Opinion Focus

- Studies are showing that, among younger generations, preferences for alcohol are changing dramatically in countries such as the UK and USA.

- Given that alcohol consumption normally promotes higher sugar consumption, we can glean some insights on potential consumption changes.

- A sustained cultural decrease in alcohol intake could signal less appetite for sugar.

The younger generation has grown up in a very different environment to its predecessors. Due to the high penetration of social media, an aversion to alcohol and preference for low-sugar functional beverages seems to have followed, particularly in Western economies. But it’s not all bad news for sugar as coffee culture continues to take root among Gen Z.

Connection Between Sugar and Alcohol

Alcoholic drinks are rarely considered when we speak about sugar consumption, but they have a huge role to play. First of all, alcohol is synonymous with ethyl alcohol – or ethanol, a sugar by-product.

Some alcohol products such as rum or cachaca are produced with sugarcane. Not all alcohol is made with sugarcane though – some is made with other fruits and cereals such as grapes, apples, rye or wheat.

Regardless of what it is made from, just about all alcoholic drinks contain carbohydrates in the form of sugars. The amount varies from product to product.

Not only do alcoholic beverages contain sugar, but they also predictably impact blood sugar levels. After an initial spike, blood sugar subsequently drops and creates cravings – which inevitably leads to binge eating and sugar cravings.

Therefore, alcohol consumption has a correlation with sugar consumption and a reduction in the former could lead to a reduction in the latter.

Gen Z Shun Alcohol

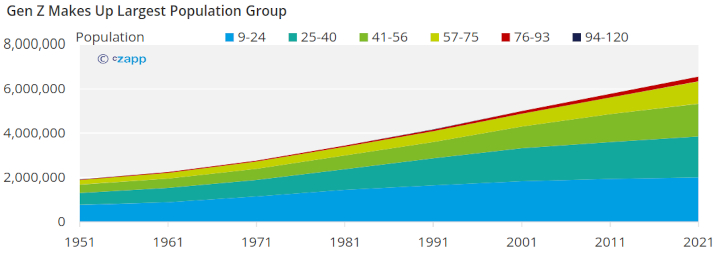

The global population has continued to grow over the past 70 years but as of 2021, the largest population segment in the world is that of 9–24-year-olds, which now make up about 30% of the whole world.

Source: United Nations

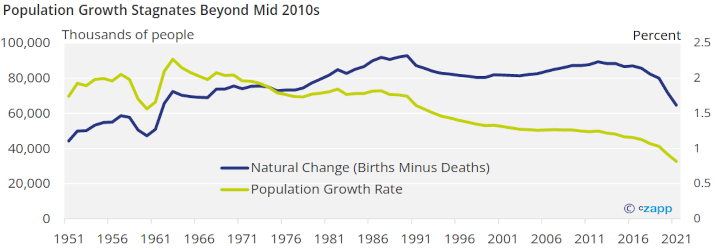

Consumption habits tend to change from generation to generation and dependent on socio-economic factors, but the Gen Z population are set to race ahead in purchasing power in the next decade or so, especially as the population growth rate dwindles.

Source: United Nations

There is evidence to suggest that the younger generation is drinking less than their predecessors. On a per capita basis, global alcohol consumption dropped to 23 calories per day from 24 calories per day in 2015 – the same year the Gen Z generation began to reach the age of 18.

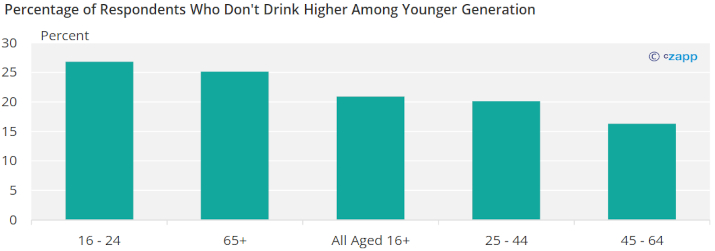

In the UK, 2016 data related to drinking habits showed that the 16 to 24 cohort is the least likely to drink alcohol in the country.

Source: Office of National Statistics

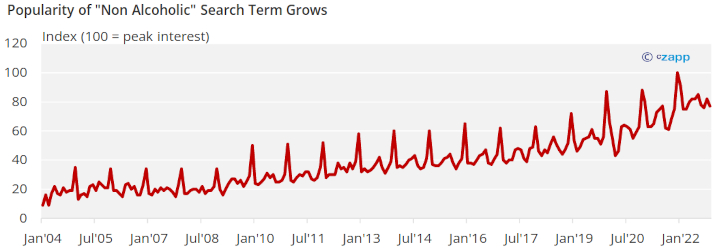

And Google Trends shows that global searches for the term “non alcoholic” has increased fivefold since 2004.

