Insight Focus

- Conflict in the Suez Canal has a huge impact on EU-Asia trade.

- But container trade volumes from Asia to Europe continue to rise despite disruptions.

- FTAs in the pipeline are only likely to increase bilateral trade.

Asia-Europe Trade Volumes Pick Up

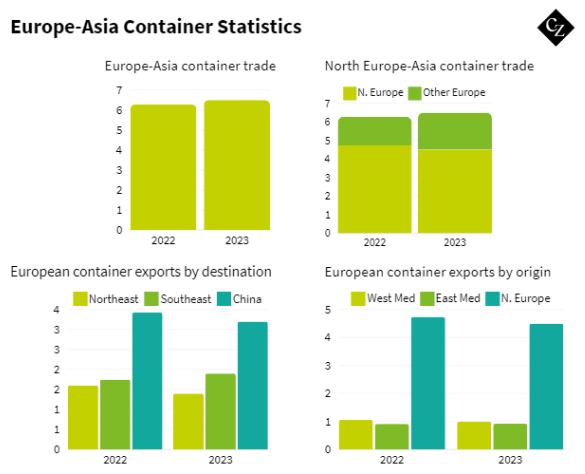

According to data from Container Statistics (CTS), container exports from Asia to European ports increased significantly in 2023, reaching 16.6 million TEUs. This figure represents a 7.8% growth from the previous year and indicates a return of Asia’s Europe-bound trade flows to pre-pandemic levels.

China’s container exports European destinations rose 9.5% to 12.5 million TEUs, holding the lion’s share and driving Asia’s overall outbound movement. Exports from Northeast Asia also increased by 12.1%, reaching 1.8 million TEUs, while those from the Southeast part of the continent declined by 3.7% to 2.2 million TEUs.

Asian exports to the West Mediterranean rose by 11.4% to 3 million TEUs, while those to the Eastern Mediterranean skyrocketed by 28.9% to 3.4 million TEUs. Box exports to North Europe saw a slight uptick of 1.4%, reaching 10.2 million TEUs.

In the opposite direction, container exports from Europe to Asia have been on a downward trajectory in the last three years, totalling 6.5 million TEUs in 2023 — 3.5% year-on-year decrease.

North Europe-Asia container trade fell by 5.1% to 4.5 million TEUs, West Med-Asia volumes declined by 5.2% to 1 million TEUs and East Med increased its exports to Asia by 4.5% to 920,000 TEUs.

And while Europe’s exports to China waned 6.6% to 3.2 million TEUs, those to Northeast Asia shrunk by 12.1% to 1.4 million TEUs. However, Europe-Southeast Asia container volumes climbed to 1.9 million TEUs, translating to an 8.7% increase.

In short, while China’s container exports to Europe have been steadily rising, trade in the opposite direction has been falling.

Red Sea Sucks Up Capacity

It comes as no surprise that the crisis in the Red Sea has significantly affected Europe-Asia trade in the past few months. Shipping analysis company Linerlytica explained the extent that Cape diversions have sucked in global capacity in early February.

The firm found that total container ship capacity deployed on Asia to Europe routes had reached a record high of 6.44 million TEUs, up 23.3% compared to a year earlier, with over 700,000 TEUs of additional capacity added to the trade in the previous two months alone as carriers started to divert around the Cape of Good Hope.

Linerlytica pointed out that 55% of the additional capacity has been absorbed in the Far East-Med trades, where transit times have increased by 10 days to the West Mediterranean and 18 days to the East Mediterranean, while transit times to North Europe have increased by seven days on average.

In addition to its effects on the Asia-Europe route, the Red Sea crisis has generated extra demand for intra-Europe capacity. Linerlytica’s report reveals a substantial year-on-year increase of 24.8%, with the most significant growth observed on routes within the Mediterranean and between North Europe and the Mediterranean.

EU’s Diversifies Food Sources

Despite the recent increase in trade volumes between Europe and Asia, it seems that the EU aims to further strengthen its ties with eastern countries, as the union is in free trade agreement (FTA) discussions with India, Indonesia, Malaysia, the Philippines and Thailand.

The EU has already signed 10 new free trade agreements (FTA), which, according to a new JRC study, are expected to diversify trade sources, and thus improve the resilience of EU food supply chains. The agreements aim to create additional markets for EU agri-food products, diversify trade sources, and enhance the resilience of food supply chains, reducing dependence on a limited number of trade partners.

A study from the JRC explores the economic implications on the EU agriculture sector, considering FTAs that are concluded or under negotiation. There are finalised deals with Mercosur (Argentina, Brazil, Paraguay, and Uruguay), New Zealand, Chile, Mexico, and ongoing negotiations with Australia, India, Indonesia, Malaysia, the Philippines and Thailand.

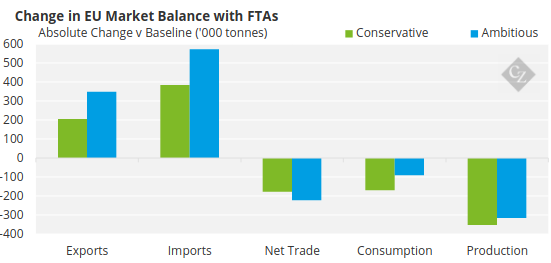

The JRC projects a substantial increase in EU agri-food exports to these 10 partners by 27%, equating to EUR3.5 billion in a conservative scenario and 38% (EUR4.8 billion) in an ambitious scenario by 2032. This compares to a baseline without the implemented trade agreements.

Source: JRC

While these countries and regions are expected to represent 6.6% of EU agri-food exports and 28.2% of imports by 2032, the overall EU agri-food trade balance is predicted to increase by EUR25 million and EUR311 million in the conservative and ambitious scenarios, respectively.

Trade opportunities are particularly expected for dairy, pig meat, wine, and processed agri-food products. However, some sectors, including beef, sheep meat, poultry, rice, and sugar, may face increased competition from FTA partners, leading to a potential decline in EU production and domestic producer prices. Notably, imports of meats from Mercosur, Australia, New Zealand and Thailand could increase, impacting specific meat sectors.

The study also considers the UK’s recent trade agreements with Australia and New Zealand, along with its accession to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which could impact EU export opportunities to the UK market for agri-food products, particularly beef and sheep meat.

While there could be some negative impacts on EU agri-food exports to the UK, the overall positive impact from the 10 FTAs outweighs potential losses, maintaining a positive trade balance of EUR 40 million in an ambitious scenario. In contrast, under a conservative scenario, the combined result could lead to a negative trade balance to the tune of EUR 213 million.