Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2023 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

EURO / US DOLLAR

The backlash from a 1.128 Fib retracement has been tempered by the prior flag under 1.10 but the EU will have to react up over the mid band (1.108) to suggest a more substantive catch. Meantime pressing on through 1.095 would just intensify the look of a prior false breakout over 1.11 and warn of further steps down to a next main shelf at 1.05.

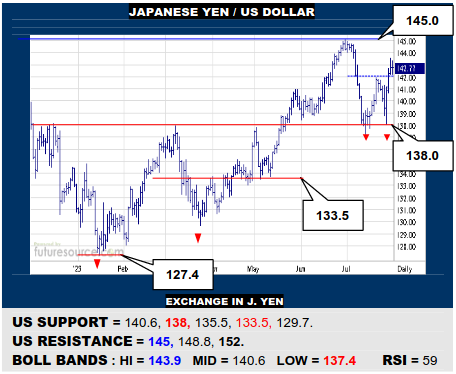

JAPANESE YEN / US DOLLAR

The main 138 base border had to withstand two tests but has propped up the US and spurred a break of 142 to propose a modest new dual bottom. This implies the tools to pry open the 145 apex and so open passage towards 152. Only slipping back under the mid band (140.6) would show vulnerability still where 138 could yet be in danger.

BRITISH POUND / US DOLLAR

The preceding flag tried to stem the BP’s retreat but has been picked apart to allow access to the arriving uptrend (1.273). This is likely to be the last chance to retrieve the setback and try for the 1.30’s again. If the trend gave way, beware further erosion to 1.245 and potentially a sharper slump to 1.18 if the 1.24’s brace failed to survive.

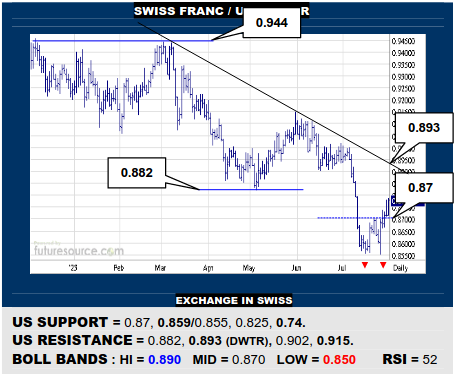

SWISS FRANC / US DOLLAR

There was little support initially to be seen but after fulfilling a 0.859 target from the big ’22 double top, the US grabbed on and has jogged back over 0.87 to create a small new double bottom. This presents a shot over 0.882 but will have to defeat the downtrend (0.893) to make a lasting impact or beware renewed scrutiny of the sub-0.87 void.

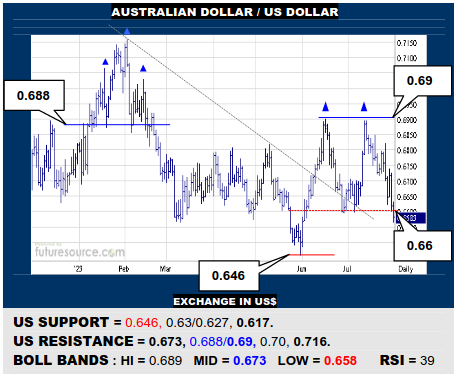

AUSTRALIAN DOLLAR / US DOLLAR

The prior Q1 H&S kept the lid on and two recent peaks at 0.69 are threatening to become a new double top as the 0.66 area decays. If confirmed, this dual top looks liable to overpower the 0.646 trough and press through to a 0.63 goal. Only a rapid retrieval over 0.66 that soon pierced the mid band (0.673) would pluck the AD out of this trouble.

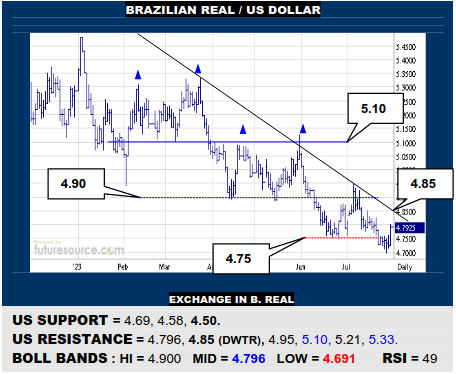

BRAZILIAN REAL / US DOLLAR

The US has staged an initial recovery from new mid term depths but must dispatch the mid band (4.796) and interim downtrend (4.85) to make a more persuasive impression back to the upside and light a path towards 5.10. If otherwise held at bay by the trend, be prepared for a next downwave to continue on into the 4.50’s.

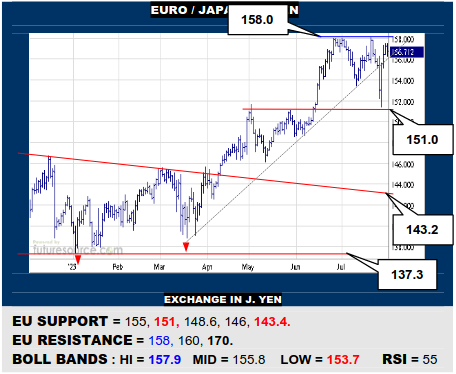

EURO / JAPANESE YEN

Despite an interim uptrend break, prior support at 151 soon gathered up the EU and it is nearing a third try of the 158 area. Third tests are usually ‘make or break’. The whiplash off 151 initially holds promise so popping 158 would retrain sights on 170. Not much time to spare though and veering back under 155 would revive the threat to 151.

EURO / BRITISH POUND

While a mid Jly spike was comfortably quelled shy of the prior H&S top, the EU has since tamed the new downswing for a spell of nearby consolidation. Cautious of the bear flag vibe of this pause so beware breaking 0.855 could yet trip a dive through 0.85 to about 0.83. Must get a footing back in the 0.86’s to ease the bear flag risk.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2023 Technical Commentary.