Insight Focus

EUA prices are poised to drop below EUR 60. In fact, they could even breach EUR 50 in coming months. Fossil power emissions are down 16% in year to September. However, EUA supply is set to drop sharply after 2026, at which point prices will gain strong support.

Price to Dip in Short Term

EU carbon allowance prices could drop below EUR 60 and even EUR 50 in the coming three to six months as the region’s energy market rolls to the next set of front-year futures contracts, according to a veteran analyst.

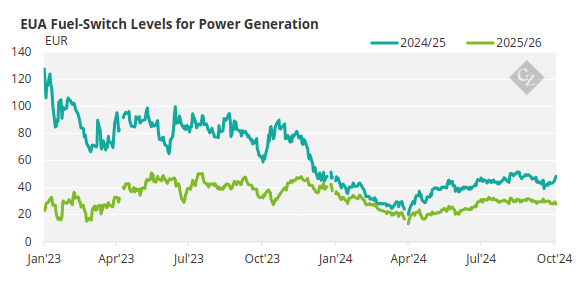

Currently, December 2024 EUA futures are trading at around EUR 62/tonne to EUR 63/tonne, some EUR 15 above the notional level at which carbon permits should force a switch from the least efficient coal plant to the most efficient gas unit.

However, when the futures contracts expire in December and the market rolls to the next year contract, this notional switching level will drop by around EUR 25/tonne, according to estimates.

The roll to new futures contracts has persuaded analyst Bjarne Schieldrop of SEB bank to forecast that EUA prices will therefore drop by around EUR 19/tonne from their 2024 levels next year.

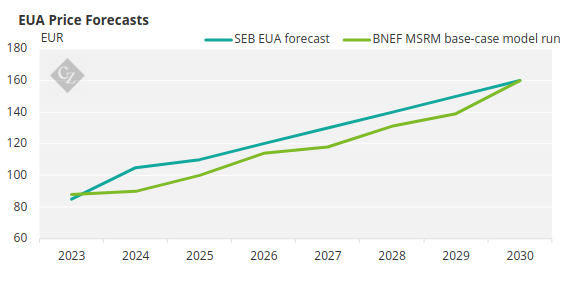

“We expect the EUA price to average EUR 50/tonne in 2025 and EUR 55/tonne in 2026,” Schieldrop wrote in a market note last week. However, he added that “accelerating market tightness and abatement increasingly shifts from the power sector to the industrial sector and drives the EUA rapidly higher from 2027 onward.”

REPowerEU Allowances Wane

EUA prices have been dampened by the injection of extra supply in 2023 and 2024 under the EU’s REPowerEU initiative, which is selling at least 250 million more EUAs to fund the energy transition and to wean the bloc off Russian fossil fuels.

The ongoing economic downturn has also hit industrial production hard, and demand from energy intensive sectors like steel and cement has also declined. But most significantly, data from the EU’s ENTSO-E grid agency shows power generation from fossil sources is down more than 16% in the first three quarters of 2024, after a 20% drop in the same year-on-year period in 2023.

SEB’s Schieldrop is not the only analyst forecasting continued weakness in EUA prices. Most experts see a flat market for the next 18 months to two years, as the steady flow of REPowerEU sales as well as the lingering macroeconomic gloom continue to depress demand for carbon permits.

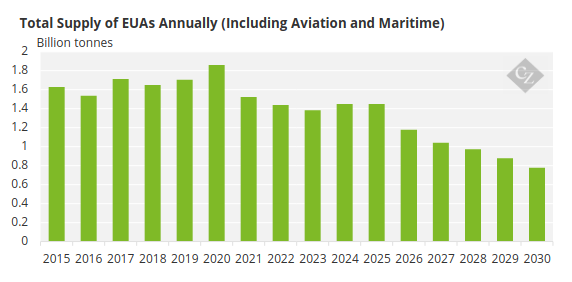

But REPowerEU ends in 2026, and the total number of EUAs that it has injected into the market between 2023 and 2026 will be removed from supply starting in 2027, meaning that not only does carbon allowance supply drop back to normal levels, but it will shrink even further than originally planned.

Source: SEB

Maritime, Aviation Join the Fray

This drop in supply is accompanied by the addition of new fundamental demand. Airlines start to lose their free allocation of EUAs from next year, which will bring more buyers into the secondary market. And maritime shipping companies too are starting to hedge their carbon emission exposure, as that market too comes under the purview of the EU ETS.

Shippers currently need only to cover 40% of their total eligible emissions, but this rises to 70% in 2025 and reaches 100% in 2026.

This combination of factors is expected to spark a steep rally in EUA prices as we approach 2030 and most analysts are seeing prices back towards EUR 100/tonne by at least 2029.

Source: SEB

At the same time as the market reorients itself in light of tightening supply, EU lawmakers will embark on the work of reviewing the EU ETS’ targets for 2040.

The Commission has already proposed a goal of cutting emissions by 90% from 1990 levels by 2040, and together with Parliament, will consider various changes to the EU ETS as part of the 2040 target in the coming months before political discussions begin in earnest.

Included in the review will be consideration of how emission removals can be incorporated into the market structure. This heralds a return to the eligibility of specific “offsets” in the market, after the EU had banned the use of carbon reductions from 2020.