Insight Focus

- US anticipates 152k tonnes shortage of TRQ sugar.

- Brazil, Australia, and Guatemala could receive TRQ re-allocation.

- This means a little less sugar for the world market.

Pessimistic US Sugar Outlook

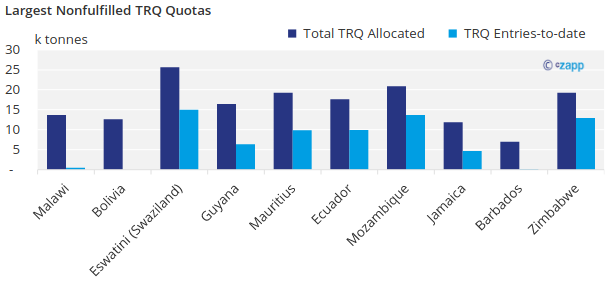

The US Department of Agriculture (USDA) has predicted in its latest World Agricultural Supply and Demand Estimates (WASDE) that around 1.2 million metric tonnes of raw sugar will enter the United States under the 2022/23 TRQ program. As September winds down, only 825k tonnes of sugar has entered the United States. The United States should expect 417k tonnes of sugar to enter under the TRQ Program by the end of the year. However, the US anticipates some of its trade partners will fall short of their allocated quota, by 152k tonnes.

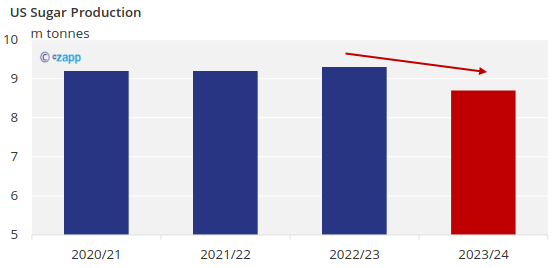

The projected shortfall raises the risk that the US will be under-supplied in 2024, especially with its poor-performing crop. The US Drought Monitor claims that 44% of the Louisiana sugar cane is affected by exceptional drought, while 54% was under extreme drought. The drought has caused experts to lower the state’s forecast by 200k tonnes. Then, in Texas, 100% of the cane crop is experiencing severe drought.

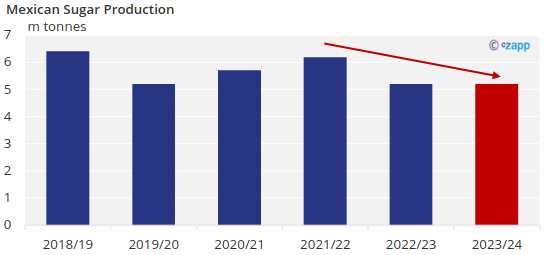

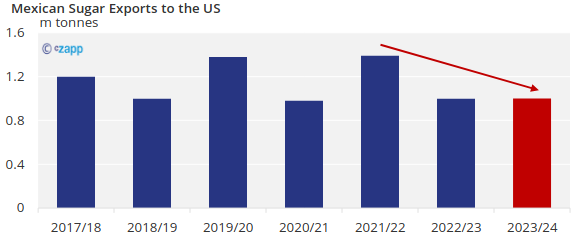

To make matters worse, the United States cannot depend on its largest sugar supplier, Mexico. We don’t expect a recovery from the poor 2022-23 crop due to El Niño. During El Niño, Mexico experiences more rain during the winter, followed by an arid summer. A summer drought could adversely affect cane development in Mexico as the crop needs rainfall through the middle of the year to grow and mature fully. The drought could lead to lower yields as more than 60% of Mexican cane is not irrigated. Rain during the winter could also delay cane harvesting.

Lower yields and production in Mexico mean they will not be able to export as much sugar to the United States as in previous years.

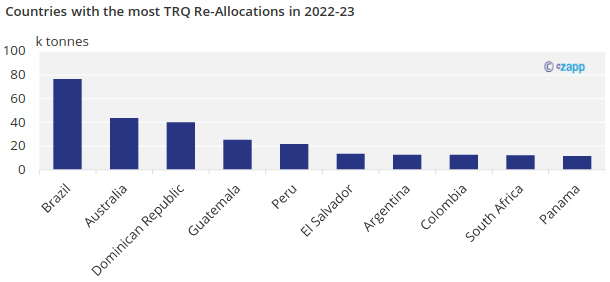

The USDA will therefore probably reallocate around 150k tonnes of raw sugar import quota from countries that haven’t shipped:

Tis quota will be reallocated to countries that fulfilled their quota consistently in the past few years and received a reallocation during the last occurrence.

TRQ Reallocation Effect on World Market

The world sugar market is currently facing a production deficit. We now forecast global production at 178.3 m tonnes and global consumption at 179 m tonnes for 2023/24, leaving an 800k tonnes deficit. The TRQ reallocation means more sugar will divert towards the US market, meaning even less sugar is available for world markets.