Insight Focus

- European carbon prices top €100 for the first time.

- Surge in speculator buying.

- Analysts warn bull market unlikely to last.

European carbon tops for first time as speculators take centre stage.

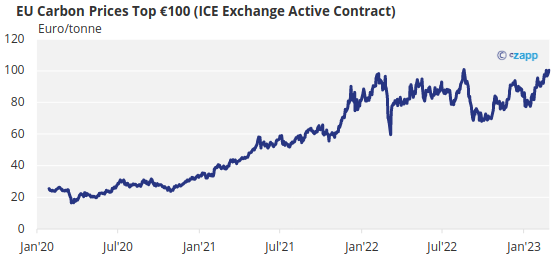

European carbon prices topped the €100 barrier for the first time ever last Tuesday as speculative traders continued to drive the market, in spite of analyst warnings that carbon permit prices are unsustainable at current levels.

EU emission Allowances (EUAs) traded at a record high of €101.25 on Feb. 21, a gain of nearly 20% for the year-to-date. The contract settled on Feb. 27 at €100.23.

The rally has been driven by a surge of speculative buying following the European Union’s formal approval of the “Fit for 55” reform package, that will tighten market supply from 2025, bring the maritime shipping sector into the market for the first time, and gradually eliminate the allocation of free EUAs to energy-intensive, trade-exposed industries.

Investment funds increased their net long positioning in EUAs from 1.2 million EUAs in the week ending Jan. 27 to 16.5 million EUAs in the weeks ending Feb. 17. While this is far from a record – funds held a net long position of as much as 80 million EUAs in April 2021 – it’s the largest net long since late last year.

To be sure, the price rise comes at the same time as the annual compliance season nears its peak, when industrial companies complete their purchases of EUAs to surrender to the European Commission before the end of April.

But analysts warn that the bull market may have a limited lifespan. The European Commission is expected by the summer to announce the addition of more than 250 million EUAs to market supply over the next three years, as part of the REPowerEU initiative, that seeks to raise €20 billion from carbon permit sales to fund the bloc’s pivot away from Russian fossil fuels.

The additional volumes are being sourced from future (2027-2030) auction volumes set aside for member states, as well as from future sales from the Innovation Fund, a separate initiative that supports new low- and zero-carbon technology projects.

These sales are generally expected to depress prices once the schedule is announced, and analysts are also suggesting that verified emissions data for 2022 will also show a drop in industrial output, further dampening demand for EUAs and depressing market prices.

At the same time, the drop in industrial EUA demand may not be enough to outweigh an increase in demand from power generation.

The energy crisis caused by Russia’s interruption of natural gas supplies to Europe, which drove gas prices to unprecedented highs last summer, remains a critical factor for Europe, but prices have fallen nearly 90% from their 2022 peak.

This in turn means that natural gas is once more competing closely with coal as the leading fuel for power generation. A broad switch back to gas would cut demand for EUAs, since gas emits half as much CO2 as coal per unit of power produced.

If gas prices continue to decline, sources say, it could lead to a further reduction in demand for EUAs and additional price weakness.

However, news reports this week suggesting that the European Commission is not hastening the scheduling of the additional REPowerEU auction volumes emboldened traders to boost prices back above €100 this week, after levels dipped to €95 on profit-taking after the market hit three digits for the first time.

Some sources see the potential for further increases in the coming days as speculative traders continue to test the limits of the market, and of politicians’ resolve to maintain prices at lower levels to help industry deal with the continuing high costs of energy.