Insight Focus

EUAs are up 23% since mid-December. Fossil-fuel based power generation recovered in November and December, led by gas. Some traders are beginning to think ahead towards the 2027 EUA supply cut.

EU Carbon Prices Surge

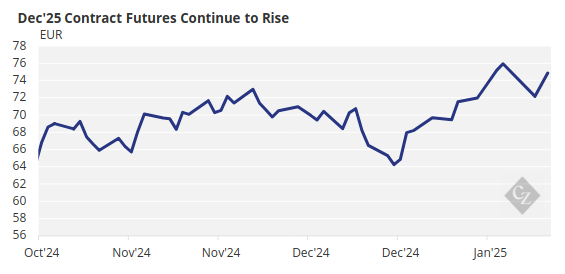

The steep rally in EU carbon allowance prices that started in mid-December has resumed in January, as EUAs reached their highest level in seven months amid continuing concerns over Europe’s gas supply and a recovery in fossil-based power generation.

December 2025 EUA futures reached nearly EUR 77/tonne on December 13, their highest since June last year, as the market absorbed rumours that Ukrainian forces had attacked the Turkstream gas pipeline over the weekend. Prompt natural gas prices also surged nearly 5% following the news.

Source: ICE

Turkstream is now the only remaining Russian-operated pipeline that sends natural gas to Europe, and the news came as EU member states faced sharply colder weather. The line delivers gas into Serbia and Hungary, and then on to Romania, Greece and other Eastern European states.

Source: ICE

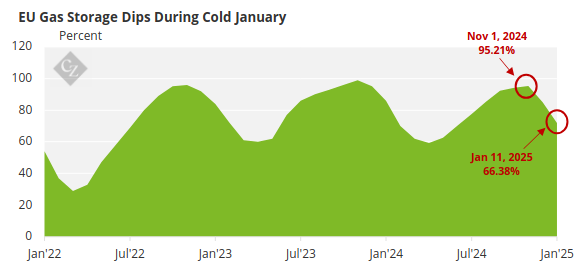

The sharp reaction of energy markets shows how sensitive traders are to any news that might reflect a drop in supply. Europe has been drawing down its gas reserves for around six weeks, and storages are presently 66% full, after having been at more than 90% at the start of November.

Source: AGSI

The large drawdown in stocks suggests that traders will need to work harder over the summer to rebuild reserves ahead of next winter, and this could maintain the upward pressure on gas, and therefore carbon, prices.

The latest geopolitical upset came shortly after the US unveiled a new raft of sanctions on Russian LNG exporters and associated service providers such as shippers and insurance companies.

European Gas Surge Supports EUA Rally

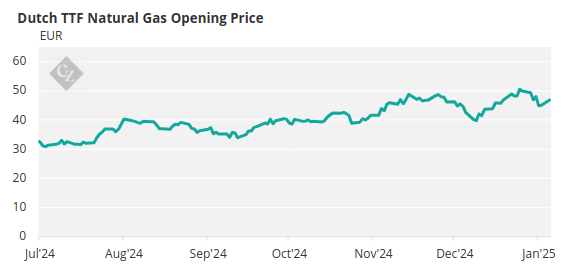

European gas prices, which had been edging lower in January amid milder weather, reversed direction sharply and approached their recent highs near EUR 50/MWh.

Typically, as natural gas rises in cost relative to coal, it becomes less competitive as a fuel for power generation, encouraging more coal use and boosting demand for EUAs. But coal has been “in the money” for several months already, traders point out, and gas’ latest price jump should not change the material outlook.

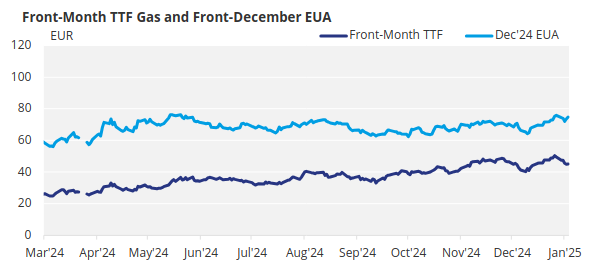

However, computer-driven algorithmic trading has led to a strong link between gas and carbon prices. Over the last two months, the rolling 10-day correlation between front-month TTF gas futures and EUA prices has rarely been less than +0.5.

Data from the power sector indicates some fossil-based support for higher EUA prices. According to data from Europe’s grid regulator, European gas consumption for power generation jumped 43% year-on-year in November and was up 20% in December.

Similarly, hard coal use by the electricity sector fell by just 0.6% year-on-year in November – after having declined by around 27% year-on-year until then – and was just 3.4% down in December.

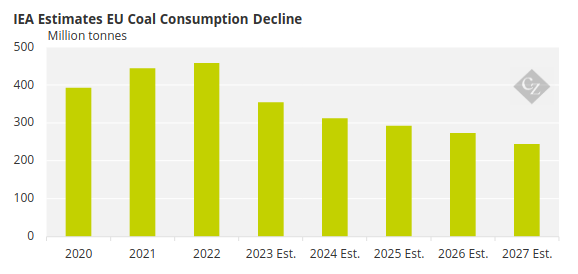

Source: IEA

Meanwhile, the renewables output was 15% lower in November, and 9% down in December, data shows.

Some carbon market participants believe the current rally in EUAs, which were at as low as EUR 62-63/tonne in mid-December, is the start of a steady recovery ahead of substantial cuts in allowance supply that are scheduled to take place from 2027 onwards.

Currently, allowance supply is boosted by additional permits being sold to fund the European Recovery and Resilience Fund, which is supporting efforts to transition away from Russian fossil fuels. But these sales – which are offering allowances from future years’ supply – will end in 2026, and the market expects a steep cut in availability from 2027.

These trading sources point to the market’s reaction in 2018 to the news that the European Commission would introduce a market stability reserve to adjust EUA supply. While the mechanism only went into force in 2019, prices started ramping up a year in advance, almost trebling in 2018.

Other sources believe the price recovery is more short-term in nature, and do not expect a supply-driven rally until much later in the year.