Insight Focus

- Too much rain in Northwest Europe is just as much of a problem as too little rain in Argentina and Australia.

- The Ukrainian Black Sea humanitarian grain corridor faces ups and downs.

- China, the largest wheat stockholder, continues to import significant volumes.

Headline stories for wheat around the world are not setting prices on fire, but they are creating an interesting fundamental picture for supply and demand over the coming months into 2024.

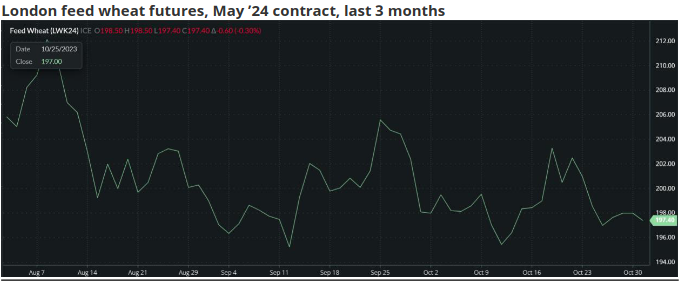

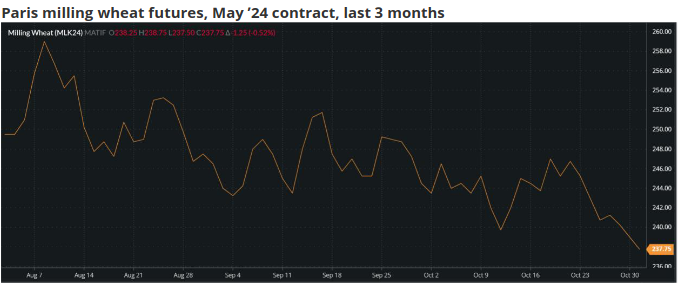

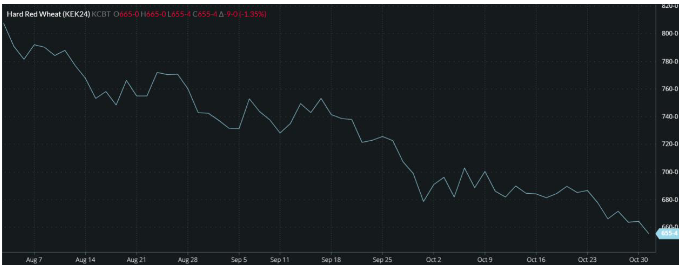

The charts below show how wheat prices around the world have been struggling to lift off their recent lows as the general trend favours the bears.

Kansas hard red wheat futures, May ’24 contract, last 3 months

Source: Barchart commodityview

Weather Challenges Farmers Globally

Farmers are constantly watching the weather, as they need sunshine or rain at critical times of the growing season. In Argentina and Australia, recent reports have focused on lack of rain and falling crop production numbers.

There has finally been some rain to help wheat. In Argentina there is hope that this will help boost crops. In fact, the most recent crop condition reports suggested some improvement. But in Australia, where harvest is underway, rain will have less benefit. According to some early reports though, yields are not as bad as expected.

On the other side of the world, in the Black Sea region, the lack of rain is hampering plant growth. At this stage of the crop, fields need rain to boost the germination of wheat seeds in the ground.

In Western and Northern Europe, too much rain is troublesome. After a good start to planting, some parts of the continent have experienced extreme rain, causing soil saturation. This means no further drilling until a good dry spell emerges. The rain is also a worry for seeds already in the ground as they risk being literally drowned out and rotting before they grow.

