Insight Focus

- Upcoming Thai cane crop to be the lowest in 15 years.

- Drought leads to failure of some newly-planted cane.

- Low rainfall also hampers fertiliser application.

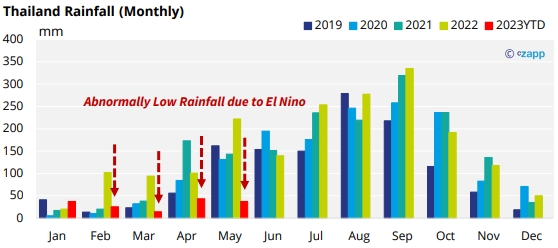

The impact of Thailand’s drought on cane development has been more severe than we’d first expected. We now forecast a further drop in cane availability in the North East of the country, which accounts for around 50% of all cane.

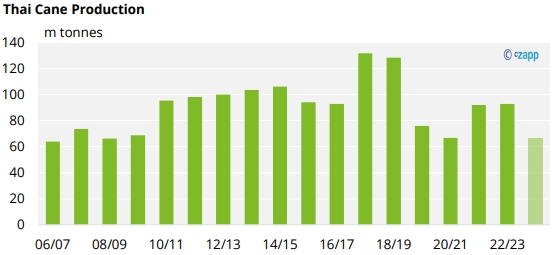

We now think Thailand will harvest only 66.5m tonnes of cane, down from our first estimate of 74m tonnes and 93m tonnes harvested in 2022/23. This would be the lowest cane harvest since 2008/09 if realized.

Most of the sugarcane that will be crushed in 2023/24 was planted around Q4’22.

For cane to develop fully it needs a high amount of rainfall during its growth phase, specifically from April through to October. However, it also needs some rainfall through the dry season too. The below chart shows the cumulative rainfall from January to May dropped by -71% year-on-year.

The abnormal pattern and small amount of rainfall has seen some areas of newly planted cane failing to survive.

We have seen that farmers have reacted quickly, by ripping out poorly developed cane and planting cassava, as the cassava price in late Q1 was paying very high returns.

We were already nervous about how large the coming season’s cane area would be given strong local cassava and rice returns. The failure of some plant cane to survive adds to the problem.

As a result, we forecast a reduction of at least 20% year-on-year of the planted area in the Northeast.

In addition, we observed that the average agricultural yield is underperforming versus our previous forecast, both new planted cane and ratoon cane are in poor condition largely due to the low rainfall. This is similar to what we saw for the 2020/21 crop season where Thailand crushed 66.7m tonnes.

Finally, domestic fertilizer prices have declined by about 20-30%. However, farmers will be waiting for good rains to come, in order to apply fertilizer. In the event we continue to see dryness then there is a risk that the opportunity to apply fertilizer might be missed, which will further impact yields.

Cane is Underperforming

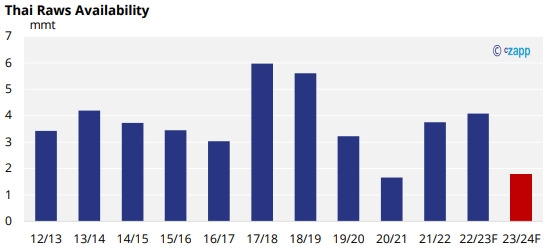

Thailand will have 1.8m tonnes of raw available for export for the 2023/24 crop season (-56% YoY), 760k tonnes lower than what we had originally estimated. We still think that the mills are going to maximize refined production given the higher levels of the white premium.

As a result of the downgrade, we do not expect any risk of buybacks as the 2023/24 hedging has just started. On the other hand, there will be less sugar to be hedged in the future.