Insight Focus

- European carbon prices have fallen below €90 once more.

- Industrial buyers have now completed compliance buying for 2022.

- Outlook for 2023 prices is clouded by regulatory changes in the EU.

After peaking at just over €96 last week, European carbon prices have dropped back below €90 on Monday as this week marks the end of the annual compliance season and industrial buyers will have completed their buying ahead of the April 30 deadline.

Industrial installations and commercial aircraft operators submitted their independently-verified annual emission reports for the previous calendar year to the European Commission by the end of March, and have until the end of April to acquire and transfer to the Commission EU emission Allowances (EUAs) matching those verified emissions.

The financial penalty for failing to transfer allowances to the Commission by the end-April deadline is €108/tonne, while any shortfall in EUAs must be made up in the following year. This means that companies that fail to surrender enough allowances are effectively penalised twice.

The end of the compliance cycle also coincides roughly with the end of the winter heating season in the electricity and gas markets, and these two events mean a shift lower in demand for EUAs.

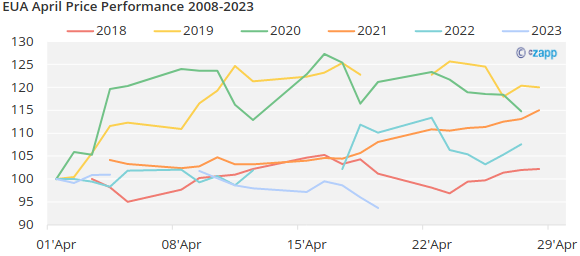

EUA prices typically rise over the course of the month of April, but this year levels have been weaker than the historical average (see chart), reflecting relatively poor compliance demand after many industrial companies reduced output in 2022 amid soaring energy costs.

The outlook for prices in 2023 is clouded by a significant amount of regulatory activity in Brussels that will affect the carbon market.

The European Parliament last week ratified the “Fit for 55” package of reforms to the EU ETS. The package includes a number of key changes to the market starting in 2026:

- A reduction in the market cap of 117 million tonnes, carried out in two stages in 2024 and 2026.

- An increase in the annual reduction in the cap from 2.4% today to 4.3% in 2024 and 4.4% in 2028.

- A gradual reduction in the number of free allowances given to industrial installations, beginning in 2026. Free allocations will end by 2034.

- At the same time, the EU is introducing a Carbon Border Adjustment Mechanism on selected materials imported into the bloc. Importers will be required to pay the difference in the cost of carbon between the EU and the country of production.

- The inclusion of maritime transport emissions in the EU ETS from 2024.

These reforms all form part of a tightening of the EU ETS cap, which now has a goal of reducing covered emissions by 62% compared to 2005 levels by 2030.

The EU has also introduced a second Emissions Trading System to cover greenhouse gases emitted as a result of fuel use by the domestic and transport sectors.

This ETS, commonly referred to as “ETS 2”, will regulate fuel producers and distributors rather than consumers, and will have a price cap target of €45/tonne.

In addition to EU ETS reforms, the EU has also increased its targets for other sectors of the economy, for emissions reduced by land-use and forestry, for emissions from transport

These reforms have been debated among EU lawmakers for the last 18 months and their impact is by now generally priced into the market expectations for the coming years. But another more recent decision by the EU is expected to depress prices in the shorter term.

Member states have agreed to create financial support to enable a speedy pivot away from fossil fuels, in particular Russian energy supplies, after the invasion of Ukraine last year.

Under the REPowerEU initiative, the EU will mobilise more than €200 billion in total funding to help member states transition away from carbon-intensive energy sources.

Some €20 billion of this total funding will come from the sale of additional EUAs starting in the summer, after the EU agreed to bring forward the sale of some EUAs from member state auction reserves and from separate reserves dedicated to funding new low-carbon technologies.

These volumes, which were originally scheduled to be sold between 2027 and 2030, will now be sold from 2023 to 2026.

These “front-loaded” EUA sales are expected to depress prices in the near term, but levels are likely to rise even faster after 2027 when the market supply will be lower than originally planned, analysts say.