne, up USD 5/tonne. By Friday, the daily premium was USD 21/tonne.

The PET resin futures forward curve flattened moderately across the main contract months. May’25 holds just a RMB 52/tonne (USD 8/tonne) premium over the main Mar’25 contract, while Sept’25 has a RMB 172/tonne (USD 22/tonne) premium.

Concluding Thoughts

Chinese PET resin export prices are expected to firm into the coming with following the uptick in PTA and crude oil prices towards the end of last week.

As the Chinese PET resin industry gradually returns after holidays, much of the immediate activity will be focused on delivery and export of existing orders, drawing down factory stocks that may have built up over the last fortnight.

Late-February and early-March typically see a surge in export activity. After this, we hit the pre-season buying period for bottle-grade resin exports in March. As a result, we expect Asian resin producers will demand strengthen, potentially returning some production margin.

That said, at present forward curves for both PET resin and the raw material futures continue to show minimal carry through to May’25 (<USD 10/tonne).

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.