Mixed Messages on Ukraine Grain Corridor

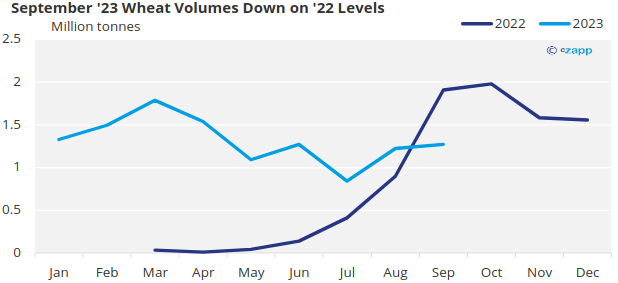

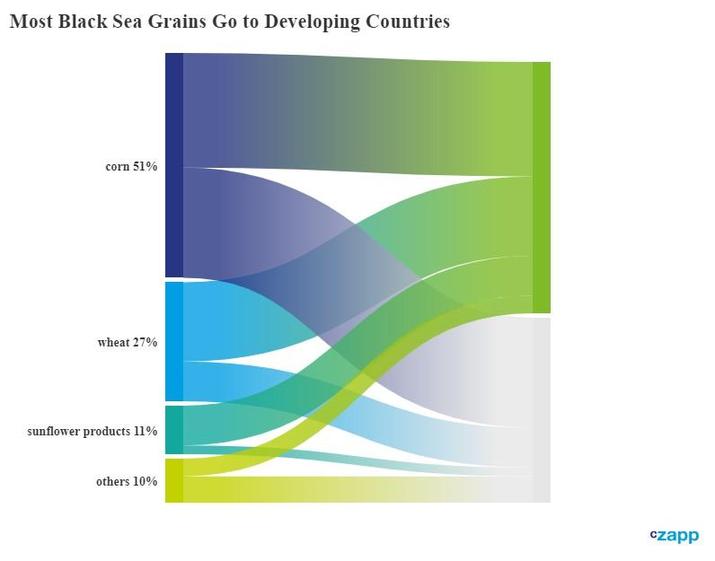

The Black Sea, never far from the news, has seen reports and counter reports surrounding the Ukrainian implemented ‘humanitarian grain corridor’. The Ukrainian government has been heralding its grain corridor since the July breakdown of the UN/Turkey brokered edition involving Russia.

It has had much success, although overall exports of wheat are down on this time last year.

Source: Ukraine Ministry of Agrarian Policy and Food

Last week, reports circulated suggesting a partial halt for the corridor as Russian warplanes were a threat. These reports were dismissed by the Ukrainian Government and there have been several ships loaded moving out of ports in recent days. This is a saviour for those in Africa and beyond, who are desperately in need of the wheat shipments.

Source: UN Black Sea Grain Initiative

China Continues to Import at Breakneck Speed

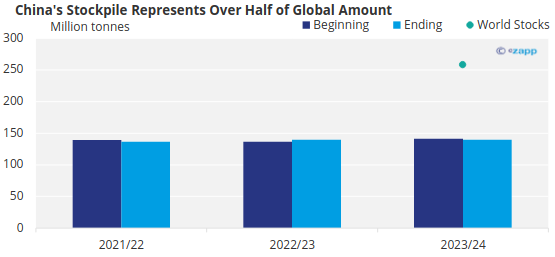

China has become a more important participant in the wheat market during 2023 as it ramps up purchases as world stocks drop to eight-year lows. Despite huge stockpiles, China has been the largest buyer of wheat for 2023, with over 10 million tonnes purchased thus far in 2023.

Unique in the world of wheat, China is the largest wheat stock piler, with over 50% of the predicted world end 2024 stocks of 258 million tonnes.

Source: USDA

The consequences for the future are intriguing. It would seem logical to assume that these imports are generally for quality milling wheat, replacing the quantities lost to poor weather during the harvest. However, if these assumptions are proven to be incorrect and China’s thirst for imports continues, it could be a cause for concerns across the market as stocks could dwindle further.

Conclusions

- Too much or too little rain is certainly a warning that there could be areas of reduced production for 2024.

- Time will tell whether Ukraine can maintain its logistics and Black Sea exports to keep values in check.

- The spotlight is firmly on China and the ongoing impact of its new-found appetite for wheat imports.

- These stories do not necessarily explain wheat prices right now, but they may influence the next major move.

- Could this fire up the bulls for a change in sentiment?