Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2023 Technical Commentary.

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

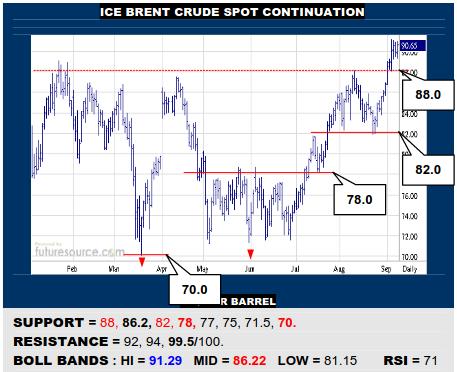

ICE BRENT CRUDE OIL SPOT

Doing its utmost for the B-Berg, Brent has bust loose over 88 from a major inverse H&S that infers a nearby goal at 94 and ultimate scope into triple digits. A tentative response from RSI just warns to keep tabs on the niche between the 88 base rim and oncoming mid band (86.2) as dips must be caught in there to maintain the broadly positive outlook.

NYMEX NATURAL GAS 2ND CONTINUATION

A glimpse over 3.16 failed to be secured by Nov Nat Gas piercing 3.26 and tailing back under 3.00 creates a toppier profile on that contract. Duly wary of dipping to a 2.80 continuation ledge before trying to rekindle the offensive and, if unable to even hold there, the broader saucer basing for ’23 would wane and 2.47 would beckon.

COMEX GOLD 2ND CONTINUATION

Gold needled over the H&S neckline but was ultimately still blocked by the upper Bollinger band (1956 now) and eased back. Closely minding the mid band (1919) as a key pick-up point if another bid to pry open the top is to follow (1956/1958). Alas, if the mid band gave way, the H&S would prevail and a deeper gouge towards 1809 would then threaten.

LME COPPER 3-MONTH

The ’23 downtrend intercepted at 8600 as Sep began to steer Copper back towards pivotal support at 8120. If it broke through it, summers’ peaks would become a new H&S pattern that would threaten to crack 7850 and press back towards a 7340 monthly shelf. Must hang on above 8120 to keep the downtrend within striking distance.

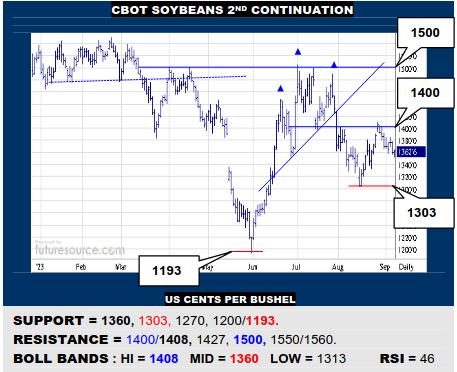

CBOT SOYBEANS 2ND CONTINUATION

Having been denied at the 1400 resistance, Beans have swerved back to attack the mid band (1360). If gathered up here, 1400 would remain a prospective springboard on to 1500 and the chance to finish a large new ’23 inverse H&S. If the mid band gave way though, be prepared to test the 1303 trough again, the 1200’s quite empty if it cracked.

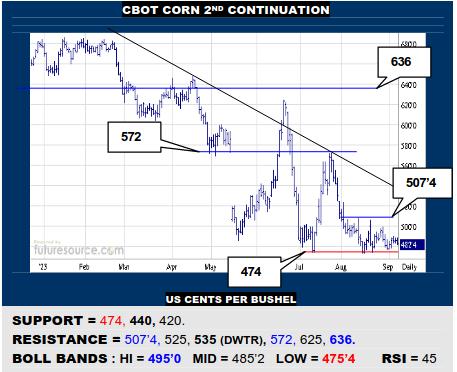

CBOT CORN 2ND CONTINUATION

A weird sort of truce in Corn as it has mopped up repeatedly on the 474 support but must translate this into a reflex over 507’4 to reassure these catches and go after the downtrend (535). Still not a secure footing while the Dollar makes gains and finally breaking 474 would instead suggest delving on down into broader monthly support between 440 and 420.

NY SUGAR #11 SPOT CONTINUATION

A bid to pull away from a second flag was fumbled Friday and Sugar has slid back towards the initial flag edge at 25.90. This feels vulnerable and breaking through would tilt on to meet the mid band (24.87) and maybe return to the inverse H&S neckline (24.20). Must otherwise hold 25.90 to preserve the chance to still engage the 27.41 April high.

NY COFFEE 2ND CONTINUATION

The attempted revival in late Aug has faded in the face of the interim downtrend and Coffee has veered back to threaten the 147.2 trough. Wary of breaking through and finally arriving in the lap of bigger monthly support at 140 before next trying to regroup. Only piercing the 155 to 157.5 span would meantime shed the trend and create room to 167.5.

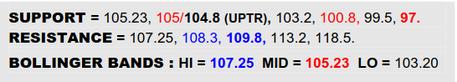

BLOOMBERG COMMODITY INDEX

With the Dollar needling the 105’s, the B-Bergs’ prior progress towards the main ’23 base escape hatch of 108.3 to 109.8 has stagnated this week. Generally the summer has been good for commodities but it must culminate in conquest of that band to come to true fruition, then painting a far more textbook inverse H&S on the landscape that could fuel a run for the 120’s. There isn’t much room to play with meantime and the niche between the mid band (105.23) and the uptrend (104.8) looks like vital bracing, a trend derailment then giving the past three months more of an upright H&S impression that could pave the way back towards double digits.

US DOLLAR INDEX

The Dollar quickly won back a late Aug dip and has crossed a preliminary bridge at 104.5. The Q3 recovery from that near miss of a major Fibonacci retracement at 99 is looking better and better then and just now needs the coup de grace of piercing 105.6 to really shore up the basing structure of ’23 and get out into some much clearer skies where 110 would be the next serious obstacle. Meanwhile only gouging back beneath the mid band (103.9) would give real reason to question the Dollars’ return to form to threaten the seemingly pivotal 103 ledge where things could badly upend, the loss of that looking like the B-Bergs’ ticket out over 109.8 if it is to happen.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2023 Technical Commentary.