Insight Focus

Lower US stocks and Russian export cuts boost prices. Reduced corn production in Eastern Europe adds volatility. Chicago corn is expected to have limited upside as harvesting proceeds smoothly.

Lower stocks in the US and the risk of reduced Russian wheat exports have pushed all grains higher once again. But moderate rains in the US Midwest are expected, which should not significantly delay corn harvesting but will benefit soil moisture for wheat planting.

All eyes are now on the Black Sea area. While there should be no further surprises in wheat production, as it is virtually harvested, Russian exports may be reduced, and corn production could still yield surprises. We continue to believe that lower corn production in Eastern Europe is largely priced in, although it is contributing to market volatility.

Additionally, the potential for a reduced wheat export program from Russia could be supportive for European prices. However, Chicago corn is likely to have limited upside as harvesting progresses well and no serious weather risks are apparent.

There is no change to our forecast for Chicago corn for the 2024/25 crop (September/August), with an average price projected at USD 3.90/bushel. The average price since September 1 is running at USD 4.09/bushel.

Corn Forecast Remains Stable

Corn in Chicago opened strong last week, buoyed by a Monday rally following lower-than-expected stocks as of September 1 and concerns about logistics due to a strike by port workers in 14 US ports. Additionally, production issues in the Black Sea region—especially in Romania—are contributing to worries. However, favourable weather expected in the US Corn Belt this week triggered some profit-taking during the latter half of last week.

The US quarterly stocks report was released last Monday, marking the official end of the old crop. The USDA not only published inventory data as of September 1 for the old crop but also revised production and consumption figures as necessary.

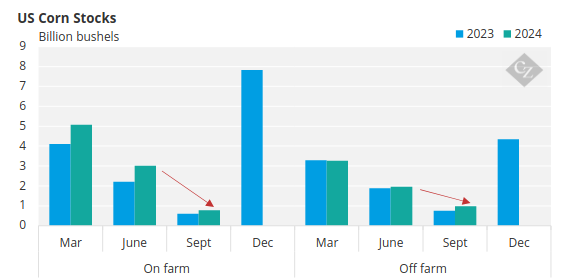

For corn, the 1.76-billion-bushel carry was divided into 780 million bushels on farms and 980 million bushels off-farm. Despite a 29% overall increase year-on-year, the stock comparison between June 1 and September 1 implies a consumption of 3.24 million bushels, which represents an 18% increase year-on-year.

Source: USDA

The key figure is the 1.76 billion bushels, which compares with the latest WASDE report showing the carry for the old crop at 1.81 billion bushels.

The US corn condition was rated at 64% good or excellent, down one point week-on-week and compared to 53% last year. US corn is 21% harvested, on par with last year and in line with the five-year average. The area under drought conditions worsened to 27% compared to 25% a week earlier.

The French corn condition remained steady at 79% good or excellent, compared to 83% last year. Harvesting has started in France and is currently 2% complete, which is slow compared to the 23% harvested at this time last year.

Russian corn is 31% harvested with a yield of 4.14 tonnes/ha compared to 5.82 tonnes/ha last year. Ukrainian corn is 37% harvested versus 29% last year, with an average yield of 5.16 tonnes/ha, 16% lower year-on-year. Corn planting in Argentina is 13.7% complete.

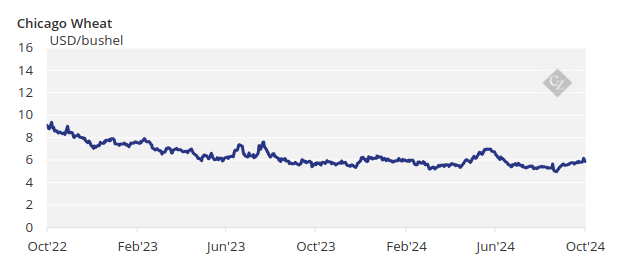

Low Russian Exports Offset By US

In the wheat market, prices initially rallied following corn but then took the lead after the RUSGRAIN Union sent a note to the government indicating a need to reduce the country’s export quota due to insufficient wheat supply. Exports are running at the same pace as last year, although last year’s export quota was significantly higher.

Estimates for Russian wheat production range from the government’s estimate of 84 million tonnes to 81 million tonnes from private analysts. Russian wheat is 88% harvested with a yield of 3.07 tonnes/ha compared to 3.43 tonnes/ha last year.

In terms of weather, the Black Sea region, along with Russia and Ukraine, is expected to continue experiencing hot and dry conditions, while northwestern Europe is forecasted to receive some rain by the second half of the week. Winter wheat planting has begun in France, now 1% complete versus 2% last year.

US spring wheat is now fully harvested. Winter wheat planting is 39% complete compared to 36% last year and the five-year average of 38%.

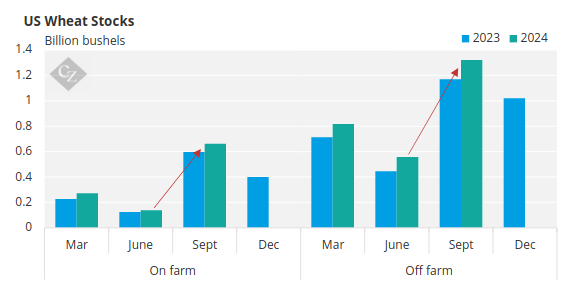

In the US quarterly stocks report, the 1.99-billion-bushel wheat carry was divided into 664 million bushels on farms and 1.32 billion bushels off-farm.

Source: USDA

The US is expected to experience rain across the Midwest and cooler weather. Brazil is likely to be wet in the south, and although some rain is expected to reach the centre-west, the region will mostly remain hot and dry.