Insight Focus

The world has been experiencing a shortage of orange juice since last year. Now, the latest production figures from Brazil – the main producer – show a reduction in volumes, worsening the supply problem.

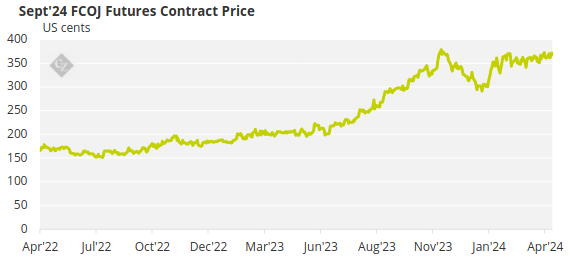

The FCOJ futures contract has been steadily trending upward since the beginning of 2023. The price rise began to gain pace in mid-2023 and, although it has now lost momentum, it remains elevated. The Sept’24 contract is now at around USD 366, compared to USD 166 two years ago.

Source: ICE

Orange Dynamics Explained

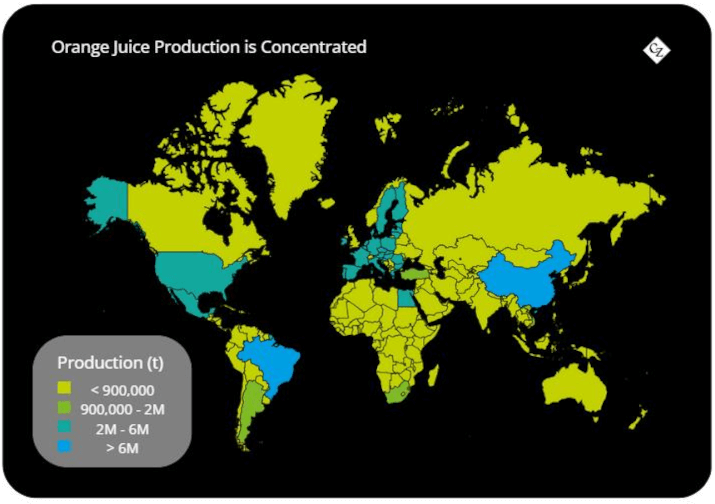

Brazil is the largest producer of orange juice globally, followed by China. It is also the biggest orange juice exporter, accounting for just under 60% of global exports. Brazil, Mexico, the US, and Argentina make up about 70% of all orange juice exports, meaning that international supply is highly concentrated in the Americas.

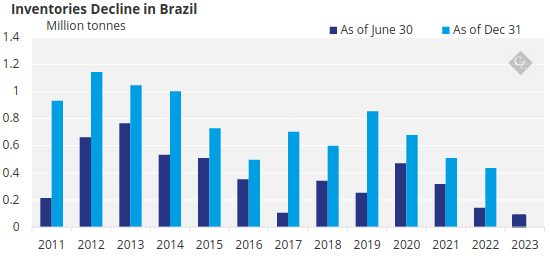

This means that any production or supply issues in Brazil or the Americas have a huge impact on global orange juice stocks. Right now, supply in Brazil is dwindling. In 2022, it had the lowest stocks since at least 2011 according to CitrusBR, the National Association of Citrus Juice Exporters.

Source: CitrusBR

Brazil Experiences Challenges

As per the latest update from Fundecitrus, there is a decline in the production of oranges for the São Paulo and West-Southwest Minas Gerais citrus belt in the 2023/24 season. The estimated production is expected to be 309.34 million boxes of 40.8 kg each (90 lbs), which is a 2.22% decrease when compared to the previous season’s 314.21 million boxes.

Source: Fundecitrus

Several factors have contributed to this decline in production. One significant element was the adoption of a faster harvesting pace aimed at reducing the fruit drop rate and losses in production. However, despite this effort, the fruit drop rate remained higher than historical levels.

A pivotal factor influencing the production decrease was the weather pattern shift experienced during the crop season. The first half of 2023 saw ample rainfall, but a precipitation deficit ensued in the subsequent six months, persisting until the end of the season in 2024. This change in weather conditions, coupled with the worsening of citrus greening disease and the hastened harvest pace, shortened the development period of oranges.

Source: Fundecitrus

As a result of these combined factors, harvested fruits were smaller than anticipated. While the accelerated harvest pace posed challenges to fruit growth, it did yield a positive outcome by mitigating losses attributed to premature fruit drop.

