Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

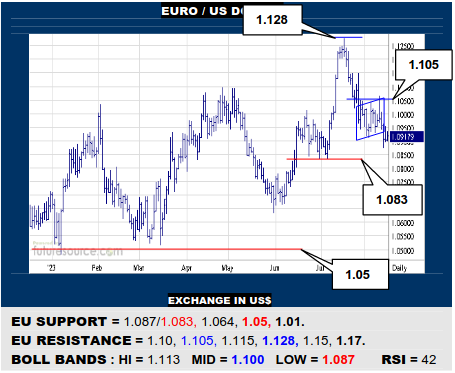

EURO / US DOLLAR

Confined by 1.105 resistance during a jab higher last week, the EU has since broken down from a bear flag but the lower Bollinger is trying to rectify this with an inside day. If it can seed a boost back over the mid band (1.10) and 1.105 it would fully reverse course to go on the offensive again but loss of 1.083 would otherwise take aim at 1.05.

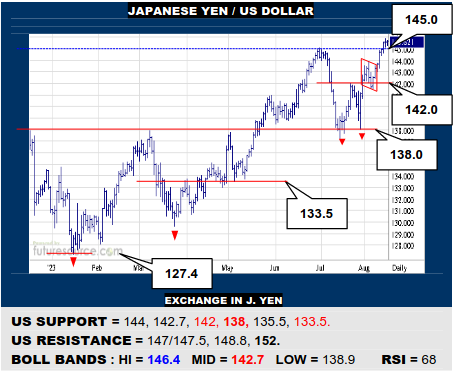

JAPANESE YEN / US DOLLAR

After an early Aug flag enhanced the Jly dual bottom, the US has rallied away across the 145 resistance, setting sights initially on the 147’s where both the immediate patterns would have targets met. Would be ready for a pause there or a corrective dip but meantime only swerving back under 144 would start to undermine stability.

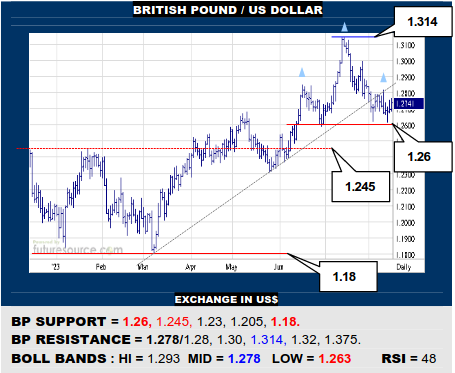

BRITISH POUND / US DOLLAR

The BP is managing to skirt clear of the 1.26 support shelf, so keeping at bay the danger of the summer merging into a H&S top. Even so, it must pull free of 1.28 to shed the mid band in order to better allay that top threat and have a fresh shot at the 1.30’s. Meanwhile if 1.26 were to finally succumb, the resulting top would point down to 1.205.

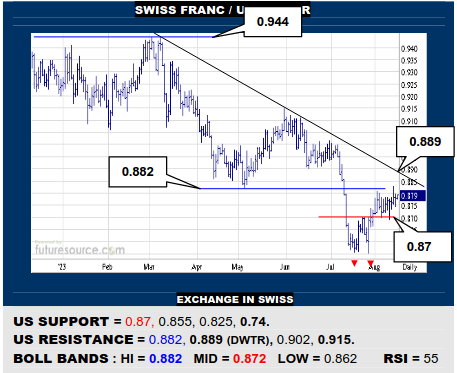

SWISS FRANC / US DOLLAR

The US has grappled on from a small Jly dual bottom but still faces an additional niche of resistance between 0.882 and the downtrend (0.889) that must be dispatched to really score a clearer turn higher. If remaining blunted by the 0.88’s, keep watch on the 0.87 base rim as the tripwire to end a correction and resume south once more.

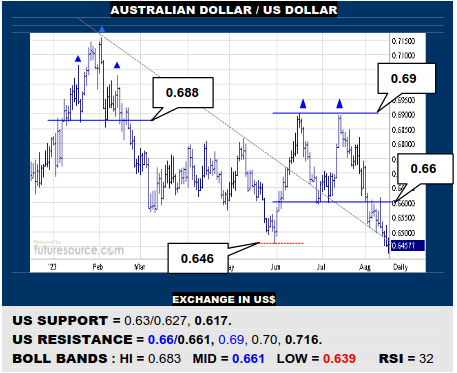

AUSTRALIAN DOLLAR / US DOLLAR

The mid-year double top has kept the AD under pressure in Aug and it has started to whittle away a prior 0.646 trough, exposing the path on down to the 0.63 top projection and maybe even 0.617. Making more space underfoot then while otherwise needing a reaction back over 0.66 and the arriving mid band to contest this bearish scene.

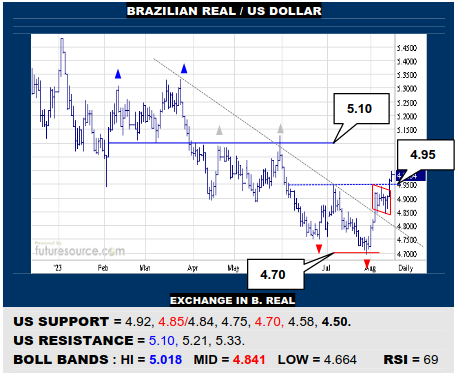

BRAZILIAN REAL / US DOLLAR

The US has torn free of its ’23 downtrend(s) and piercing 4.95 has merged the summer period into a new double bottom, punctuated by a bull flag. This all appears to pave the way to a next obstacle at 5.10 before a breather or correction would look more likely. Only veering back under 4.85 would seriously undercut the Aug achievements.

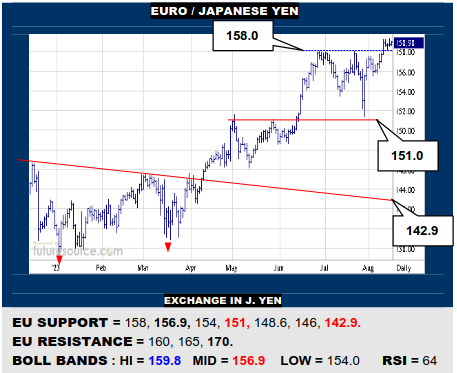

EURO / JAPANESE YEN

The EU has grappled on across prior 158 resistance and is seeking to form a bull flag in the aftermath. For the moment this keeps focus on the upside path towards a 165 base projection and maybe the 170 millennium high in due course. Just keeping an eye on the mid band (156.9) meanwhile for any signs of eroding the new base platform.

EURO / BRITISH POUND

The upper Bollinger band (0.867) has capped another lunge north by the EU and thus guarded the preceding H&S over 0.872. This is now creating a similar but smaller H&S landscape wedged in below and puts the 0.855 to 0.85 support on alert as a tripwire on down to 0.83, a major multi-year cliff edge looming at 0.82.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.