- Brazil’s drought could hit orange production in 2021/22.

- With this, juice processing and exports could slow.

- However, things should run smoother than they did in the COVID-hit 2020/21.

Brazilian Drought Could Weaken Orange Production

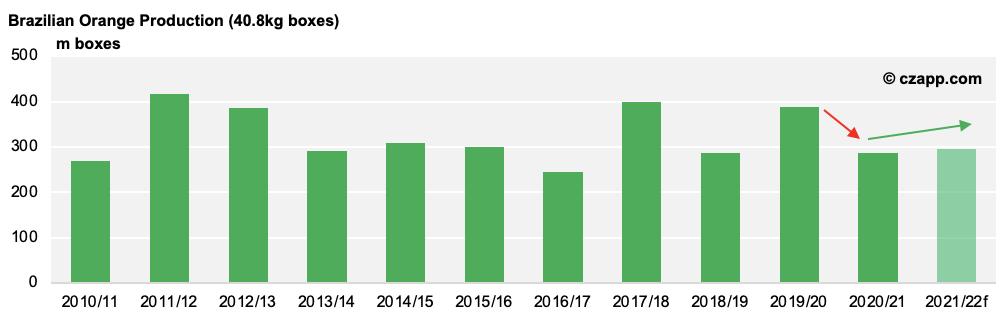

- We think Brazil will produce 294m boxes of orange in 2021/22.

- This is a 9.51% increase from this season but 10.53% below the 10-year average.

- Drought has seriously hindered crop development.

- Around 70% of Brazil’s orchards aren’t irrigated, meaning things can go seriously wrong when rainfall is insufficient.

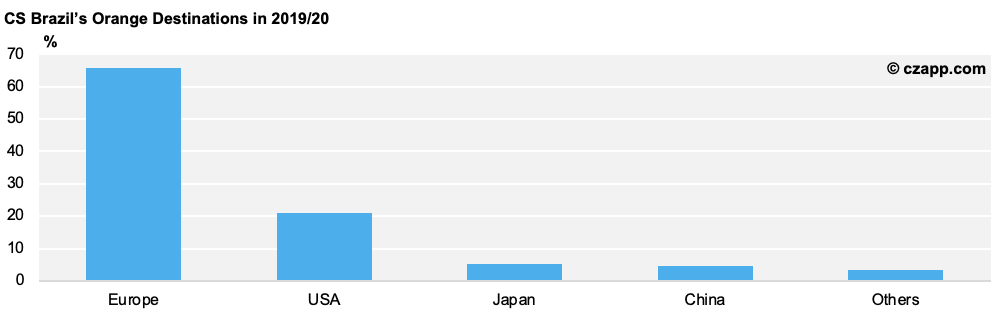

- This is concerning as around 75% of the orange juice consumed globally comes from Brazil’s Citrus Belt.

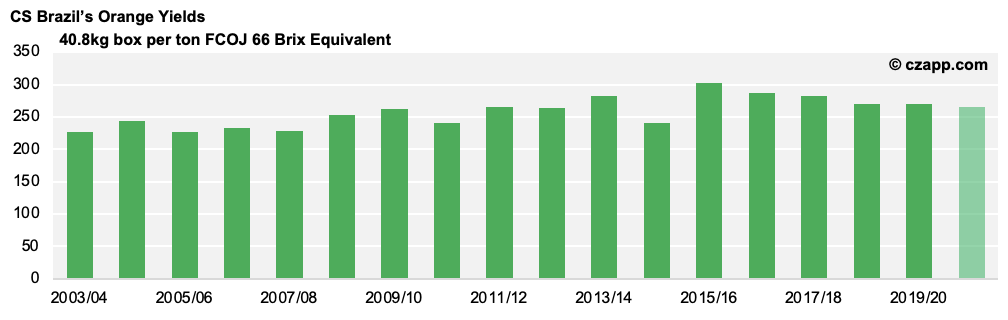

- Last year’s late bloom may also mean the fruit harvested is smaller in size.

- We’ll soon see whether this has impacted juice yields.

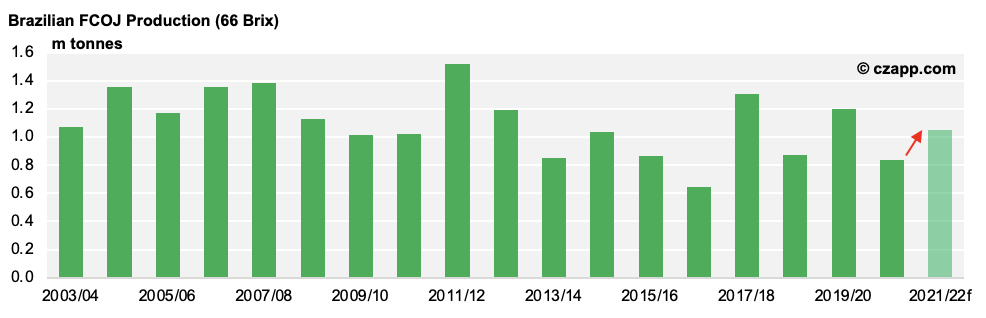

- As it stands, the USDA thinks Brazil will produce 1.048m tonnes of FCOJ (65 brix equivalent in 2021/22), up 12% year-on-year.

- Most of this should be exported, with the remainder being used to satisfy domestic demand.

How Have Prices Responded to the Drop?

- Prices are currently sat between at 2,000 and 2,100 USD/mt for 66 Brix FCA Europe; last month, they sat between 1,750 and 1,800 USD/mt.

- Concerns surrounding drought, higher prices and the stronger Real could mean Brazil’s main producers increase offers for FCOJ.

- Larger producers own their own vessels, so aren’t impacted by the current spike in freight rates and other prices.

- Smaller producers, however, are offering lower on an FOB basis; once the container freight rates are factored in, price levels aren’t that dissimilar to the larger operators on an FCA basis.

Other Opinions You Might Be Interested In…