Across all varieties, the average size of harvested fruits meant 255 fruits filled a 40.8 kg box. This was an increase of eight fruits compared to the May 2023 projection by Fundecitrus. These fruits weighed on average 160 grams (5.64 oz), falling below the average weight recorded over the past decade, which stood at 163 grams (5.75 oz).

Source: Fundecitrus

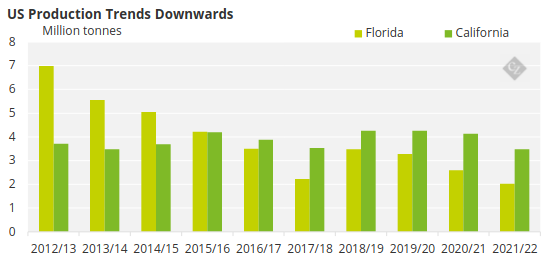

US Production on the Decline

These issues are not only impacting the production of oranges in Brazil but also in the United States, which is a significant cultivator of the fruit. Florida and California are the country’s biggest orange producing states.

Last year, the US had the lowest volume of oranges since the USDA, Department of Agriculture, began keeping records. In the 2011/12 harvest, the US was ranked second in orange juice production worldwide, after Brazil. Today, the US is in third place, behind Mexico.

Source: USDA

This is due to citrus greening disease, also known as HLB. The disease affects the sweetness and colour of oranges, leaving a significant portion of the crop in the state deemed unsuitable for juice production as national regulations require juice oranges to have a Brix level of at least 10.5 degrees. According to a USDA Row Count survey conducted in March, 51% of the Valencia crop had been harvested and the fruit size was below average.

In addition, the US is currently facing orange juice supply limitations due to the 2022/23 crop being impacted by high winds from Hurricane Ian, which caused a decline in yields in Florida. Inventory is also dropping.

Source: Florida Citrus

In the face of various challenges, Florida’s production and other regions have managed to witness a slight recovery in output for the year 2023/24. However, this was not enough to make up for the lower production in Brazil. As a result, the global FCOJ equivalent output is estimated to be 1.4 million metric tonnes, a decline of 3% compared to the previous year’s output of 1.34 million in 2022/23.

Orange Future Looks Bleak

Looking ahead to the 2024/25 season, the global orange juice market is currently facing high prices due to ongoing supply constraints, and it has been confirmed that inventories will remain depleted for some time, making the situation even more complex.

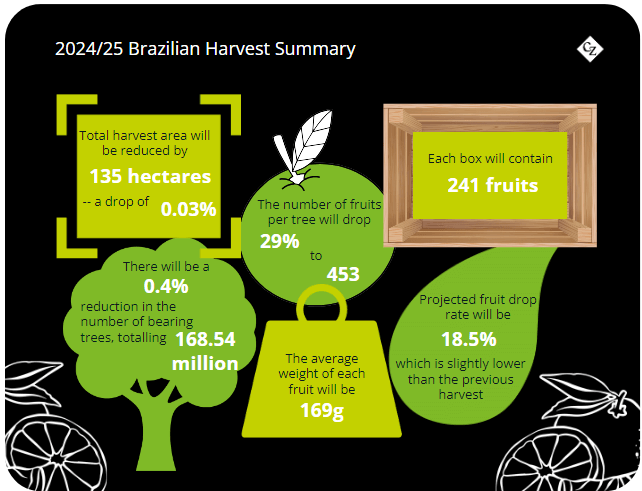

According to Fundecitrus’ latest forecast, the 2024/25 harvest is expected to yield 232.38 million boxes of oranges, each weighing 40.8 kg. This is 24.36% less than the 2023/24 harvest, making it the smallest in the last decade. This can be attributed to a combination of lower rainfall levels, which are expected to be 30-40% lower than the average over the next six months, and elevated temperatures.

Citrus greening remains a concern, which will probably lead farmers to harvest early due to its effects. High temperatures will also contribute to this, as it leads to faster fruit ripening. These factors can impact fruit quality and diminish juice yields. Additionally, with a smaller harvest, there will be more labour available, which will also result in a faster harvest.

What to Expect this Harvest

As usual, the highest volumes will be harvested over the first and second blooming, representing 64% and 18% of the crop respectively. The third blooming will represent 11%, while fourth is predicted to represent around 7%. This is atypical as it usually accounts for around 2% to 3%.

With this unusual late blooming, some additional volume could be provided, and this will allow Brazil to compensate for earlier losses.