Insight Focus

- Europe’s natural gas prices remain far above pre-2022 levels.

- This has disincentivised industrial production in Europe.

- As a result, there has been less demand for EUAs, which has caused prices to drop.

High Gas Prices Hold Back Industrial Production

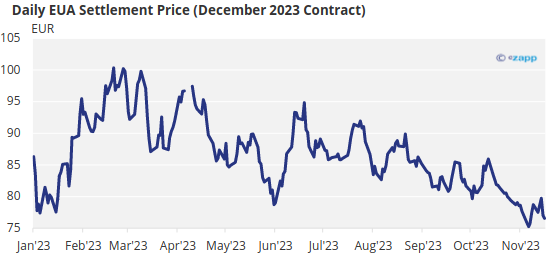

European carbon allowance prices fell to their lowest in more than a year at the start of November. Investors continue to bet that prices will continue to fall amid a steep drop in fossil-fuel emissions from power stations and industrial plants across the EU.

Prices for EU Emission Allowances (EUAs) futures for delivery next month fell to EUR 74.84 on November 8, after having reached a record EUR 101.25 as recently as February. The December contract has averaged EUR 86.79 this year, compared to EUR 81.24 in 2022 and EUR 53.69 in 2021.

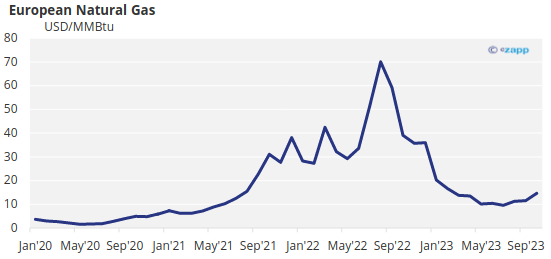

The energy price crisis that was triggered by Russia’s invasion of Ukraine in early 2022 continues to roil the European market. Prices for natural gas have fallen back from their mid-2022 peaks but are still more than twice as high as they were prior to the invasion, and the increase in energy costs has triggered a sharp drop in industrial output over the past 18 months.

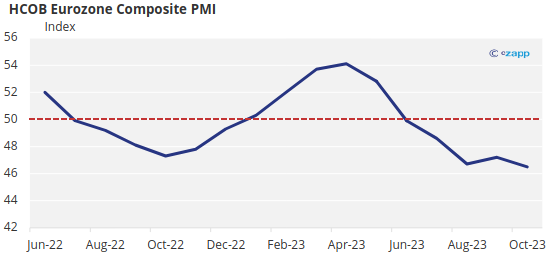

The Eurozone manufacturing purchasing managers’ index (PMI), a signal of industrial sentiment, has been below 50 for much of the last 16 months, indicating that output in the region is falling. With few signs of a recovery in the offing, the outlook for 2024 may be as weak as 2023.

Experts predict that industrial emissions of greenhouse gases in the EU Emission Trading System have fallen by around 7% in 2023 compared to 2022 levels, while emissions from the power generation sector are confidently predicted to have tumbled by as much as 20% over the same period.

Renewable Energy Generation Picks Up

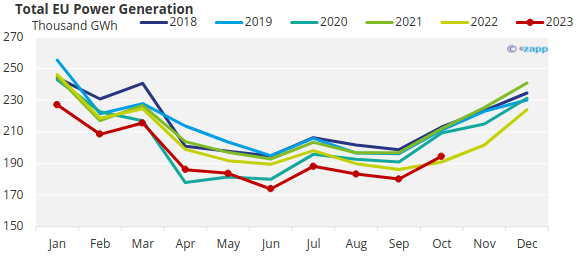

Data from the European grid consortium Entsoe-E and analysed by the Fraunhofer Institute show that total power generation from public sources across the EU has been the lowest in five years, as demand from industry has slumped and consumers have economised amid rising retail energy prices.

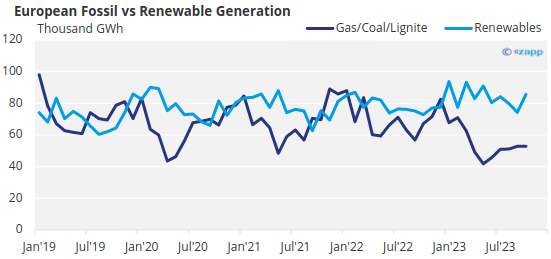

Power generation from hard coal and lignite has slumped to the lowest total since at least 2018 in the past few months, while natural gas-fired electricity generation has also been near the lowest in five years. Generation from the two sources has slumped by 25% in the year to October, compared with the first ten months of 2022.

At the same time, solar and wind sources have generated more power than at any time since 2018, the data show, boosted by EU policies supporting the low-carbon transition and encouraging development of renewable sources. Renewables generation from January to October is up by 6.7% compared to the same period in 2022, the data show.

Winter Could Trigger Higher Gas Prices

As a consequence of lower industrial production, investors are betting at record levels on a sustained price fall for carbon permits in the coming months. Data from the two main European exchanges show that as of November 10, investment funds held long positions totalling 24.7 million EUAs, but had built a record short position of more than 58 million EUAs.

With just four weeks left until the current benchmark futures contract expires, many market participants expect that funds will move to cover their bearish bets rather than be required to deliver allowances when the contract expires.

However, funds could instead simply “roll” their positions ahead of expiry. By buying back their December 2023 short positions, and selling an equivalent number of December 2024 contracts, investors can sidestep any delivery risk and maintain their short position through the expiry and into the new year.

With contrasting expectations surrounding investors’ likely strategy for the remainder of the year, the carbon market has been volatile a

Source: World Bank

Cheaper natural gas prices allow the fuel to be used to generate power instead of coal, and this is seen as bearish for carbon. Conversely, higher gas prices mean more coal is likely to be burned, and this supports demand for EUAs.

With Russian gas no longer flowing through the Nord Stream pipeline, Europe has been forced to look farther afield for energy, and this year has seen an armada of liquefied natural gas cargoes delivering fuel to the continent.

As of early November, gas storage in the EU were at record levels of more than 99% after strenuous efforts to ensure sufficient supplies ahead of winter. With an extended mild autumn, demand has been slow to pick up and prices for prompt-delivery gas have therefore slipped back to around EUR 45/MWh.

However, the supply position remains tightly balanced, and any interruption in North Sea production or deliveries from abroad are likely to trigger a sharp jump in the gas price, taking carbon with it.