Insight Focus

- USDA believes 34% corn area is experiencing drought.

- Was 19% last year.

- US corn crop condition remains within expectations.

Forecast

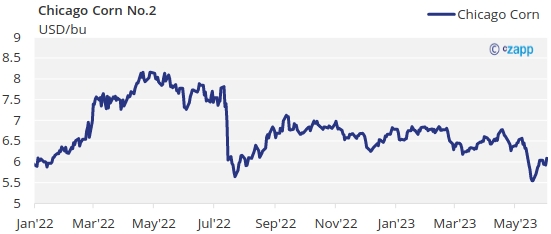

No changes to our Chicago Corn average price forecast for the 22/23 (Sep/Aug) crop in a range of 6 to 6,5 USD/bu. The average price since Sep 1 is running at 6,57 USD/bu.

Market Commentary

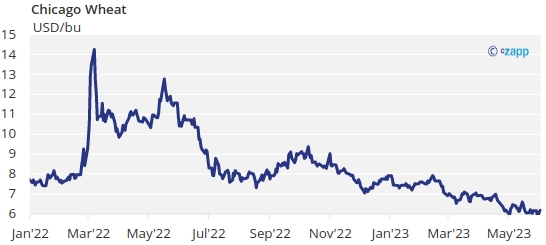

End of the week rally in Chicago due to dry weather in Corn regions and too wet in Wheat regions. Ukraine said Russia is blocking exports. Corn and Wheat are now basically trading in parity both in the US and Europe.

Chicago had a negative start last week with some rains in the Corn Belt easing fears of several weeks of dry weather risking yields. In fact, this week was the first reading of crop condition with good and excellent values four points below last year but within expectations. But then the USDA drought monitor said last Friday 34% of the Corn area is experiencing drought vs. just 19% last year and the market rallied. Also the weather forecast is showing dry weather for this week in the Corn Belt which no doubt it risking the very aggressive yield the USDA is projecting.

US Corn planting made another big weekly progress and is now 92% planted vs. 84% last year and vs. 84% of the five year average. This continues to favor crop development with 72% of Corn already having emerged vs. 58% of last year and 63% of the five year average. The first reading of crop condition showed Corn is 69% good or excellent vs. 73% last year.

In Brazil, the avian flu cases continued to increase although only in wild birds and no signal it has jumped to commercial farms. The animal health state of emergency remains.

In Russia, Corn planting is 82,5% complete, Ukraine has finished spring planting, and in France Corn is 98% planted and is 92% good or excellent. The EC lowered their Corn production forecast marginally by 200k ton to 64,4 mill ton. Neutral to the market.

In the Wheat front, the EC increased their production forecast by 1,7 mill ton to 132,5 mill ton.

US Wheat condition improved by 3 pts and was 34% good or excellent vs. 29% last year. French Wheat condition fell 2 points to 91% good or excellent.

Interesting is that during last week there were moments when US Wheat traded below Corn for the first time since 2013 although it closed the week marginally above. In Europe, Corn and Wheat are basically in parity.

By the end of last week Ukraine said Russia was boycotting the Black Sea corridor by blocking shipments from Ukrainian ports formally violating the deal expected two weeks ago. If this situation continues, we will see Wheat prices higher.

We have the June WASDE this week Friday and the market is expecting to see higher wheat yield in the US.

The EC confirmed they will extend until October the import ban on Ukrainian Agricultura products into five of the 27 member states to protect farmers of those five countries from cheap Ukrainian prices.

In the weather front, US is expected to have dry weather this week in the Corn Belt while Wheat areas are expected to receive much rain, both worrying for crop condition. Brazil is expected to have a return of sunny and dry weather after the rains of the last week. In Europe the same as the last few weeks, dry in the south and rainy in the north.

The focus continues to be weather and again, mostly US weather with the doubt if the June WASDE this Friday will reduce Corn yield or not yet. We think it will happen if not in this report -still a long summer ahead of us- in the July or August ones. The bulk of the downside may have occurred.

End of the week rally in Chicago due to dry weather in Corn regions and too wet in Wheat regions. Ukraine said Russia is blocking exports. Corn and Wheat are now basically trading in parity both in the US and Europe. The focus continues to be weather and again, mostly US weather with the doubt if the June WASDE this Friday will reduce Corn yield or not yet. We think it will happen if not in this report -still a long summer ahead of us- in the July or August ones. The bulk of the downside may have occurred. No changes to our average price forecast for Chicago Corn for the 22/23 (Sep/Aug) crop in a range 6 to 6,5 USD/bu. The average price since Sep 1 is running at 6,57 USD/bu.