- We suspect China will show political support to El Salvador by purchasing their sugar.

- This follows last year’s formal diplomatic agreement with China at the expense of Taiwan.

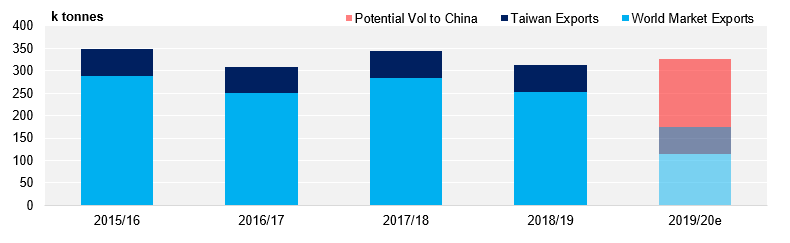

- The status of El Salvador access to the Taiwan quota is still unclear, but as of yet we have not heard of any change in the FTA.

Sweet Diplomacy

- In August 2018, El Salvador recognised the People’s Republic of China at the expense of the Republic of China (Taiwan).

- El Salvador had previously received an 80k tonne per year sugar export quota to Taiwan, the status of this access is unclear.

- As of today the Taiwanese government has not indicated that they are planning to revoke the free trade agreement with El Salvador.

- The diplomatic move had been challenged at the Salvadorian high court by sugar producers who had been concerned at losing valuable export markets.

- We have subsequently heard that Chinese buyers have offered to purchase El Salvadoran sugar at high premiums.

- This may be an attempt to gain support in the country.

El Salvador Raw Sugar Supply by Season

- In addition, China has committed USD 150m aid to El Salvador for “technological and social projects” and also contributed rice food aid following drought in 2018.

- This follows a similar trading pattern for China this year, where bilateral sugar deals have been created alongside infrastructure investments.

- In April, China awarded Pakistan a 300k tonne sugar export quota to shore up investments at Gwadar Port and other infrastructure linked to the Belt and Road Initiative.

- China has recently bought 120k tonnes of white sugar from Myanmar, and sought to invest in sugar mills there.

What Does This Mean for the Raws Market?

- Details around this are unclear, and there is no formal purchase agreement between China and El Salvador, so all sugars would be bought on a spot basis.

- But it appears China would be keen to take a significant amount of sugar.

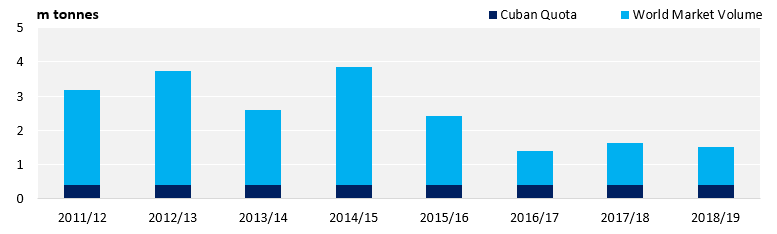

China Raw Sugar Offtake by Season

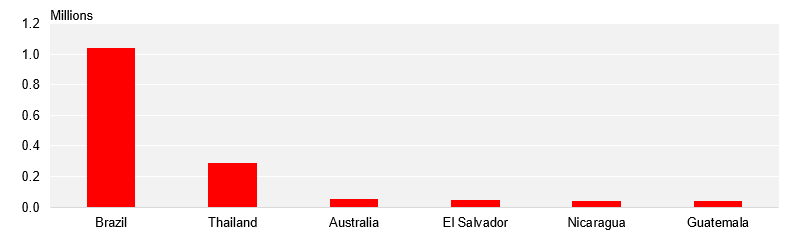

- These sugars could displace Chinese world market imports of Brazilian VHP.

- The effect on world market availability would be neutral, as Central American sugar would replace Brazilian raws one for one.

2019 Chinese Raw Sugar Imports by Origin

- However, this would mean less lower-polarisation Central American sugar is available to the world market, and more Brazilian VHP.