Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

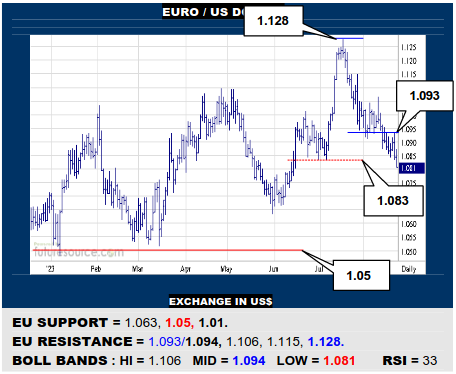

EURO / US DOLLAR

Not a thumping decline but the EU has continued to slide and gnawed away the next 1.083 ledge Wednesday. Coming from a 1.128 Fib retracement of the prior ‘21/’22 decline, this is looking an increasingly ominous drop and a next main shelf beckons at 1.05. Only a reflex back over the 1.093/1.094 mid band would take more of a stand.

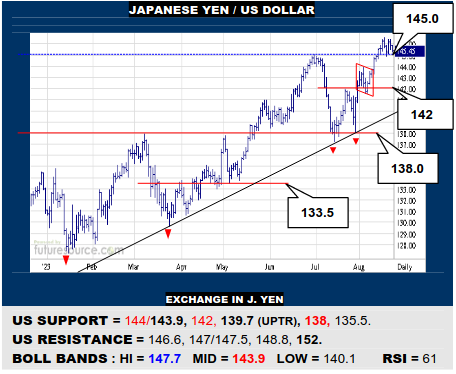

JAPANESE YEN / US DOLLAR

The US break of 145 didn’t bring much of a new spark despite a prior flag and small base both pointing on into the 147’s. This warns to watch the flag edge (144) and arriving mid band (143.9). If they can gather up dips still, so the upside would keep beckoning. Break back below 144 though and a delve to the uptrend (139.7) would threaten.

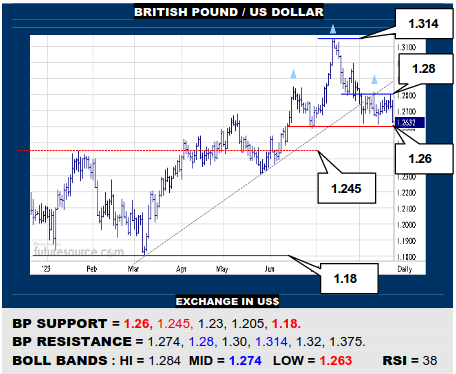

BRITISH POUND / US DOLLAR

The BP has been unable to resurface over 1.28 to shake off the Q3 lull and resuming pressure this week threatens to form a mid-year H&S if 1.26 gave way, in that case paving the way on down towards 1.20. Only a clean boost beyond 1.28 would instead forge a small new base area that could instigate another foray into the 1.30’s.

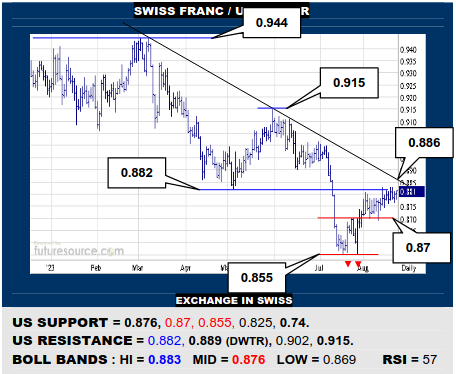

SWISS FRANC / US DOLLAR

A key juncture as the US probes the 0.882 resistance, the downtrend arriving just behind (0.886). This is a critical obstacle that must soon be dispatched to rekindle some energy and thus make a run towards 0.915. A sense of fatigue meantime so beware any twist back under the mid band (0.876) gouging on through 0.87 towards 0.855.

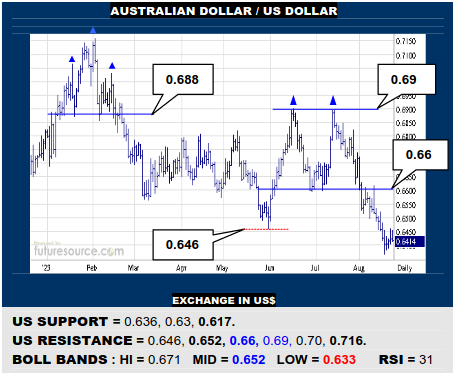

AUSTRALIAN DOLLAR / US DOLLAR

The AD is taking a breath of air following the breakdown from a mid-year dual top above 0.66. Alas, at the bare minimum it must jolt back over 0.646 to spur a correction to test that 0.66 frontier. While confined under 0.646, beware a bear flag evolving where 0.636 marks a trigger on down through a 0.63 top projection towards a next 0.617 trough.

BRAZILIAN REAL / US DOLLAR

The US appeared to score a new offset dual bottom as it popped 4.95 but has since been routinely blocked at the 5.0 figure. Must duly mind the oncoming mid band (4.892). If it can mop up this wobble, a swipe at heavier 5.10/5.125 resistance could yet occur. A slip back under the mid band would otherwise threaten another rummage in the 4.70’s.

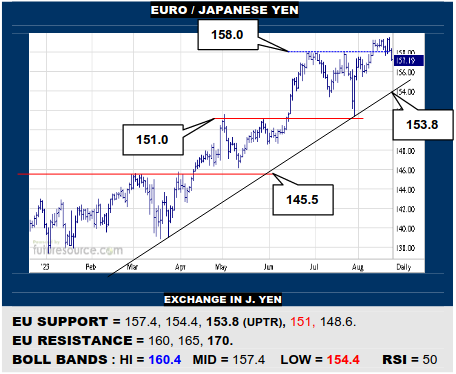

EURO / JAPANESE YEN

Temporary conquest of the 158 resistance has failed to stick and the EU is gnawing away at the mid band (157.4). If quick to head off this stumble here, be open minded to another try to reach the 160’s. If the mid band was truly breached though, a false breakout would be hailed and the ’23 uptrend would be next in line for testing (153.8).

EURO / BRITISH POUND

A dice with the 0.85 trough has been fought off as Wednesday has prospect as a key reversal for the EU but would want conquest of the mid band (0.858) to reassure this and raise sights onto the ’23 downtrend (0.865). If blocked by the mid band, keep minding 0.85 as a trapdoor on down to a multi-year ledge at 0.82.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.