Source: Google Trends

Due to the correlation between alcohol and sugar consumption, this could mean that sugar demand is peaking amid a preference for non-alcoholic drinks among the younger generation.

The Logic Behind Less Alcohol

So why are younger people drinking less alcohol and how can beverage companies re-engage them in their products?

In a survey conducted by Google in 2019, there is some suggestion that the greater online presence is a major culprit. In the survey, 48% of the Gen Z generation surveyed said they are always conscious of their online image when socialising. And 41% associated alcohol with vulnerability, anxiety and abuse.

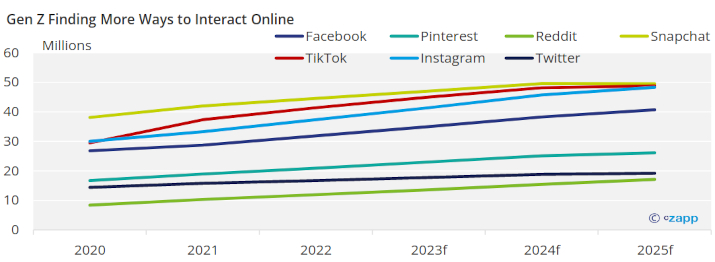

In the same vein, the online world creates a new option for socialising that didn’t exist before. For previous generations, that social scene existed purely in pubs, restaurants and bars. Instead, Gen Z is finding more and more of its social interaction on social media.

Source: Insider Intelligence

And even when Gen Z does visit bars, non-alcoholic beverage options now abound. Research commissioned by alcohol-free brewery Lucky Saint found that almost a third of pub visits are now alcohol free. And totally dry pubs are popping up all over the UK, hoping to provide the social experience for those who want to consume in a different way.

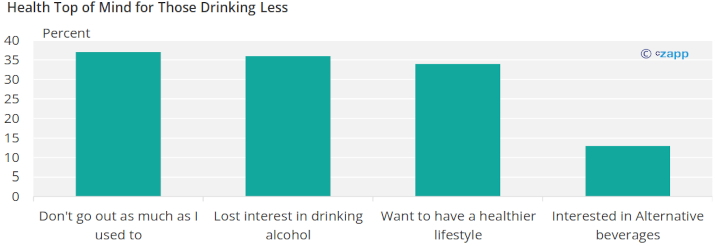

Since the beginning of the pandemic, there has been a bigger aversion to alcohol in general. In a NielsenIQ survey, 34% of respondents said they wanted a healthier lifestyle.

Source: NielsenIQ

What Are the Alternatives?

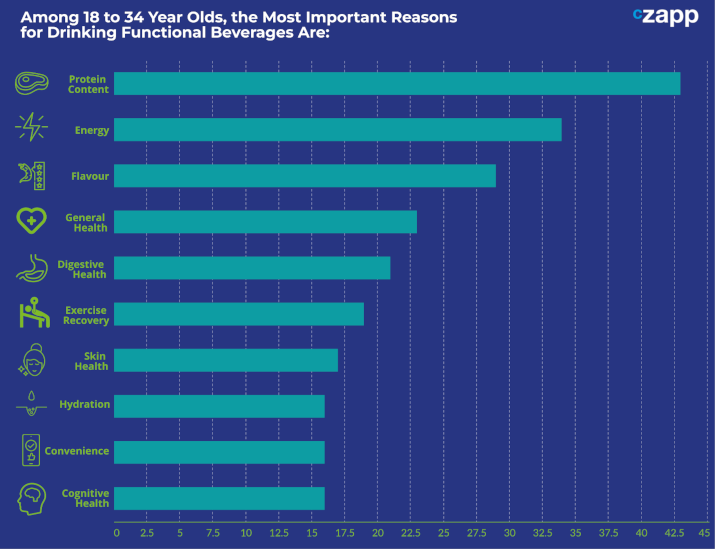

For 18- to 24-year-olds, an emphasis on health and high protein is driving them into the world of mood-boosting and functional beverages. Think performance drinks, protein drinks and ready to drink teas such as kombucha.

Source: Glanbia

According to research, the functional beverages market could be worth about $200 billion by 2030, and even mainstream beverage producers are jumping on board.

In 2020, PepsiCo launched the Driftwell drink, which is marketed as a sleep aid that helps consumers wind down. And Coca Cola launched its own kombucha called Health-Ade, alongside Coca-Cola Energy, which contains guarana extract and B-vitamins.

For sugar consumption though, this is not good news as most of these functional beverages contain low or no added sugar. But that’s not to say that Gen Z is shunning sugar altogether. In fact, this generation may be consuming even more sugar than those that came before thanks to a much more engrained coffee culture.

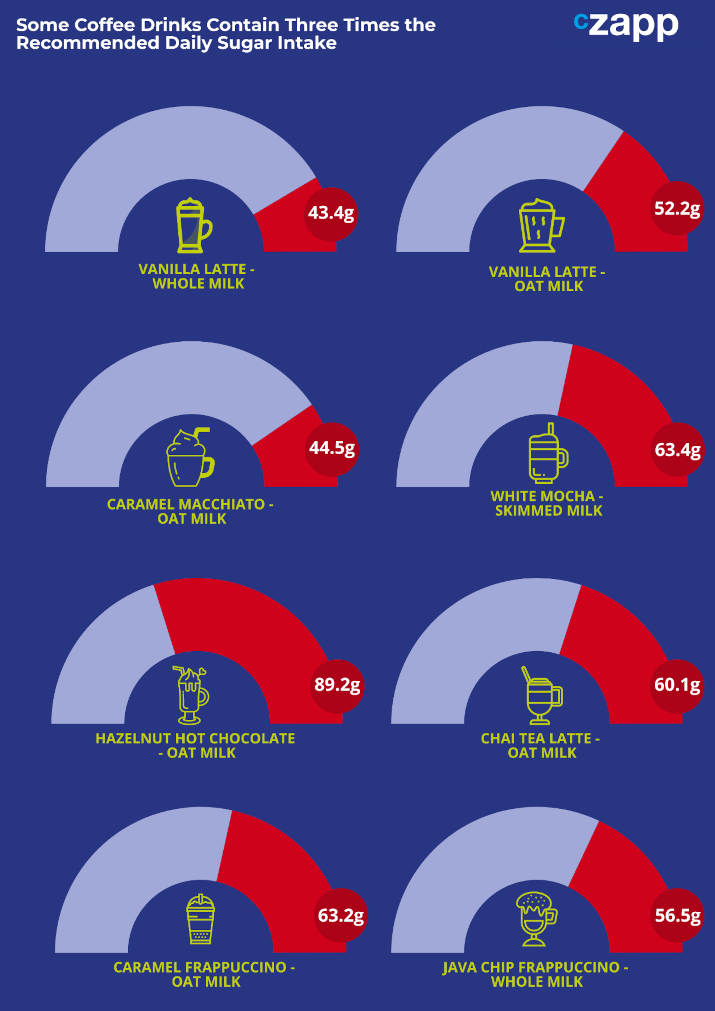

Chains such as Starbucks now offer coffee drinks that contain high levels of sugar, fat and cream. In fact, some drinks on Starbucks’ menu contain as much as 70g of sugar in their largest drink size. And according to the company’s most recent financial report, cold beverages represented 75% of the total US beverage sales in the last quarter of 2021.

Source: Starbucks

According to Drinkaware, alcoholic drinks account for 11% of the UK population’s daily intake of added sugar. Our estimates show that the UK consumes about 27kg of sugar per person per year, meaning alcoholic beverages contribute just shy of 3kg per year.

To compensate for this, young people would have to drink about 43 of the highest added sugar Starbucks drink every year, or 85 of the middle-of-the-road varieties. Given that Starbucks has stated that it accounts for 4 billion cups globally each year, this level of consumption is not entirely out of the question.

Concluding Thoughts

- The consumption habits of Gen Z are very different to other generations largely due to a more intense social media presence.

- Research shows that this online presence has soured the taste of alcoholic beverages for younger generations in Western countries that typically consume high volumes.

- This, alongside a preference for low or no added sugar beverages has stymied sugar demand.

- But it’s not all bad news: a more engrained coffee culture more than makes up for losses.

- Beverage manufacturers will need to tap into the new demand for exciting drinks.

- Retailers need to keep an eye on Gen Z habits – they’re likely to become the most important buying demographic in the next few years.